Dairy giants avoid Australian tax bill: Fonterra, Lactalis, Saputo and Bega

Global dairy giants Saputo, Fonterra and Lactalis pay less than half a per cent of their Australian earnings in tax.

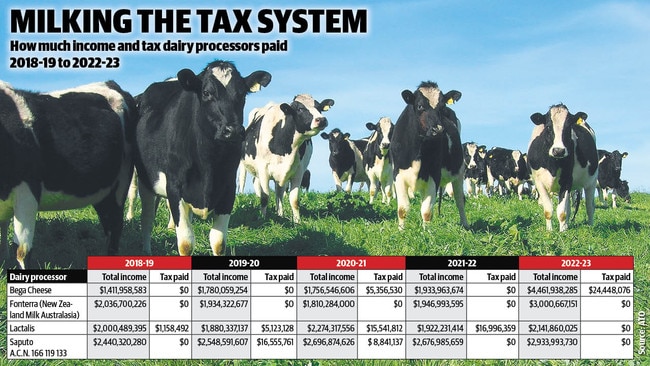

The dairy processing giants that dominate the Australian industry paid less than 0.25 per cent income tax on $38 billion of earnings over five years.

Australian Taxation Office records show New Zealand dairy giant Fonterra paid no tax on the $7.73 billion it earned in Australia from 2018-19 to 2022-23.

A Fonterra spokeswoman said that in Australia the company had not paid tax on profits made over the past five years “as it has utilised tax losses carried forward from earlier years”.

The ATO’s Corporate Tax Transparency list also shows Saputo Australia only paid $24m income tax on $13.3 billion of earnings over the five years to June 2023, equal to 0.18 per cent of its gross income.

Saputo even tried to avoid being named in the transparency report by using a subsidiary, listed as ACN 116 119 133, which could only be revealed by paying a fee to search Australian Securities and Invest Commission records.

The Canadian dairy giant defended its position, stating “Saputo Dairy Australia fully meets its tax obligations and operates as a responsible corporate citizen.

“In recent years, SDA has reported negative taxable income and has continued to pay all applicable fringe benefits taxes, payroll taxes, stamp duty, land taxes, and GST, in line with Australian regulatory standards.”

The world’s largest dairy company, Lactalis, refused to comment on the fact it paid just $38.8m in income tax on the $10.22 billion it earned in Australia from 2018-19 to 2022-23.

Even locally listed Bega Cheese paid $29.8m in income tax on $11.3bn in earnings over the same period.

Australian Dairy Farmers president Ben Bennett said not only were processors contributing little in the way of tax, “our beef is they aren’t even contributing to (funding) Dairy Australia”.

ADF has campaigned for years to try and get processors to contribute to DA, given its work in marketing, research and development benefited everyone along the dairy supply chain.

“It’s pretty mean spirited and un-Australian,” Mr Bennett said.

In contrast last financial year dairy farmers contributed $30.5m in levies to DA, with taxpayers chipping in another $27.8m, with nothing from processors.

United Dairyfarmers of Victoria president Bernie Free said he wasn’t surprised that processors were curbing their tax contributions.

“It’s the old adage ‘the more money you’ve got the easier it is to reduce your tax’,” Mr Free said. “If they’re not paying any tax, why are they still here – so they must be making a return on their investment.”

As for processors contributing to DA, Mr Free said “if they did, we might all make more money.”

TAX TRANSPARENCY REPORTS

The ATO has been publishing its tax transparency reports since 2013-14, to “improve awareness about corporate tax, increase community confidence that corporate entities are paying the right amount of tax and encourage voluntary compliance”.

But it appears the listing is having little impact, given the almost 4000 companies listed in its most recent 2022-23 report paid $97bn in tax on $3.138 trillion of income – about 3 per cent of their earnings.