Bega records $233.7m loss: cuts value of Koroit, Tatura and Bega plants

The ASX-listed Bega Cheese Group, like others, is being squeezed between high local farmgate milk prices and a commodity slump.

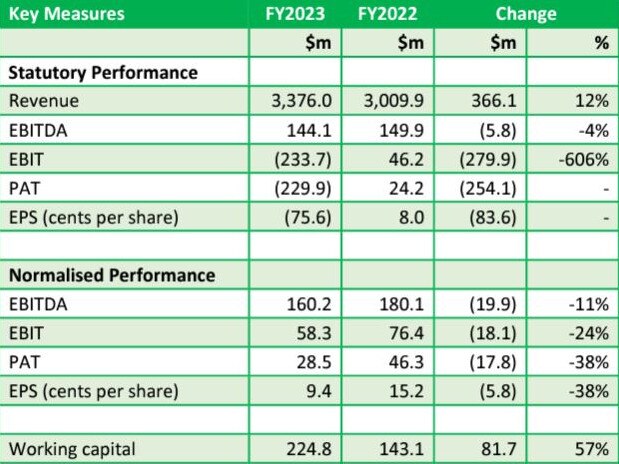

Bega Cheese has recorded a $233.7 million statutory loss for 2022-23, in the wake of a 30 per cent slump in global dairy commodity prices.

In releasing its annual report today, the company announced a $276 million impairment, predominantly due to a decline in the value and earnings capacity of its bulk dairy processing plants at Koroit, Tatura and Bega.

As with all Australian dairy processors Bega reported “the bulk segment experienced a challenging second half of the financial year with global dairy commodity prices significantly decreasing.

“In addition, the ongoing decline of milk production in Australia and excess milk manufacturing capacity continues to create a highly competitive milk procurement environment and now a large disconnect between returns received in international commodity markets and Australian farm gate milk price exists.

“This disconnect will impact the performance of the bulk segment in 2023-24 as these circumstances are expected to continue for some time.

“This impairment, whilst substantial and disappointing, is offset by the vitality and growth in our branded segment, is not reflective of the quality of our bulk assets, does not impact our underlying financial strength, nor does it create any issues with our current bank facilities.”

The group received 1.34 billion litres of milk during 2022-23, down four per cent on the 1.4 billion litres received in 2021-22 season, which is broadly in line with the percentage decline in the national milk pool.

The annual report factors a decline in milk intake of 4.4 per cent over the next four years.

Meanwhile Bega chairman Barry Irwin and chief executive Peter Findlay signed off on a joint report they said was forging ahead with the businesses transition from simply dairy processing “to a predominantly branded business”, which already owns Vegemite, Bega Simply nuts peanut butter, Yoplait, Daily Juice, Dairy Farmers, Farmers Union, Pura and its own-brands.

Shareholders net tangible asset backing has slumped by a third, from $1.86 to $1.24.

Bega’s balance sheet shows total equity fell from $1.262 billion on June 30, 2022 to $1 billion by June 30 this year.

The cashflow statement shows that while receipts from customers (GST inclusive) rose from $3.34 billion in 2021-22 to $3.6 billion in 2022-23 Bega’s payments to suppliers and employees rose from $3.18 billion in 2021-22 to $3.6 billion in 2022-23.

Bega expects financial performance to be relatively flat in 2023-24 with an expected normalised EBITA of $160m to $170m and a more positive outlook in the medium term.