Who owns Australia’s farms 2021: Canadian firm PSP Investments the biggest landholder by value

The race for Aussie farmland is heating up. Canada’s PSP is closing in on $4 billion worth — and others are also buying big.

The world-famous Royal Canadian Mounted Police force has loosened its reins and is reaching for the whip as the multi-billion dollar race for Australian farmland heats up.

AgJournal’s annual investigation into who owns Australia’s farms can reveal the nation’s biggest landholder by value, Canada’s PSP Investments, which manages the superannuation of that nation’s government workers including the mounted police and armed services, is closing in on a whopping $4 billion worth of agricultural assets in Australia.

PSP, which was involved in more than $2.3 billion worth of transactions alone in late 2018 and 2019 – including two of the biggest deals in Australian agriculture’s history – has again been active on the buying front in the past year, paying almost $100 million for two major dairy farm portfolios in South Australia and Victoria, in addition to growing its extensive beef, sheep, cropping and horticulture ventures.

The Australian-controlled but partly foreign-backed Macquarie Agriculture, with local farmland investments topping $3 billion, is the second-biggest agriculture player. Macquarie, whose backers include The Netherlands’ public sector pension fund Stichting Pensioenfonds ABP, oversees the Paraway Pastoral Company, Lawson Grains and Viridis Ag portfolios of farms spanning more than 4.9 million hectares.

It has also been a busy year for Macquarie, which in recent months listed for sale its 105,000-hectare Lawson Grains business, with expectations of $600 million, and in recent weeks has been in a battle to buy major citrus-orchard owner Vitalharvest for about $330 million. The Vitalharvest portfolio includes four berry farms in NSW and Tasmania and three citrus properties in South Australia.

Unchanged at No. 3 on the list of major landholders by value is the New York-based Teachers Insurance and Annuity Association of America and College Retirement Equities Fund, which through its subsidiary Nuveen has put together a portfolio of local land and water assets valued at $US1.1 billion in December 2019, according to its annual farmland report.

TIAA-CREF off-loaded about $40 million worth of farms around Culcairn in southern NSW late last year. Collectively, PSP, Macquarie Agriculture and TIAA-CREF own 6.3 million hectares of farmland and have an estimated $8.8 billion worth of local land, water and infrastructure assets under management.

Other key value investors include the ASX-listed Rural Funds Group, with $1.1 billion in agricultural assets, the US-based Hancock Agricultural Investment Group ($1 billion-plus), Melbourne-based investor, developer and investment manager goFARM ($1 billion-plus) and billionaire mining magnate Gina Rinehart ($1 billion).

Rinehart’s 10 million-hectare portfolio, through her Hancock Prospecting and Outback Beef ventures, makes her Australia’s biggest landholder – by far – with the ASX-listed Australian Agricultural Company coming in at No. 2 with 6.4 million hectares. Rinehart’s lead, however, could be soon curbed due to her decision to offer for sale seven stations, totalling almost 1.9 million hectares, which is expected to yield about $300 million.

Shooting into No. 3 position on the land-size leaderboard is the MacLachlan family’s South Australian-based Jumbuck Pastoral Company through its recent purchase, with third-party investors, of the 1.25 million-hectare Wave Hill Station in the Northern Territory taking its footprint to more than six million hectares.

Other major landholders by size include the Queensland Investment Corporation-backed North Australian Pastoral Company (6.1 million hectares) and the family-owned Crown Point Pastoral Company (five million hectares-plus).

CBRE Australia managing director David Goodfellow says the current property market is very strong, driven by increased access to cheap money, improved seasonal conditions and strong commodity returns. “And we think the market will continue to be strong for quite some time,” Goodfellow says.

“It is exceeding expectations in some regards; we probably underestimated the amount of capital that is available to both local and foreign farmers, and low interest rates is what really is driving that.

“Some of the foreign funds have access to low-interest-rate loans from the likes of Europe – which has probably got the cheapest loans at the moment – but even local farmers are accessing core debt now at about 2 per cent per annum, and we’ve not ever seen interest rates that low before.”

Goodfellow says there is good competition from foreign investors on assets over $50-$100 million, with horticulture and broadacre cropping particularly in demand.

According to the most recent Foreign Investment Review Board data, the number of Australian farms owned by foreign interests ballooned almost 10 per cent during 2019-20.

FIRB’s annual farmland ownership showed 9897 farm titles in Australia were owned by some level of offshore interest in 2019-20 – an increase of 853 or 9.4 per cent on the previous year. According to the report, foreign interests snapped up a further 900,000 hectares of land during the 12-month period, bringing the total to more than 53 million hectares, representing about 13.8 per cent of Australia’s farming area.

China was again the biggest offshore landholder with 9.2 million hectares – 8.4 million hectares of which is lease country – followed by the UK (7.3 million hectares), the Netherlands (2.8 million hectares), the US (2.75 million hectares), Canada (2.61 million hectares) and the Bahamas (2.2 million hectares).

According to experts, foreigners are investing in Australia over other nations due to its economic stability, cheaper farmland costs, and opportunities available for trialling and proving new technologies.

