Giant Future Fund adds risk amid historic market shift: ‘It’s time to act’

A ‘turning point’ for investing is forcing the $190bn fund to push up the risk curve.

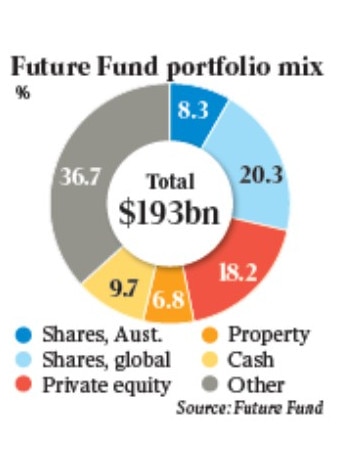

The $190bn Future Fund has signalled a major shift in how it invests as it pushes up the risk curve by taking on more private equity, moving into commodities such as gold and prepares further big-ticket infrastructure buyouts.

Chief executive Raphael Arndt says the way global markets operate is at a turning point.

The giant investment fund argues a combination of factors – war; a move away from globalisation; increasingly populist policies; high government debt; an energy transition; and the view that inflation is going to be more persistent in future – requires a change of investment style to continue to secure market-beating returns.

Dr Arndt said the Future Fund’s strategies needed to respond to structural forces that were overturning many of the assumptions underpinning investing over the past three decades.

His comments are significant, because given the size of the Canberra-backed fund, small changes in investments can have outsized effects on markets. At the same time, big super funds could start moving down a similar path.

“What we’re doing is we’ve lifted risk in the portfolio overall to try to get better returns,” Dr Arndt told The Australian. Rather than just trying to find riskier and riskier assets, “we’re trying to build a more diversified portfolio”, he said.

His comments come as the Future Fund on Monday releases a major position paper, entitled “The death of traditional portfolio construction?”. The document highlights that forces ranging from globalisation to the rise of the Chinese economy, energy surplus and a move to ultra-low interest rates over the past three decades mean past strategies can no longer be relied on to deliver a “tailwind of investment returns”.

Dr Arndt said a lot of the trends during the pandemic played out simultaneously and much more quickly than expected. This is making portfolio construction far more complex and triggers a permanent shift in the fundamentals of investing. “A lot of the trends that were happening through Covid-19 were like a catalyst, but they are going to be sustained,” he said. “And that has fundamentally changed politics, policy, economics, markets, and therefore investing.

“We think that every long-term investor in the world needs to be engaged on these issues and more importantly, act on them.”

The Future Fund has already been in the process of adjusting its vast investment portfolio to reflect a new investment world. Further changes in its portfolio are likely to be seen in coming quarterly updates.

Changes include increasing exposure to private equity, particularly around venture capital and growth. It has been reducing its exposure to listed shares but increasing exposure to the Australian market, given geopolitical risks.

The Future Fund has been reducing its exposure to emerging markets because they are heavy importers of energy. Because of global political risks, it has been putting more funds back into Australia, particularly in property and infrastructure.

Dr Arndt said the infrastructure exposures have the ability to pass through inflation. Last year the Future Fund became a major co-investor in Telstra’s mobile phone towers and was part of the consortium including IFM Investors AustralianSuper that acquired Sydney Airport for $32bn.

“We’ve now got seven Australian infrastructure investments of more than a billion dollars each. And we continue to look at that market,” he said.

For the first time the Future Fund is moving into commodities directly, including owning gold.

Meanwhile, the Future Fund has emerged as one of the world’s biggest single investors in hedge funds.

“We think those sorts of strategies can make money in any market environment, provided you’re investing with skilled managers,” Dr Arndt said.

The new approach also throws out the 60-40 investment approach – a rule of thumb advocating 60 per cent investment in growth assets such as equities and 40 per cent in defensive assets such as bonds or infrastructure. This long-held approach “just doesn’t cut it anymore”.

The Future Fund’s most recent update shows it has been hit by global volatility. Returns have come in at negative 3 per cent for the year to end-September. Annualised returns over five years of 7.5 per cent and 9.2 per cent over a decade have outperformed the fund’s own targets

The fund is setting up an internal treasury function, similar to big banks, to manage liquidity flows, particularly currency exposure on large illiquid infrastructure assets.

With the global economy facing a recession, Dr Arndt points out that central banks aren’t coming to the rescue this time.

“In this case we’ve actually got central bank’s seeking to manage the inflation problem, which has started with a supply-side shock that is now becoming more systemic. They’re actually causing a recession,” he said.

“It’s quite different to the GFC, quite different to Covid-19. There’s no central banks coming with stimulus. And governments are highly constrained with what they can do because of inflation and they are carrying deficits.”

Dr Arndt said global market volatility showed that investors were realising that central banks such as the US Federal Reserve were more hawkish than many were expecting.

“We think that the interest rate rises are going to really bite in 2023, especially in the US, and the (US) Fed looks very determined to get inflation under control,” he said.

“We don’t know exactly what will happen, but it’s going to be volatile and unpredictable. And we need to build our portfolios to withstand that.”

More Coverage

Originally published as Giant Future Fund adds risk amid historic market shift: ‘It’s time to act’