Australian farm prices continue to grow

Australian businesses are suffering under the weight of a worldwide economy but the rising value of agricultural land is proving to be a recession buster. Here’s why our farmland is popular with investors.

INVESTING in Australian farmland is the new black.

As the world battles a pandemic that has crippled economies, it is Australian farms that are proving to be the wisest investments.

Recent major reports have found farmland prices have not only significantly increased over recent years but are expected to hold firm throughout the remainder of the year, despite COVID-19.

A recent report released by Rural Bank found the median price of Australian farmland increased by 13.5 per cent last year – the sixth consecutive year Australian farmland values have grown.

MORE FROM AGJOURNAL

BEHIND AUSTRALIA’S CONTINUAL DAIRY INDUSTRY CRISIS

TOP FOREIGN INVESTMENTS IN AUSTRALIA’S FARMS

Rural Bank chief executive Alexandra Gartmann says on average Australian farmland has delivered compound annual growth of 7.5 per cent over the past 20 years.

“It’s a remarkable result and it highlights that investing in farmland over the long-term will deliver, through good times and bad,” Gartmann says.

“When you remove the noise, agriculture is stable, consistent and an under-recognised source of economic growth. If you know what you are doing and are prepared to see through short-term vagaries and variations, there are rewards to be harvested.”

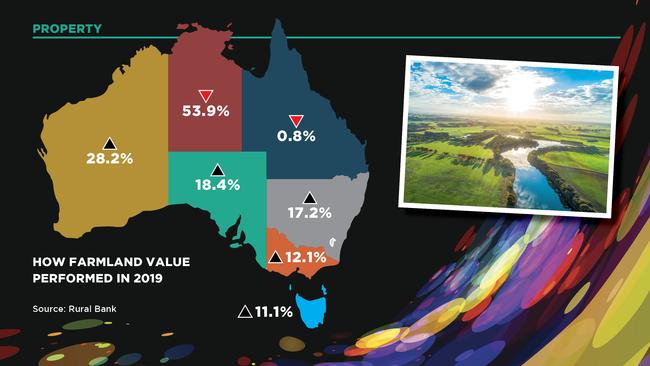

Rural Bank found in 2019 the median price per hectare of farmland:

INCREASED in Victoria by 12.1 per cent, the fourth year of consecutive growth.

LIFTED in NSW by 17.2 per cent, the sixth consecutive year of growth.

DECREASED in Queensland by 0.8 per cent.

JUMPED in South Australia by 18.4 per cent, for a 67.7 per cent increase over the past four years.

ROSE in Tasmania by 11.1 per cent, after a decline of five per cent in 2018.

SKYROCKETED in Western Australia by 28.2 per cent, following an increase of 3.8 per cent in 2018.

PLUNGED in the Northern Territory by 53.9 per cent, after an increase of 135.5 per cent in 2018.

The good news is these figures aren’t about to plummet anytime soon. A recently released report by Rabobank found agricultural land prices are expected to hold firm this year, despite a severe COVID-19-led global recession.

The report says while much of the global and local economy is being severely buffeted, Australian agricultural land is expected to remain “largely unscathed”.

It revealed:

● RELATIVELY low returns on alternative asset classes, including bonds, equities and commercial property, will favour agriculture land investment for both local and foreign investors. Yields of long-term bonds are at or near record lows and in Canada, the US and the UK – sources of a large share of foreign direct investment in Australian agriculture – long-term bond yields are currently below 1.5 per cent. Yields are also much lower now than during the Global Financial Crisis, when they were between 3.5 per cent and 4 per cent.

● A WEAK and depreciating Australian dollar will support demand from foreign investors. So far this year, the Australian dollar has depreciated against the US dollar and the euro, effectively decreasing the price of Australian farmland for foreign investors.

● HISTORICALLY low borrowing costs ensure the purchasing power of farmers is maintained for the medium term.

● THE volatility and impact of COVID-19 has highlighted the stable and counter-cyclical nature of agricultural land. The low-risk nature of ag land will reinforce its attractiveness as an investment, the bank says.

Rabobank analyst Wes Lefroy says positive production prospects, off the back of significantly improved seasonal conditions – along with commodity prices supported by a weaker Australian dollar – should underpin a profitable season for most Australian farmers in 2020-21.

“Farmer operating profit, in our view, is the primary driver of Australian land prices,” Lefroy says.

“In particular, sustained periods of profitability provide farmers with the financial capacity to buy more land.

“And despite the drought that has gripped much of the east coast over the past three years, reported three-year average farm operating profits are at their highest point since at least 1990 in Western Australia, South Australia, Tasmania and Victoria. Further, they are above the 10-year average in all states, except NSW.”

FOREIGN INVESTMENT RUSH

Major rural property sales in the 2019-20 financial year reflect the findings in these reports. One of the biggest sales was in September when Australian Food and Fibre, in a joint venture with Canada’s Public Sector Pension Investment Board, bought the 17,300-hectare Midkin aggregation at Moree in NSW – including 57,600 megalitres of water entitlements – for $300 million.

In December, the Macquarie-backed Viridis Ag spent almost $40 million on rural properties in NSW.

The company purchased the 3163-hectare property Oodnadatta Farms at Moree for $23.72 million and also snapped up the 2058-hectare neighbouring property, Grainfields, for more than $15.43 million.

In March, the historic 2349-hectare Mawallok Estate, near Ballarat, was snapped up by Qingnan Wen, one of the largest importers of Australian wool into China, for $25 million.

Most recently, in June, a portion of the historic Victorian Western District property Devon Park sold for $14.16 million.

The 1237-hectare portion at Dunkeld sold for the first time in more than 90 years, and was snapped up by Allan Myers, one of the nation’s leading QCs and owner of Dunkeld Pastoral Company.

CBRE head of agribusiness Shane McIntyre says the market presented an impressive calibre of properties over the past year – possibly the best in a decade.

“There is the opportunity to borrow money at historically low interest rates in a market that is under-supplied across Australia,” McIntyre says.

“Investors acknowledge that rural property is a resilient, long-term investment with proven capital appreciation, particularly over the past 10 years.

“The outlook remains optimistic due to appreciation by both investors and rural enterprises. There is the opportunity to create new markets with our trading partners, which continues to give national and international investors confidence.”