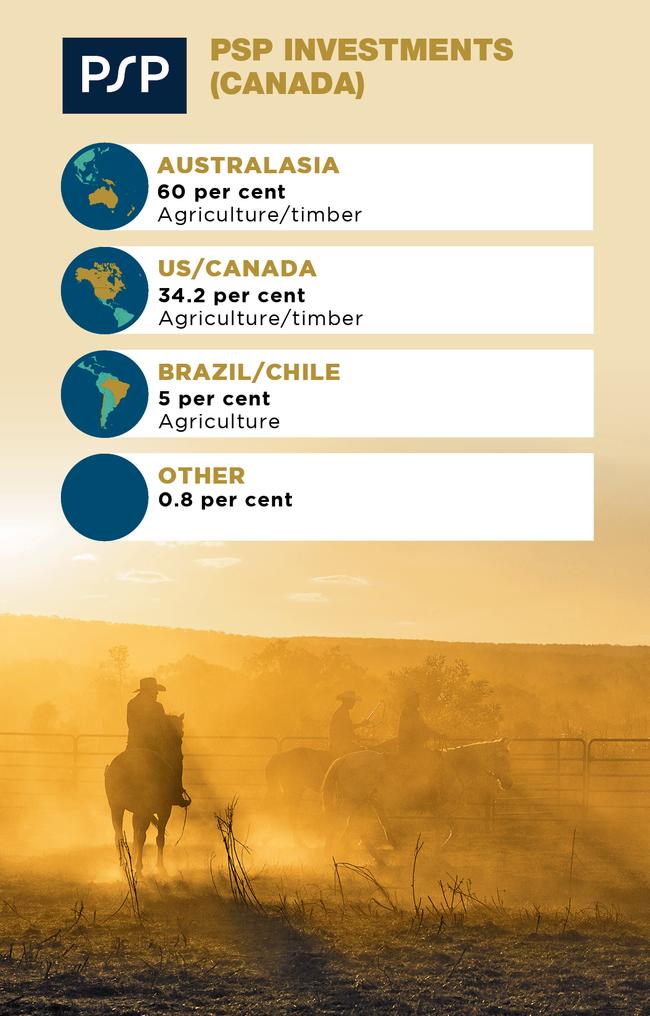

According to TIAA-CREF’s 2020 Farmland Report, it had 358,064 hectares of land in Australia in December 2019, compared to 350,460 hectares in Brazil, 133,551 hectares in the US and 39,326 hectares in Poland. Australasia accounts for 60 per cent of PSP’s investment footprint.

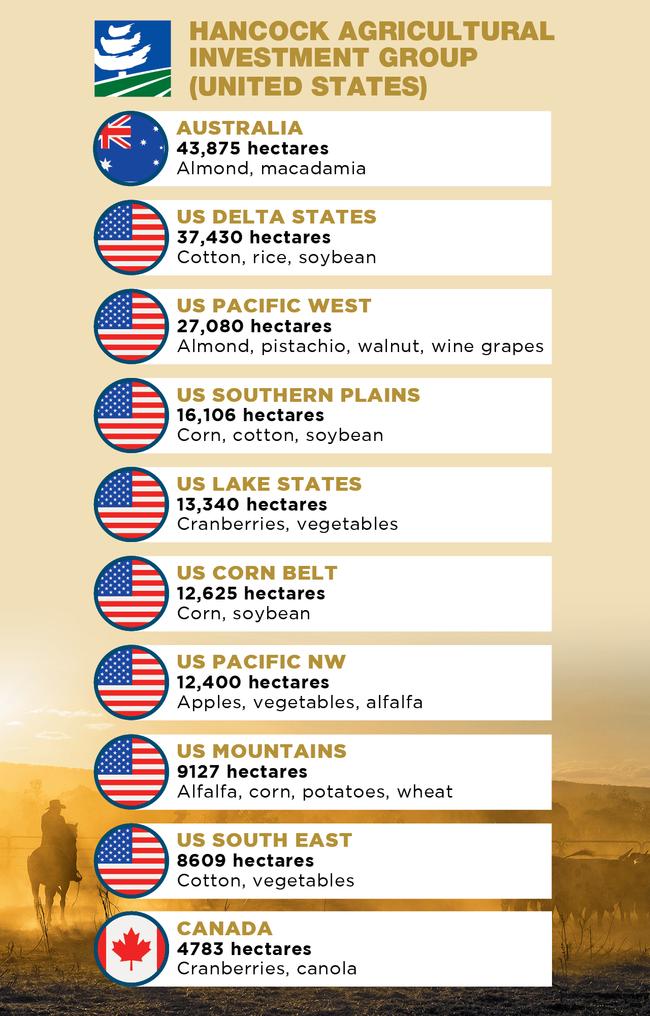

Hancock Agricultural Investment Group has 43,875 hectares under management in Australia compared to 136,717 hectares across eight regions of the US and 4783 hectares in Canada.

Goodfellow says from a foreign investor viewpoint, relative to the rest of the world Australian agricultural land is still affordable and investments in Australia give overseas businesses the opportunity to introduce and trial new technologies. Commitments by many big institutions to be carbon neutral by 2050 are also a factor.

“So where they might have a shares portfolio, have some investments in infrastructure, have some investment in real estate, have a bonds portfolio, maybe own a coal mine or two, they need to have some investments in some agricultural land where they can demonstrate they are doing some positive things for the environment.

“That is one of the reasons why we are seeing a strong appetite for crop land, and potentially horticulture land, because it is a lot easier to demonstrate that you’re doing positive things for the environment on those broadacre farming-type businesses.”

Major deals in the past 12 months include United Almonds Limited’s $129 million sale of the 1566-hectare Piangil almond orchard in northwest Victoria to the ASX-listed Select Harvests and Hancock Agricultural Investment Group’s $98 million purchase of the Mooral almond property at Hillston in NSW from the ASX-listed Rural Funds Group.

Major properties and portfolios still on the market include the 22,000-hectare vertically integrated Auscott cotton business, with expectations of $600 million, and the $100 million Harvard University Endowment Fund offering of three properties in the NSW Riverina.

MORE