Secret power players in Australian dairy: Lino Saputo jnr, Xianfeng Lu

Canada’s Lino Saputo jnr is one of Australia’s biggest dairy players, transforming the sector in less than a decade.

Danish butter and French cheese have become more prominent in Australian supermarket refrigerators in recent times.

But Australian dairy still dominates with nine out of ten sales of butter, cheese and yoghurt still locally made and manufactured.

That’s not to say international figures play a leading role in the Australian dairy sector.

Two of the nation’s big three processors — Fonterra and Saputo — are run out of Auckland and Montreal respectively.

In Western Australia, Brownes Dairy is a household name with a proud heritage in the Perth region. But it is now managed out of Hong Kong.

So who are Australian dairy’s international players?

Some have established themselves as prominent names in the industry. Others are hardly known, and may have never visited Australia — operating their dairy empires from afar.

With foreign trade stirred up like a freshly-prepared milkshake, The Weekly Times uncovers the most powerful, yet relatively silent, international players in Australian dairy.

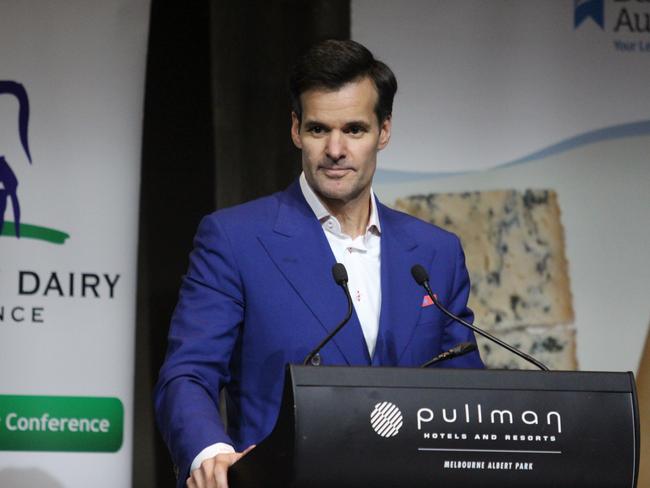

Lino Saputo jnr

The Saputo family, and Lino junior in particular, have been a big cheese in the Canadian dairy sector for many years. But the Montreal family’s links to Australia are relatively fresh.

They first made a splash Down Under when prospective suitors lined up for Warrnambool Cheese and Butter in the early 2010s. Not only did Saputo acquire WCB, it also swooped on the battling Murray Goulburn not long after its infamous 2016 clawback.

Saputo has been a relatively reticent company on the Australian dairy stage but Lino jnr made waves just prior to the pandemic at Canberra conference appearance.

In 2019, he called for older Australian dairy factories to be mothballed to counter an oversupply in processing capacity.

“We need to take a good hard look at what types of products we are manufacturing, how much product we are supplying the world markets and whether there is a requirement for that,” Mr Saputo said.

“The simple answer is that there is too much infrastructure in the system.”

Xianfeng Lu

Little is known about Xianfeng Lu, but the Chinese/Australian businessman’s dairy operations in Tasmania have generated more than its fair share of headlines in recent times.

Van Dairy was Australia’s biggest dairy operation until last year, when Mr Lu announced it would sell part, but not all, of its northwest Tasmanian operations.

Prime Value purchased 11 of the 25 dairy farms from Van Dairy for an estimated $62 million, leaving 14 remaining.

The mega farm has been the subject of scrutiny in recent months both by the Tasmanian Dairy Industry Authority and debate in the Tasmanian parliament.

Mr Lu said he had never considered selling all the farms and had also refused offers to buy the entire estate.

“I will not sell the entire VDL farms,” Mr Lu said last year.

“We want to make VDL a well-known international brand in the Tasmanian organic dairy industry.”

But Tasmanian senator Peter Whish-Wilson says Van Dairy need to do more to clean up their act.

“Last year the owner sold off parts of the property and raised $62.5 million from property sales,” Senator Whish-Wilson told The Weekly Times.

“These funds should have been immediately re-invested back into the company’s remaining dairy farms. My sources tell me that we’re not going to see the investment that’s required to provide long-term solutions to the ongoing problems facing Van Dairy.”

