Australian dairy prices: Cheese indicator cut on Global Dairy Trade index

A key indicator for Australian dairy posted a large decline overnight. What could it mean for farmgate prices?

Cheddar commodity figures have been cut by 20 per cent in a month, with an overnight trading session compounding the pricing problem.

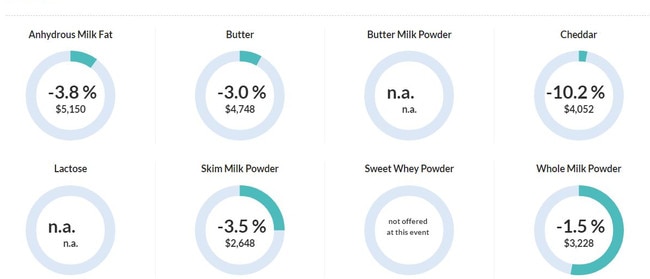

The cheddar indicator in the fortnightly Global Dairy Trade index fell 10.2 per cent overnight, hot on the heels of a 10 per cent cut earlier this month.

All up, the price per tonne of cheddar has been slashed from $US5086 ($A7610) to $US4052 ($A6063), reinforcing fears import competition will put pressure on Australian retailers and processors that will lead to lower farmgate prices.

Despite the recent dairy declines, Westpac senior economist Satish Ranchhod said medium term prospects for international dairy prices were favourable.

“Over the year, we expect that rebounding Chinese dairy demand and disruptions to New Zealand supply following recent storms will lead global dairy prices higher,” he said.

Under the mandatory dairy code of conduct, processors have to promulgate an opening price on their respective websites by a June 1 deadline.

Between June 1 and June 30, they have the capacity to raise their opening bid to existing and potential suppliers.

EastAusMilk chairman Matt Trace said a shrinking milk pool domestically counterbalanced declining international prices.

He told The Weekly Times it was too early to predict how much processors were prepared to pay by the June 1 deadline.

“There’s two competing forces: the first being a contracting milk pool in Australia and the second being weakening prices overseas,” Mr Trace said.

“For processors, when it comes down to it: they need milk. If they offer prices below cost of production, then more farmers will leave dairy and go to beef or something else.

“The processors can’t afford this. So they can point to international prices but that’s only one part of the puzzle.”

According to Dairy Australia’s latest situation and outlook report, cheese accounted for 40 per cent of Australia’s milk production in the 2021-22 financial year.

The DA report noted that drinking milk and skim milk powder/butter production were the next two largest users of milk, accounting for 30 per cent and 19 per cent of Australian milk respectively.