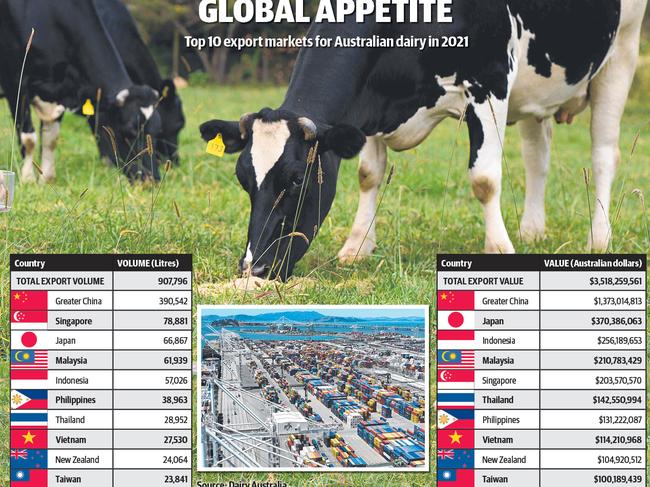

China the main port of call for Australian dairy in 2021

China has held its position as the top destination for Australian dairy, despite years of lockdowns and trade tension. Find out the other nations that buy big.

China remains Australia’s number one destination for dairy exports, despite years of lockdowns, logistical headaches and languishing relations.

Nearly 400,000 litres of dairy produce was shipped to China from Australia last year, about quadruple the quantity of the second-placed Singapore.

This was despite both China and Australia experiencing rolling coronavirus lockdowns during the 2021 calendar year, a problem particularly pronounced in China’s largest cities in recent months as the Xi regime aims for zero coronavirus cases.

Dairy Australia trade and industry strategy manager Charles McElhone said China had been Australia’s number one export market for several years.

He said the economic powerhouse had a growing appetite for dairy that was only partly quenched by Australia.

“Despite the enormous growth in Australian dairy consumption in China, we’re still only a minnow compared with other countries,” Mr McElhone said.

“Australia makes up only about 5 per cent of all dairy exports into China, so there’s huge opportunity for growth.

“Chinese consumers have a growing appetite for dairy, they have a high regard for Australian-made food and it’s an increasingly wealthy country.”

Political tensions between Beijing and Canberra have been strained for several years with the Morrison Government’s call for an investigation into the origins of coronavirus a sore point with China’s leaders.

The increasingly authoritarian nature of China’s leadership has also been a concern for Australia, with the quashing of Hong Kong’s autonomy and the oppression of the Uyghur minority in China’s western provinces.

However, a reset in Sino-Australian relations is on the cards.

Australia’s new deputy prime minister, Richard Marles, met recently with China’s defence minister, Wei Fenghe, in Singapore, the first bilateral meeting of its kind in two years.

Mr McElhone said China’s importance for Australia’s dairy industry was underscored by the fact the headline figures also accounted for produce shipped into Hong Kong and Macau.

“About $85 to $100 million worth of dairy was exported into Hong Kong last year, so that in itself is a major destination for dairy,” he said.

More than $370 million worth of Australian dairy was imported into Japan last year, while third-placed Indonesia imported more than $256 million.

Prime Minister Anthony Albanese met with Indonesian President Joko Widodo in Jakarta only weeks after his May election victory.

The Australian and Indonesian leaders discussed tighter trade ties between Canberra and Jakarta with dairy a potential beneficiary.

“Singapore, Indonesia, Malaysia — countries within close proximity, particularly to Western Australia, are strong markets for UHT and increasingly, fresh milk,” Mr McElhone said.

Despite producing enough dairy to easily sustain its domestic demand, New Zealand imported nearly $105 million worth of Australian dairy produce last year.

However, Mr McElhone said plenty more Kiwi dairy produce went Australia’s way during the same period.

“There’s always been a strong amount of dairy trade on both sides of the Tasman,” he said.

Where a trade imbalance is particularly pronounced is between Australia and the European Union. While Australian consumers buy millions of dollars of French brie, Swiss gruyère and Italian parmesan, dairy from Down Under doesn’t get the same reception on the supermarket shelves of Seville and Strasbourg.

“The European Union isn’t a big export destination for Australia but a free trade deal is still being worked out (between Canberra and Brussels), so there’s opportunities there,” Mr McElhone said.

United Dairyfarmers of Victoria vice president Mark Billing said while China remained Australian dairy’s number one trade destination, it was worth making connections with new markets.

The Federal Trade Department recently identified Chile as an opportunity for growth, with the South American nation already keen on imported dairy.

“It’s important we don’t put all our eggs in one basket. China has been great for us but we’re also making headway in a number of other countries across South-East Asia,” Mr Billing said.