ACCC approves sale of Saputo plants to Coles supermarkets

Dairy farmers have said the ACCC will regret approving the $105m Coles-Saputo deal warning of weakened competition.

Coles has been given the green light to become a milk processor, as the nation’s competition watchdog won’t stand in the way of its bid to buy Saputo’s processing plants in Sydney and Melbourne.

The $105 million deal has been opposed by most farmer lobby groups, including the Australian Dairy Farmers organisation, which expressed concern over diluted competition.

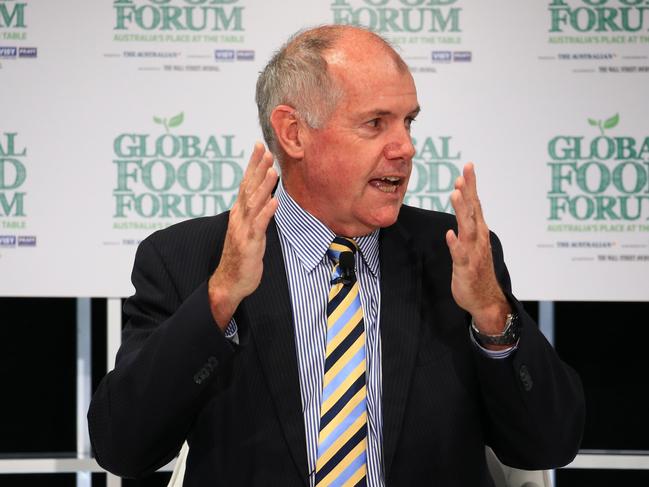

However, Australian Competition and Consumer Commission deputy chairman Mick Keogh said the Coles purchase was unlikely to create a “substantial lessening of competition”.

“We explored the industry’s concerns very closely through discussions with farmers and their representative bodies, and conducted a detailed review of Saputo and Coles’ internal documents and their incentives,” he said.

“After careful consideration, we concluded that, compared with the current state of competition where the majority of the capacity at these facilities is already contracted to Coles, the acquisition is unlikely to result in a substantial lessening of competition in breach of section 50 of the Competition and Consumer Act.”

The sites employ about 48 workers, who Saputo said would receive an offer to transfer their employment to the Coles Group.

Each plant has the capacity to process 225 million litres a year. Both are already used to manufacture Coles’ two and three-litre own brands.

A Saputo spokesman said there would be “no changes to farmer relationships” as a result of the Coles deal.

“Saputo retains its direct milk supply agreements with farmers, and suppliers’ milk will continue to be collected and processed throughout Victoria, New South Wales, South Australia and Tasmania,” the spokesman said.

Business Council of Co-operatives and Mutuals chief executive Melina Morrison said farmers would eventually see weakened competition as a result of the deal.

“We remain concerned the proposed acquisition is likely to significantly reduce competition in the dairy market to the detriment of both consumers and family farmers,” she said.

Outgoing Australian Dairy Farmers president Rick Gladigau echoed Ms Morrison’s concerns. “We consider the ACCC’s decision not to oppose the Coles acquisition of Saputo dairy plants will be a key turning point for the industry,” he said.

“(It will be a decision) ACCC will look back upon and regret.”

In April, Coles announced to the Australian Securities Exchange that it would buy Saputo’s Melbourne processing site at Laverton as well as its Sydney equivalent at Erskine Park.

Following the first stage of the review, the ACCC outlined concerns that a Coles acquisition would trigger a major structural shift in the dairy sector.

However, today Mr Keogh said further investigation showed Lactalis and Bega would remain likely competitors in the NSW milk market.

“We considered that the proposed acquisition would be unlikely to change Saputo’s incentives to continue acquiring raw milk from farmers in NSW for at least the next five years,” he said.

“We also found that other dairy companies such as Lactalis and Bega would continue to be competitors for raw milk in central NSW, and that the proposed acquisition is unlikely to change this.”