Dairy supply at risk unless processors increase farmgate milk prices

Milk producers say without further farmgate price rises, many more dairy farmers will quit the industry.

DAIRY farmers want processors to stretch themselves to pay step-up payments before the end of the season or risk losing milk suppliers from the industry.

United Dairyfarmers of Victoria president Paul Mumford said the recent rise in global dairy prices meant processors should now be in a position to “pass on every possible step-up to the producer”.

Some Victorian dairy farmers have received a modest farmgate milk price rise in the past week and Fonterra suppliers nothing at all, despite global prices of some dairy commodities jumping more than 45 per cent in the past nine months.

Canadian dairy company Saputo became the latest processor to lift its farmgate milk price for the first time since setting the 2020-21 opening price early last June.

Late last week, Saputo increased its farmgate price by 10 cents a kilogram of milk solids to $6.50/kg, matching rivals Bega Cheese and Burra Foods.

Fonterra is holding out until its bimonthly review later this month, with its price remaining unchanged at $6.40/kg.

International dairy prices skyrocketed by an astounding 15 per cent last week, with the average price of $US4231/tonne ($A5414/tonne) on the Global Dairy Trade market now 45.8 per cent higher than the $US2902/tonne ($A4268/tonne) price on June 2 last year when Australian dairy companies set their opening prices.

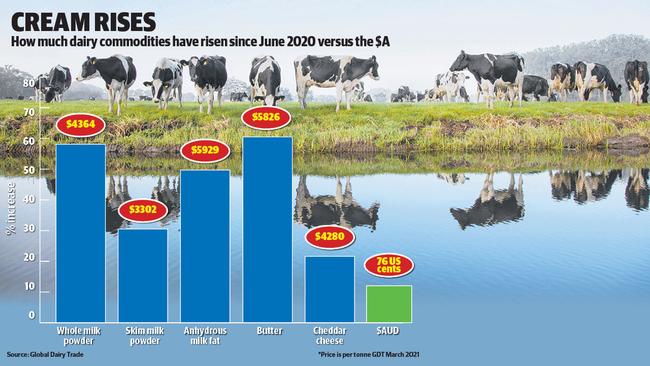

Most of the major dairy commodities on the GDT now range between 21.6 per cent and 60.5 per cent higher than they were on June 2 last year.

These are offset by the exchange rate rising from about 68 US cents last June to today’s level of about 76 US cents — or about 12 per cent.

More than a third of Australia’s milk production ends up in exported products.

Mr Mumford said processors had extended themselves at the beginning of the season with forward budgets and were probably now just making enough headway to pay step-up payments.

“They took a forward judgment back in July that global dairy prices were going to be where they are now,” Mr Mumford said.

“The processors are only now feeling comfortable those forward budgets were achievable.

“The international commodity prices show it is now imperative they pass on every possible step-up to producers.

“If they want a sustainable dairy industry in Australia, they have to pay those farmgate milk prices for a profitable dairy industry.”

Carpendeit dairy farmer Rob Campbell said farmgate milk prices were “still marginal” for many producers who were reeling from years of heavy debt.

Mr Campbell said that unless processors paid higher prices next season “a lot of people are going to walk away from dairying”.

Koondrook dairy farmer and Lactalis supplier Leigh Verhey said some processors offered strong prices at the beginning of the season while others, such as Saputo and Fonterra started out pretty low.

Mr Verhey said Lactalis offered $7/kg MS as an opening price.

“I think we should have had prices of $6.80 to $7 a kg now towards the end of the season,” he said.

“There’s probably 30c/kg in the price now that most farmers are not seeing.”

Last month, Fonterra lifted its 2020-21 forecast farmgate milk price range in New Zealand by 20c/kg MS to between $NZ6.90/kg ($A6.52/kg) and $NZ7.50/kg ($A7.09/kg).

The move across the Tasman prompted fierce debate within the Australian dairy sector over stagnant farmgate prices, particularly in Victoria.

Fonterra Farm Source director Matt Watt said the company would not consider its farmgate milk price until after its next review later this month.

“Our next bimonthly price review is due this month, and we’ve started to work through the factors which impact milk price — including currency, ongoing COVID-19 impacts, market conditions and our sales book as we head towards the end of the season,” Mr Watt said.

Saputo supplier relations director Anthony Cook said in a letter to farmers the company’s 10c/kg MS step-up would result in a 7c/kg rise for butterfat and a 14c/kg increase for protein.

“This payment is retrospective and will be applied to all qualifying milk supplied under your SDA milk supply agreement from 1 July 2020,” Mr Cook wrote.

It will be paid with February’s proceeds during this month.

Mr Cook said the recently improved conditions warranted an increase earlier than Saputo’s scheduled April review in order to “support farm cash flow”.

“Looking ahead, our next review of the 2020-21 minimum milk price is scheduled for June 2021,” he said.

The double-digit jump in the Global Dairy Trade index is the eighth consecutive increase in the average price and the eleventh out of the past twelve fortnightly auctions.

Fuelling the overall rise was the whole milk powder index, which rocketed by 21 per cent to an average $US4364/tonne ($A5585/tonne) — the highest WMP figure since May, 2014.

Last week’s WMP price is now 58.1 per cent higher than what it was last June when Australian dairy companies set their farmgate milk prices for 2020-21.

The butter index also rose by double digits last week — 13.7 per cent — to an average $US5826/tonne ($A7455/tonne) contributing to the overall spike.

Butter prices are now 60.5 per cent higher than they were in June last year.

Cheddar prices in the GDT index rose a modest 1.3 per cent to $US4280 ($A5573) last week but were now 21.6 per cent higher than when the season’s farmgate prices were set.

MORE