Who owns Australia’s food and fibre supply chain

Australia’s major abattoirs, mills, factories and feedlots have been prime targets for foreign investors. Find out which nations hold major stakes in our agricultural supply chain.

AUSTRALIAN agriculture’s foreign affair has leapt the farm gate and is racing up the supply chain at breakneck speed.

A special AgJournal investigation can reveal investors from Belgium, Brazil, Canada, China, France, Germany, Japan, the Netherlands, New Zealand, Singapore, Switzerland, Thailand and the US are lining up to spend billions of dollars on Australia’s red meat, dairy, grains, sugar and cotton supply chains in an effort to grow the industries and shore up their own food and fibre security.

And experts are tipping the global appetite for strategic agricultural assets will only grow in a post-coronavirus world.

The investigation, which has again ignited the debate about the appropriate levels of foreign capital in Australian agriculture, found:

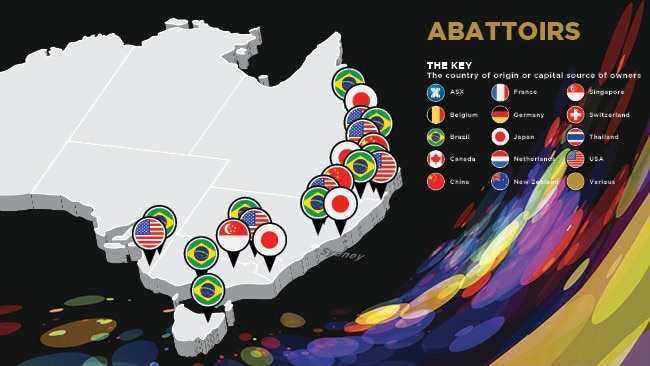

MORE than 25 of Australia’s biggest red-meat abattoirs are foreign owned, with three of the five largest processing companies owned by offshore interests.

OVERSEAS companies control more than 15 of Australia’s biggest beef feedlots, with a further five major facilities owned by funds or companies operating with some level of overseas capital.

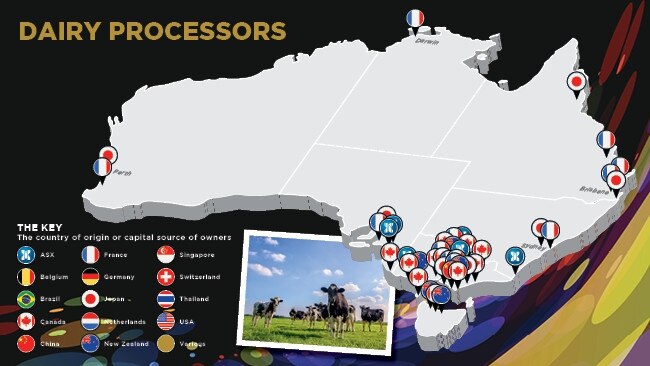

AT least 35 of Australia’s major dairy factories are owned by offshore interests with the five biggest dairy processors all operating with some level of foreign capital.

MORE than 18 of Australia’s 25 grain export port terminals are owned at least in part by foreign interests, with 11 operated solely by offshore companies.

OF the 38 cotton gins nationally, less than 10 are owned by locals, with 18 controlled by foreign interests and a further 11 backed by companies containing offshore capital.

ALL but six of Australia’s 24 raw sugar mills are owned directly by overseas companies.

The red-meat sector has emerged as one of the most attractive for foreign investors from Brazil, China, Japan and Singapore while on the dairy front, Canada, China, France, Japan and New Zealand and the US are leading the charge.

Investment in the cotton processing sector from China, Singapore, the Netherlands, the US and Canada continues to grow while Singapore, Canada, Japan and the US have invested heavily in the grains supply chain in recent years and Germany, Thailand, Belgium, China and Singapore have emerged as the major players in Australia’s sugar milling industry.

ANZ agribusiness manager Mark Bennett says while there is no shortage of differing views about the levels of foreign investment in Australian agriculture, particularly in farmland, the issue is “probably less emotive” at the processing and supply chain level.

He says foreign capital injections in the sector have been beneficial by allowing farmers to concentrate on growing their products while at the same time creating price tension for products, establishing new markets and fostering learning with technology and adaptation.

“I’ve always seen it as a healthy mix in our market to see local and foreign money combining to produce the industry that we’ve got today,” Bennett says. “From what I have seen in both farming and through the supply chain there are plenty of benefits that have come with it.”

