Price gap tightens between mutton and lamb

Tight supply and ongoing strong demand in Asia for affordable protein continue to drive mutton prices up.

THE price point of heavy lamb to mutton continues to narrow and the industry could be heading for a repeat of what occurred last winter.

At the start of this week there was a ballpark difference of 100c/kg between heavy slaughter lambs compared to mutton.

This is based on national saleyard indicators, which on Monday night were listed at 802c/kg for heavy lambs (over 22kg) and mutton at 699c/kg, according to Meat and Livestock Australia, which calculates the data based on NLRS reporting.

Direct comparisons between extra heavy lambs, those over 28kg carcass weight, to sheep would show an even closer alignment as many super-sized lambs are only making between 730c to 760c/kg.

Dollar per head results are certainly very close, a case in point being Bendigo earlier this week, where lambs averaged $187 and sheep also $187.

And on feedback from agents, this has happened a few times in recent weeks, noting that weight and the makeup of yardings can sway results.

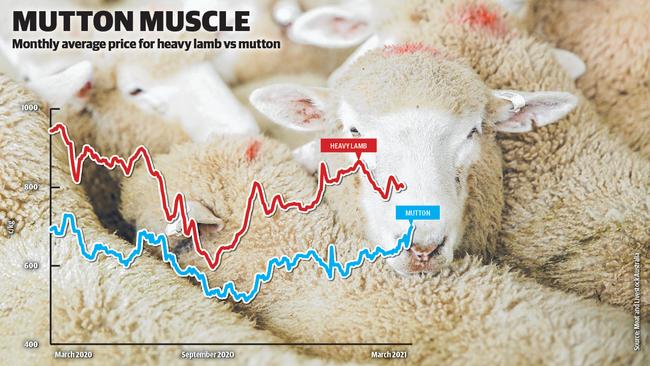

The graph shows the relationship between heavy lambs and mutton over the past three years.

What it shows is the influence of the season and flock rebuilding which cut the supply of sheep, but also the resilience of mutton compared to lamb in the disrupted COVID-19 environment which hit last year.

While lamb prices fell dramatically from March onwards, going from a peak of 950c/kg in early March to a low of 600c/kg by late August, the ride for mutton was much more nuanced.

As a result, the price difference between heavy lamb and mutton went as low as 80c/kg during winter last year, and a similar scenario could be repeated in coming weeks, particularly if the firming trend for sheep continues against the fairly flat demand being shown for lamb.

Two key factors continue to drive mutton prices — a shortage of numbers as farmers hold on to mature sheep for breeding and ongoing strong demand out of Asia for affordable protein.

On the supply front, the latest MLA/AWI survey continued to highlight the push to rebuild sheep numbers on farm, which is restricting the supply of ewes to slaughter.

The survey, released late last week, estimated there was 41.3 million breeding ewes as of February this year, of which 73 per cent were Merinos.

It further added that “as producers look to use more ewes to rebuild their flocks, only 30 per cent are looking at buying in more external breeding ewes – most are looking to retain more placement ewes, or reduce the number of ewes culled’’.

It suggests that sheep supply will continue at very low levels, at least until the next wave of culling in the spring following the sucker lamb season.

On the demand front, all the action for mutton is centred on China which continues to dominate export demand for Australian sheepmeat.

Just released data for the month of March had China absorbing nearly half of Australia’s mutton shipments at 5990 tonnes out of a total of 12,932 tonnes sold, according to the Department of Agriculture.

The next biggest destination for mutton last month was the USA at around 1900 tonnes, followed by Malaysia at 1600 tonnes.

Most of the other countries taking mutton from Australia were restricted to volumes under 800 tonnes.

Another reason for the tightening price gap between heavy lambs and mutton is the pressure currently on the lamb market due to an influx of bigger weighted lambs being sold this autumn ahead of the next cropping round.

It shows up in yarding figures, with an extra 14,274 heavy lambs assessed at the major prime markets covered by the NLRS in the past week compared to a month ago.

The national heavy lamb price is now 94c below year ago levels, whereas mutton is just 12c shy of where it was tracking last April.

MORE

ALL EYES ON PRICE TREND AS LAMB MARGINS TIGHTEN

TIGHT SUPPLY LIFTS CATTLE PRICES, BUT LAMB STEADY TO WEAKER

HEIFERS, COWS RIDE HIGH ON LIMITED NUMBERS BUT LAMB PRICES EASE