China-Australia trade: What global markets look like for agriculture in 2021

The havoc that 2020 brought Australian agriculture – notably a trade war with China – is not over, but there are calmer waters ahead. We take an in-depth look at what can be expected.

IT WAS tempting to imagine that with the turning of the calendar on January 1, the drama and havoc of 2020 would miraculously be erased too.

For Australia’s farmers and exporters, the uncertainties of COVID-19 played out under the spectre of losing their biggest market, as China dealt blow after blow in a trade war we never wanted.

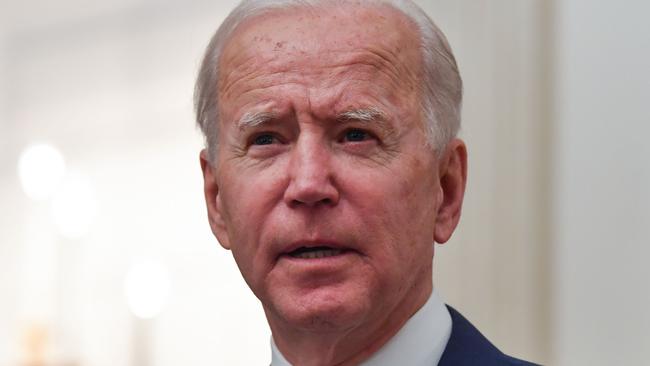

The sentiment that 2021 would somehow mean a reset in the global trading world has been helped by US President Joe Biden taking office – but those hoping his arrival could quickly help solve Australia’s problems might have to content themselves with baby steps.

“The good news is, Australian agriculture exports will be less exposed as a consequence of Trump doing deals aimed at addressing the US trade imbalance,” says Stephen Kirchner, University of Sydney’s United States Studies Centre’s trade and investment director.

That includes the US-China phase-one deal, which saw China agree to buy $US36.5 billion of US agricultural products in 2020 – a commitment some have speculated may have played a part in China imposing tariffs on some Australian goods.

Early indications are the US’s own tariffs on China will remain. But the deal itself is formally under review, and China has only met about 58 per cent of its side of the bargain so far.

“China is behind on those commitments anyway, so do you call them out on that or do you negotiate further with them?” Kirchner says. “I think there are bits of the deal Biden may want to preserve – China made sweeping commitments on intellectual property, for example, that they may want to hang on to.

“I think they will review it and enter into talks on where they go from here, but where that lands, I don’t think anyone can really say.”

Thomas Elder Markets analyst Andrew Whitelaw is less optimistic that any review of the US-China deal will put Australia in a better position. “The phase-one deal is really quite positive for US farmers, and I don’t think China would be overwhelmingly positive about repealing that and going back to the negotiating table,” Whitelaw says.

And despite China not meeting its purchasing commitments last year, it’s still locked in to buying another $US43.5 billion of US agricultural products in 2021.

“To meet that kind of value, they have to buy a lot of agricultural products, and they have to start pushing for as many products as possible being of US origin,” Whitelaw says.

“There’s more risk of more products being sourced from the US, than preferences turning back to Australia.”

He predicts almonds will be the commodity to watch: Australian almond exports to China increased dramatically at the height of the US-China trade war, but that supply could just as easily switch back to California.

Regardless how the phase-one deal pans out, there is optimism Australia’s agricultural trade will benefit from the Biden administration in other ways. Kirchner expects Biden will work much more closely with its allies on China, particularly through the World Trade Organisation – which could help when it comes to Australia’s own WTO dealings with China, such as its barley dispute.

“Trump was trying to cut deals that came at the expense of other trading partners … I think Biden will take a co-ordinated approach with respect to China, and as such the US will try to throw the rule book at China in a way they haven’t done before,” he says.

It doesn’t alter the fact, however, that Australia’s own direct relationship with China will still be a focus this year. Australia’s new Trade Minister Dan Tehan has made it clear that writing to his Chinese counterpart was one of his first priorities when he took over the portfolio; so far, he’s yet to receive a reply.

As the diplomatic strain between the two nations intensified last year, Australian agriculture was no doubt the sector hardest hit by China’s trade blows: beef exporters were shut out, barley and wine slapped with crippling anti-dumping tariffs, and crayfish left to rot on airport tarmacs in Shanghai.

But China remains unpredictable. Dairy has so far remained tariff-free, despite Australia last year reaching its export quota under the China-Australia free-trade agreement, giving China legitimate cause to impose tariffs. Meanwhile, in December China bought 600,000 tonnes of Australian wheat, valued at about $250 million, making it the biggest monthly wheat export to a single destination on record.

Matthew Reeves, senior analyst at IBISWorld, says as long as the situation between the two countries was at a stalemate, the risk remained that other agricultural commodities could be targeted at any time.

“Look at some of the markets where China has taken the bulk of demand, such as dairy, and if there was any sudden change, that would have a significant impact on Australian producers,” he says.

Beyond the trade dynamics of the US and China, Reeves cautions that demand for Aussie goods may weaken in coming months, as the Australian dollar appreciates; while agriculture’s current workforce shortages could also harm exports, particularly in horticulture.

“A major factor this year will be how much output can Australian farmers actually get with the constraints on employment; that may flow through to certain commodities having less available for export,” he says.

Despite the uncertainties, the options for new trading partners are plentiful. Dan Tehan has indicated his desire to wrap up trade deals with the EU and UK as quickly as possible, as well as refocusing on India and potentially Israel.

“All in all it’s a very good time to be in agriculture in Australia,” Andrew Whitelaw says. “We’ve got plenty of markets opening up and the more doors that open, the more options we have.”

MORE FROM AGJOURNAL