From an investor perspective Bennett says that “whether you are a global food producer or a farmer or any kind of business” reducing volatility and creating a sustainable trading environment is paramount, and Australia is seen as “a well-developed, efficient, reliable, market-driven industry” which means “you can invest with a little more certainty”.

“And if you’re investing into something that is already globally competitive, as a global player you can bring your own technology and efficiencies to match that to give you an overall improvement in the way you take goods to a global market,” Bennett says, adding that foreign investor thinking was also driven by diverse seasons, climates and geographies.

“Now we are seeing a lot more better-organised outfits, be they foreign investors, pension funds, corporates or local superannuation funds, finding alignment between their own appetite – what it takes to get a good deal done – and the way it links to operational management and expertise.

“It has made for a more smoother and mature investor market in our industry today and that’s probably still got some time to run but it’s a really productive space at the minute.”

National Farmers’ Federation vice president David Jochinke says while “having profits stay in the country would be the ideal scenario” a lack of domestic investment in the Australian agriculture sector more broadly means offshore capital in the supply chain in particular is not just wanted but needed.

“As far as farmers go, we prefer the investment doesn’t occur on our side of the equation – in farmland – but in the infrastructure we need for manufacturing and to drive access to markets,” Jochinke says.

“The great challenge is getting that balance between domestic and foreign investment right. With foreign investment, what we never want to see is a monopoly or an effect where a sector can influence a competing sector in a different country.

“I would prefer that our superannuation funds be the first cabs off the rank to be lining up to invest in ag but at the end of the day we need that capital to come from somewhere.”

In the red-meat sector, three of Australia’s five biggest red-meat processors and seven of its 10 biggest lot feeders are fully or partly backed by foreign capital.

JBS Australia – an offshoot of the world’s largest meat-processing company JBS SA from Brazil – is the biggest red-meat player, with 10 abattoirs and five feedlots.

The second biggest is Teys Australia, a 50-50 joint venture arrangement involving Cargill International, the largest privately held company in the US – which operates six abattoirs and three feedlots. Japanese-owned NH Foods Australia, which owns three processing facilities in addition to one of the nation’s biggest feedlots, is another major player.

Other foreign players include China’s Hosen Group and Bindaree Food Group, and Nippon Foods from Japan while the Australian Stock Exchange-listed Australian Agricultural Company, Elders and Rural Funds Group – all of which contain a portion of foreign funds – have also invested heavily in the supply chain space.

John McKillop, the independent chairman of the Red Meat Advisory Council, says while most Australians prefer the nation’s farms and agriculture supply chain are locally owned it is simply “not the reality of where the capital comes from”.

“Agriculture has a very strong history of foreign investment coming in, doing a lot of good for the industry and leaving as their time goes or their investment horizon changes,” McKillop says.

“Most of the angst about foreign investment in Australian agriculture comes from the cities rather than in the bush itself.”

Dairy has been a significant target of offshore capital in recent years, with Canada’s Saputo, Fonterra from New Zealand, France’s Lactalis and Kirin Holdings from Japan each carving out significant footholds in the Australian industry over the past decade. Australia’s five-biggest processors of the past 20 years – Murray Goulburn, Bonlac, Parmalat Australia, Warrnambool Cheese and Butter and Lion Dairy and Drinks – are now all foreign owned.

In a move that sent shockwaves through the industry in 2017, Saputo swooped on Murray Goulburn, after having bought Warrnambool Cheese and Butter in 2014. More recently, Chinese-owned Mengui Dairy withdrew its bid for Kirin Holdings’ Lion Dairy and Drinks earlier this year after the Federal Government ruled the deal not in the national interest.

Another sector in foreign investor sights has been grains, with the likes of Canada’s Viterra, US companies Bunge Limited and Cargill, Wilmar International from Singapore, and Swiss multinational Glencore competing strongly for strategic supply chain assets. Of Australia’s 25 grain port terminals, seven are owned by the ASX-listed GrainCorp, whose pool of money contains foreign capital, and five by Viterra.

Victorian farmer and GrainGrowers Limited president Brett Hosking says foreign investment in the grains industry is generally welcome provided there is adequate competition for farmers. “It’s when we start to see monopoly or duopoly behaviour that we get concerned,” Hosking says.

“So far we have been able to avoid that in the grains industry but it is something we are conscious and aware of – particularly when you see mergers (between offshore companies) that are out of our control.”

