The money trail from Aussie super to celebrity boxer appearances and a developer’s companies

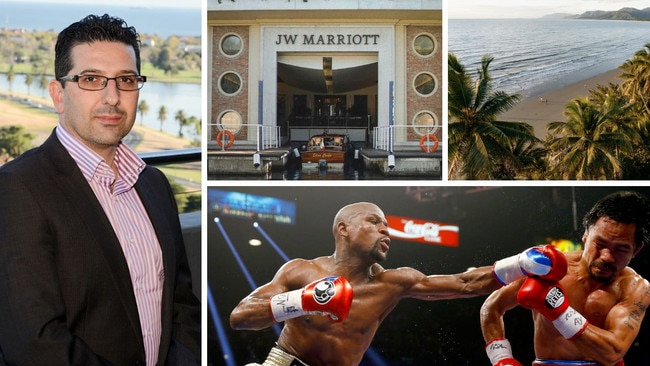

What happened to millions of dollars in super investments which flowed to a web of companies linked with Melbourne property developer Paul Chiodo? An ASIC probe reveals the money trail.

There could be a shortfall of about $280m in one of Australia’s biggest private managed investment schemes following the alleged misuse of investor money, including by Melbourne property developer Paul Chiodo.

Fresh court documents, seen by The Australian, also reveal the extent of conflicts of interest being probed where loans from the same company overseeing the Shield Master Fund, Keystone, were awarded to a web of companies controlled by Chiodo for luxury property developments including on a private island in Venice, Italy.

Chiodo, until late May this year, was also a director of Keystone but he remains a substantial shareholder in Malana Management, which owns all of the share capital in Keystone.

Deloitte were appointed as receivers and then administrators of Keystone by the Federal Court in September, after the Australian Securities and Investments Commission revealed its investigation into “large” amounts of Shield funds being directed to another fund – the Advantage Diversified Property Fund – that made loans to companies linked with Chiodo for the property developments.

An outline of ASIC’s legal case, released to The Australian, detailed the “significant shortfall” for investors in the Shield Master Fund. Chiodo has been contacted for comment, but did not respond by deadline.

Court documents reveal ASIC’s concerns that while about $500m was invested in Shield, which is managed by Keystone, Deloitte estimated the value of the assets in it are worth far less.

Of the $500m invested into Shield about $265m “was transferred to Chiodo Corporation”, ASIC alleged.

And Deloitte has not been able to account for about $39m withdrawn from another fund managed by Keystone, the Advantage Diversified Property Fund.

“In particular, approximately $531m (excluding redemptions) was invested in the SMF (Shield Master Fund). Of this, the SMF invested approximately $305m in the ADPF,” the documents read.

“However, Deloitte assesses that (as at 31 May 2024), the net assets attributable to ADPF unitholders ranges only from approximately $25.3m to $58.3m.

“This indicates a shortfall of approximately $246.7m to $279.7m, and a further shortfall between the sums invested in the SMF by unitholders and the current value of SMF.”

Shield Master Fund’s largest investments came from superannuation platforms Macquarie Investment Management and Equity Trustees.

ASIC said: “the court can have no confidence that the SMF and ADPF are being managed in the best interests of investors, or that Keystone is capable of providing such management.”

ASIC said it appeared out of the $265m paid from the ADPF to Chido Corporation, about $160m has been paid to City Built or its director Robert Filippini.

“This is despite Mr Filippini not holding a building licence (until May 2024), City Built not being required to tender or quote for any of the work it undertook, and there being no written contracts,” the documents said.

From the $265m paid to Chiodo Corporation Deloitte identified about $16.9m as having been paid to entities controlled by Chiodo where they could not link costs as related to specific projects, and said another entity, 24Calibre – controlled by Louie Kortesis, a current director of Keystone – received payments of $4.9m “apparently for celebrity appearance fees, agent fees, travel costs and operating costs”.

ASIC has previously told the Federal Court $302,000 was allegedly used to pay for an appearance by celebrity boxer Floyd Mayweather and $110,000 was allegedly paid to Tyson Fury Corporate Events.

Further documents detail a thorough ASIC investigation into the web of companies linked with Chiodo and how money allegedly flowed from investors to a string of luxury property developments, including in Italy, Fiji and Port Douglas, in many cases without formal security or formal development approvals.

One of those projects was a refurbishment of the JW Marriott luxury hotel on a private Island in Venice, Italy. ASIC’s evidence claims in December last year, Keystone agreed to lend Chiodo Corporation an amount equal to the loan amount which was €152m, or $252m to purchase the hotel.

At the time, Chiodo was a director of Keystone and Chiodo Corporation.

Of concern to ASIC was the loan agreement “allows for a third party to use the proceeds of any borrowings, in circumstances where the ADPF could have no recourse”.

Further, Chiodo Corporation has not paid interest to Keystone or the ADPF on the loan amount which it agreed to do.

Out of the current loan amount of $29m relating to the transaction, “(ASIC) is concerned that potentially $2,228,922.44 of the payments made by Keystone to Chiodo Corporation … were not for the permitted purpose described within”.

It’s possible Keystone could liquidate the remaining liquid assets within the SMF to fund the Italian investment, ASIC’s documents said.

As well, another company linked with Chiodo – 75 Port Douglas Road Pty – entered into a loan agreement with Keystone, worth about $105,915 plus 15 per cent annual interest for the so-called Fairmont Port Douglas Resort, Queensland.

While flashy renders of the site have been splashed online, ASIC’s investigation notes the Queensland planning and environment court refused Chiodo Corporation’s plans to build a “luxury, five-star resort complex”.

Chiodo has lodged an appeal against this decision, with the outcome pending.

ASIC said it is concerned that “the 75 Port Douglas loan agreement does not appear to be (at) arm’s length”, and the loan agreement was entered into with no development approval for a five-star resort.

The corporate cop also said it had concerns for a proposed luxury resort in Fiji, in which Keystone entered into a loan agreement with a company called Luxurious Resort linked with Chiodo.

It noted ADPF allocated $73,051,323.66 to the investment according to a February ledger, despite the loan amount being limited to $23,875,524. As well, the loan is unsecured with no formal arrangements in place regarding Luxurious Resort’s obligations to Keystone.

More Coverage

Originally published as The money trail from Aussie super to celebrity boxer appearances and a developer’s companies