Philippe Palazzi

Starting his career with French supermarket giant Metro, Philippe Palazzi rose through the ranks to ultimately become head of the European retail juggernaut.

In June 2020, he switched supermarket trollies for the dairy produce placed into them — shifting across to another French giant — Lactalis.

Lactalis controls popular brands on Australian refrigerator shelves including Pauls milk, President and Lemnos cheese brands as well as Oak flavoured milk.

Its Australian operations were rebranded from Parmalat to Lactalis Australia in 2019 when it purchased the Parmalat shares did not already own.

Lactalis previously acquired the yoghurt and desserts business from Fonterra in 2015.

Miles Hurrell

When Miles Hurrell took over the top job at Fonterra in 2019, he had already notched up two decades at the Auckland-based processor.

The son of a banker, he was raised in both Christchurch and Wellington.

Mr Hurrell started his career at a freight shipping company before having some involvement with the New Zealand Dairy Board.

New Zealand’s largest dairy player entered the Australian market in 2005 with the purchase of the Nestle factory near Warrnambool in southwest Victoria.

Fonterra sold the Dennington site in 2020 to ProviCo Australia.

It announced plans in September last year to restructure the Australian arm of its business, although details are yet to be finalised.

Yin Shan Qi

Arguably one of the least-known major players in Australian dairy, Yin Shan Qi is chairman of Shanghai Ground Foods.

Brownes Dairy is arguably Western Australia’s most recognised dairy names.

Private equity group Archer Capital sold the company to Shanghai Ground Foods, with news recieving little blow back in Western Australia.

Last year, Brownes paid penalties totalling $22,200 after the Australian Competition and Consumer Commission issued it with two infringement notices.

The notices relate to Brownes Dairy allegedly failing to comply with the mandatory Dairy Code of Conduct last year.

Min Fang Lu

Who would have thought the ownership of Pura milk and Dare iced coffee would become a geo-political struggle?

Japanese-owned beverage giant Kirin announced the sale of Lion Dairy and Drinks to Mengniu Dairy in November 2019.

The sale went through the Foreign Investment Review Board process but many in Canberra questioned giving the regulatory green light to Mengniu.

In August 2020, Federal Treasurer Josh Frydenberg decided the $600 million deal was “contrary to the national interest”. Bega ended up acquiring Pura and Dare last year.

Despite being thwarted with Lion, Min Fang Lu and Mengnu remain key players in Australian dairy. Holding eight different dairy board directorships, he is also chairman of the aforementioned Shanghai Ground Foods.

Mark Schneider

Nestle owns dozens of brands, many with dairy links on Australian shelves. It’s unsurprising really. The Swiss-based food conglomerate is the biggest dairy brand in the world, with a presence in most industrialised countries (including Russia, which has generated controversy following the Putin regime’s invasion of Ukraine last month.)

At the executive apex of Nestle is Mark Schneider. The German-born businessman is a Harvard graduate and became an American citizen in 2003. Nestle sells an array of dairy-based produce on Australian supermarket shelves — most notably, its condensed milk range.

Sun Yugang

Head of China Modern Dairy, Sun Yugang has been a major player in the Chinese dairy industry for more than two decades. He was a financial manager at what was then known as Inner Mongolia Mengniu Milk company, before going onto work for the Hebei Yinong Network. He returned to Inner Mongolia Dairy seven years ago and the agricultural player has since rebranded as China Modern Dairy. Like Yin Shan Qi, little is known about Sun Yugang, but China Modern Dairy plays a significant role in the management of Burra Foods, based in south Gippsland.

Masahiro Okafuji

While China Modern Dairy’s links with Burra are reasonably fresh, the Itochu corporation has had a connection with Burra Foods for more than a decade. In 2009, Itochu acquired nearly half of Burra and established new milk powder facilities at the Gippsland site. Seven years later, when Inner Mongolia approached Burra management to take on a majority shareholding, then managing director Grant Crothers said there was plenty of interest in the company but no potental suitors were based in Australia. Itocho maintains a 21 per cent stake in Burra with the company operated out of Japan by veteran businessman Masahiro Okafuji. Itochu has been seen as a safe bet by investors during the pandemic years with one of the world’s wealthiest men, US billionaire Warren Buffett, taking out a slab of stocks in Okafuji’s company in 2020.