An example of this concern came in 2013, when growers successfully lobbied the Federal Government to reject a proposed takeover of GrainCorp by US agribusiness giant Archer Daniels Midland amid calls that a foreign entity shouldn’t own critical infrastructure such as ports and rail links. “So we’ve seen growers stand up and get the Government’s attention so there’s no reason that couldn’t happen again (if there was need for it),” Hosking says.

On the fibre front, with cotton increasing its footprint in Australia in recent years, the levels of interest from offshore players has also grown, with the likes of Singapore’s Olam Group, the US company Boswell (Auscott Limited), the Netherlands-headquartered Louis Dreyfus, and, more recently, the two-biggest investors in Australian agriculture – Canada’s Public Sector Pension Investment Board and Macquarie Infrastructure Real Assets – flexing their muscles.

Macquarie, whose pool of money includes significant foreign capital, last year purchased a stake in Australia’s biggest cotton farm, the Chinese-owned Cubbie Station at Dirranbandi in Queensland, which has its own ginning facilities. PSP – which manages the superannuation funds of Canada’s public service, armed forces and the world-famous Royal Canadian Mounted Police – snapped up, in a joint venture, Auscott’s Midkin vertically-integrated farming and ginning business near Moree in northern NSW for more than $300 million. Auscott has since put the remainder of its portfolio, including five ginning facilities, on the market with expectations of more than $600 million.

PSP natural resources managing director Marc Drouin says the supply chain is a major focus for the business as it looks to spend another $1 billion on agriculture globally. He told last month’s Global Food Forum this concentration “more on that post-farmgate investment” is in an effort to “leverage the scale that we have built and be a little more meaningful for the larger customers that we are ultimately serving through our farms”.

For Queensland farmer Paul Schembri, foreigners adding a sweetener to Australia’s agricultural industry has had its fair share of ups and downs. The chairman of Canegrowers Queensland believes 85-90 per cent of Australia’s sugar mills are now overseas owned, a sharp turnaround from 25-30 years ago when a similar percentage of the industry was locally backed, typically by grower-owned co-operatives.

“In a perfect world we would want that to be the case but it is not how it has panned out,” Schembri points out. “Obviously at least we’ve had investors wanting to invest in our industry, and they have introduced much-needed capital into our industry, but they are foreign companies.”

Schembri says offshore investment in the sugar industry generally came from companies that are global sugar players and had an interest in their own domestic market – Wilmar International from Singapore, Finasucre from Belgium, Nordzucker AG from Germany, COFCO from China and the Mitr Phol Group from Thailand.

“Regardless of who owns the mills, whether they be Australian-owned or foreign-owned, it is the nature of the relationship between the growers and the mill (that determines whether it is a success or not),” Schembri says. “It is a symbiotic relationship where they both need each other. So when we have foreign investment it is important that those foreign companies understand the growers, understand Australia’s institutional arrangements. It has had its moments … I’d be lying if I said otherwise.”

One of Australia’s biggest agricultural players, Macquarie head of agriculture Liz O’Leary, says foreign capital will be critical to the continued success of the industry.

“I think we’ve got a great tailwind right now given many other asset classes are really wrestling with the impact of COVID – and many of those asset classes were traditionally thought of as not particularly volatile with stable earnings and strong risk-adjusted returns,” O’Leary says.

“You see Australian agriculture coming up through the middle with what is looking like a pretty stunning year so it really speaks to the incredibly uncorrelated nature of the investment.”

