Rixon Capital takes cautious lending approach, targets $250m fund

Rixon Capital is targeting $250m for its inaugural fund over the next two years, even as the private debt firm avoids lending in sectors such as property development and consumer discretionary.

Rixon Capital is targeting $250m for its inaugural fund over the next two years, even as the private debt firm avoids lending in industries such as property development, commercial real estate and consumer discretionary.

Rixon’s co-founder and managing director Patrick Prasad William said the “sheer scale of opportunities” to fund small and medium businesses in the local market gave him confidence of achieving the target.

“There’s just so much opportunity. The question, then, is what do they do if we don’t turn up with the capital,” he said. “They’ll either kick the can down the road and try to fund with operating cash flow or raise equity.”

Despite official interest rate hikes totalling 3 per cent this year, the firm said demand remained strong for its secured lending, including for loans to fintech companies. Mr William noted that after launching the fund to sophisticated investors in September it now had a pipeline of $40m in potential lending.

The fund counts Up co-founder and fintech stalwart Dominic Pym and his family office as an investor. Digital bank Up’s parent entity was sold to Bendigo and Adelaide Bank last year in a $116m share-based deal.

Brothers and fintech investors Luke and Dallin Howes and colleague Blair Murphy are cornerstone investors in the Rixon fund. Their firm Tanooki Ventures also provided seed capital to Rixon Capital. Rixon’s push into the market comes as the private debt asset class expands in Australia, and this market attracts increased interest from offshore-based firms.

Last month Chimera Capital, an affiliate of Abu Dhabi-based Chimera Investment, and global investment group Alpha Wave Global announced an open-ended credit fund with initial commitments of $US2bn. The fund will mainly focus on the US, Canada, Britain, the European Union and Australia.

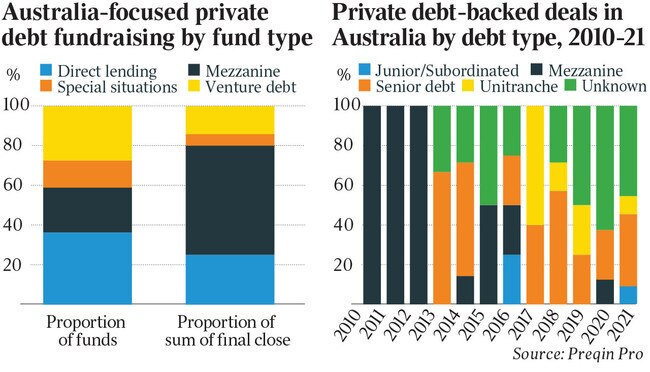

Private debt assets under management swelled 144 per cent to $1.4bn from December 2020 to June 2021, according to the Australian Investment Council. But within Australian private capital – which spans areas including venture capital, private equity, real estate and infrastructure – private debt represents just 2 per cent of the market. That compares to about 12 per cent globally.

Mr William believes the Australian private debt market will follow global growth trends, as banks continue to pull back from some lending or find the due diligence required too time-intensive.

“It’s quite clear we’re going the way of America,” he said.

Rixon will lend $2m to $20m to secured borrowers, but is homing in on the $2m to $10m loan segment, which Mr William says is most under-serviced.

This year’s rate rises have seen Rixon adopt a variable interest rate model, with a pricing floor of 13 per cent per annum. Mr William labels the pricing to borrowers a “scarcity premium”, with the cost of access to loan funds being lower than equity in the company.

The firm is selective about which industries it lends to, avoiding cryptocurrency-related exposures and treading cautiously on sectors that depend heavily on government funding. It won’t lend to companies pursuing property development, brownfield commercial property projects or operating in consumer discretionary sectors. “We never do consumer discretionary because it can change at the snap of your fingers,” Mr William said.

“We are really focused on businesses where it’s almost acyclical and there is upside in the business if the economy slows. That gives us security that we are going to get the income stream.”

The lion’s share of Rixon’s lending is for asset financing and is secured over equipment, real estate, inventory, receivables or equity. A small proportion of loans are for companies looking to undertake mergers and acquisitions, but they are also secured. The median loan-to-value ratio of Rixon’s pipeline is 60 per cent.

As private debt captures the interest of a larger pool of investors, more players are emerging. Established firms in the local market include Metrics Credit Partners, Aquasia and Wingate.

Mr William has had stints at Aquasia, Macquarie Group and FC Capital. The latter firm funded Big Review TV, a unit of failed company Big Un.

The Rixon fund targets a pre-tax cash return of 10 to 12 per cent annually, net of fees and costs, but investors need to be mindful of restrictions if they need to access their funds over the short term.

Separately, Mr William laments that investors are not being given a transparent picture of the risks within portfolios by some players in the private debt market.

“It (private debt) has not been through as many cycles as equity strategies. This has made investors comfortable with 8-10 per cent returns underpinned by subordinated debt, or senior debt with no real asset backing plus equity warrants (for ‘upside’),” he said. “Investors are not aware that they have little prospect of recovering their full investment in the event of a default as they haven’t lived through such a scenario – yet.”

The Rixon fund’s information memorandum notes all its loans will be senior ranking, meaning the money it is owed typically has first claims on the borrowing company. The fund charges a 1.50 per cent per annum management fee and a 20 per cent performance fee.

To join the conversation, please log in. Don't have an account? Register

Join the conversation, you are commenting as Logout