COTTON MILLS

Ashley, NSW, Namoi Cotton, ASX LISTED

St George, QLD, Olam Group, SINGAPORE

Boggabri, NSW, Namoi Cotton, ASX LISTED

Bourke, NSW, Namoi Cotton, ASX LISTED

Cecil Plains, QLD, Olam Group, SINGAPORE

Dalby, QLD, Louis Dreyfus Company, NETHERLANDS

Dalby, QLD, Olam Group, SINGAPORE

Dirrinbandi, QLD, Shandong-Macquarie Agriculture, CHINA

Emerald, QLD, Louis Dreyfrus Company, NETHERLANDS

Emerald, QLD, Olam Group, SINGAPORE

Goondiwindi, QLD, Naomi Cotton-Louis Dreyfus, NETHERLANDS/ASX

Hay, NSW, Boswell Company, UNITED STATES

Hillston, NSW, Namoi Cotton, ASX LISTED

Merah North, NSW, Namoi Cotton, ASX LISTED

Merrywinebone, NSW, Namoi Cotton, ASX LISTED

Moree, NSW, Louis Dreyfus Company, NETHERLANDS

Moree, NSW, Australian Food and Fibre PSP, CANADA

Moura, QLD, Olam Group, SINGAPORE

Mungindi, NSW, Namoi Cotton, ASX LISTED

Mungindi, NSW, Olam Group, SINGAPORE

Narrabri, NSW, Boswell Company, UNITED STATES

St George, QLD, Olam Group, SINGAPORE

Trangie, NSW, Boswell Company, UNITED STATES

Trangie, NSW, Namoi Cotton, ASX LISTED

Warren, NSW, Boswell Company, UNITED STATES

Warren, NSW, Namoi Cotton, ASX LISTED

Warren, NSW, Olam Group, SINGAPORE

Wathagar, NSW, Namoi Cotton, ASX LISTED

Wee Waa, NSW, Boswell Company, UNITED STATES

Wee Waa, NSW, Naomi Cotton-Louis Dreyfus, NETHERLANDS/ASX

Wee Waa, NSW, Olam Group, SINGAPORE

Yarraman, QLD, Namoi Cotton, ASX LISTED

DAIRY PROCESSORS

Allansford, VIC, Saputo, CANADA

Bega, NSW, Bega Cheese, ASX LISTED

Bendigo, VIC, Lactalis, FRANCE

Bentley, WA, Kirin Holdings, JAPAN

Burnie, TAS, Saputo, CANADA

Chelsea Heights, VIC, Kirin Holdings, JAPAN

Clarence Gardens, SA, Lactalis, FRANCE

Cobden, VIC, Fonterra, NEW ZEALAND

Cobram, VIC, Saputo, CANADA

Crestmead, QLD, Kirin Holdings, JAPAN

Darnum, VIC, Fonterra, NEW ZEALAND

Darwin, NT, Lactalis, FRANCE

Echuca, VIC, Lactalis, FRANCE

Harvey, WA, Lactalis, FRANCE

Jervois, SA, Beston Global, ASX LISTED

Kiewa, VIC, Saputo, CANADA

King Island, TAS, Saputo, CANADA

Koroit, VIC, Bega Cheese, ASX LISTED

Korumburra, VIC, Inner Mongolia Fuyuan, CHINA

Laverton, VIC, Saputo, CANADA

Leongatha, VIC, Saputo, CANADA

Lidcombe, NSW, Lactalis, FRANCE

Longwarry, VIC, Lactalis, FRANCE

Maffra, VIC, Saputo, CANADA

Malanda, QLD, Kirin Holdings, JAPAN

Morwell, VIC, Kirin Holdings, JAPAN

Mt Gambier, SA, Saputo, CANADA

Murray Bridge, SA, Beston Global, ASX LISTED

Nambour, QLD, Lactalis, FRANCE

Penrith, NSW, Kirin Holdings, JAPAN

Port Melbourne, VIC, Bega Cheese, ASX LISTED

Port Melbourne, VIC, Saputo, CANADA

Rochester, VIC, Saputo, CANADA

Rockhampton, QLD, Lactalis, FRANCE

Rowville, VIC, Lactalis, FRANCE

Salisbury, SA, Kirin Holdings, JAPAN

Scoresby, VIC, Lactalis, FRANCE

South Brisbane, QLD, Lactalis, FRANCE

Spreyton, TAS, Fonterra, NEW ZEALAND

Stanhope, VIC, Fonterra, NEW ZEALAND

Strathmerton, VIC, Bega Cheese, ASX LISTED

Tatura, VIC, Bega Cheese-Tatura Milk Industries, ASX LISTED

Wynyard, TAS, Fonterra, NEW ZEALAND

ABATTOIRS

Beenleigh, QLD, Teys-Cargill, US

Biloela, QLD, Teys-Cargill, US

Bordertown, SA, JBS Australia, BRAZIL

Cooma, NSW, S Foods, JAPAN

Corowa, VIC, QAF Limited, SINGAPORE

Inverell, NSW, Hui Wing Mau, CHINA

Ipswich, QLD, JBS Australia, BRAZIL

Kilcoy, QLD, Hosen Capital, CHINA

Longford, TAS, JBS Australia, BRAZIL

Mackay, QLD, Nippon Foods, JAPAN

Melbourne, VIC, JBS Australia, BRAZIL

Naracoorte, SA, Teys-Cargill, US

Oakey, QLD, Nippon Foods, JAPAN

Rockhampton, QLD, Teys-Cargill, US

Rockhampton, QLD, JBS Australia, BRAZIL

Scone, NSW, JBS Australia, BRAZIL

Tamworth, NSW, Teys-Cargill, US

Toowoomba, QLD, JBS Australia, BRAZIL

Townsville, QLD, JBS Australia, BRAZIL

Wagga Wagga, NSW, Teys-Cargill, US

Wingham, NSW, Nippon Foods, JAPAN

Yanco, NSW, JBS Australia, BRAZIL

FEEDLOTS

Bell, QLD, Australian Agricultural Co, ASX LISTED

Bowenville, QLD, NAPCO (QIC), VARIOUS

Charlton VIC, Teys Australia-Cargill, US

Comet QLD, Australian Agricultural Co, ASX LISTED

Condamine QLD, Teys Australia-Cargill, US

Glen Innes, Marubeni, JAPAN

Griffith, NSW, Rural Funds Group, ASX LISTED (LEASED TO JBS – BRAZIL)

Inverell, NSW, Paraway Pastoral Company, VARIOUS

Leyburn, QLD, Macquarie Downs, JAPAN

Mungindi NSW, Rural Funds Group, ASX LISTED (LEASED TO JBS – BRAZIL)

Myola, NSW, Bindaree Beef Group, CHINA

Powranna TAS, AEON Co. Ltd, JAPAN

Quirindi, NSW, Rural Funds Group, ASX LISTED (LEASED TO JBS – BRAZIL)

Quirindi NSW, Elders, ASX LISTED

Sedan, SAS, Kidman and Co, CHINA

Stockinbingal, NSW, Teys Australia-Cargill, US

Tamworth, NSW, Nippon Meat Packers (leased), JAPAN

Texas, QLD, Nippon Meat Packers, JAPAN

Toowoomba QLD, Rural Funds Group, ASX LISTED (LEASED TO JBS – BRAZIL)

Yanco, NSW, Rural Funds Group, ASX LISTED (LEASED TO JBS – BRAZIL)

GRAIN EXPORT PORT TERMINALS

Brisbane, QLD, GrainCorp, ASX LISTED

Brisbane, QLD, Wilmar International, SINGAPORE

Geelong, VIC, GrainCorp, ASX LISTED

Gladstone, QLD, GrainCorp, ASX LISTED

Mackay, QLD, GrainCorp, ASX LISTED

Melbourne, VIC, Sumitomo Corporation, JAPAN

Newcastle, NSW, GrainCorp, ASX LISTED

Newcastle, NSW, Riverina/Glencore JV, JAPAN/SWITZERLAND

Port Adelaide, SA, Glencore, CANADA

Port Adelaide, SA, Cargill, UNITED STATES

Port Giles, SA, Glencore, CANADA

Port Kembla, NSW, GrainCorp, ASX LISTED

Port Kembla, NSW, Cargill/COFCO/Emerald, US/CHINA/JAPAN

Portland, VIC, GrainCorp, ASX LISTED

Port Lincoln, SA, Glencore, CANADA

Thevenard, SA, Glencore, CANADA

Wallaroo, SA, Glencore, CANADA

SUGAR MILLS

Ayr, QLD, Wilmar International, SINGAPORE

Brandon, QLD, Wilmar International, SINGAPORE

Bundaberg, QLD, Finasucre, BELGIUM

Farleigh, QLD, Nordzucker AG, GERMANY

Giru, QLD, Wilmar International, SINGAPORE

Gordonvale, QLD, Mitr Phol Group, THAILAND

Home Hill, QLD, Wilmar International, SINGAPORE

Ingham, QLD, Wilmar International, SINGAPORE

Ingham, QLD, Wilmar International, SINGAPORE

Mareeba, QLD, Mitr Phol Group, THAILAND

Marian, QLD, Nordzucker AG, GERMANY

Maryborough, QLD, Mitr Phol Group, THAILAND

Proserpine, QLD, Wilmar International, SINGAPORE

Racecourse, QLD, Nordzucker AG, GERMANY

Sarina, QLD, Wilmar International, SINGAPORE

South Johnstone, QLDMitr Phol Group, THAILAND

South Kolan, QLD, Finasucre, BELGIUM

Tully, QLD, COFCO, CHINA

MORE AGJOURNAL

THE TOP 10 AGRICULTURE TRENDS OF THE NEXT DECADE

AUSSIE FARMERS LEADING THE AGTECH MOVEMENT

‘PULSES ARE UNDERRATED’: CROP PUMPS LIFE INTO GRAIN INDUSTRY