Double your rate cut: Best lender deals

Want another rate cut straight away? These 16 banks now have variable rates 0.25 per cent lower than the big four average.

Want another rate cut straight away? These 16 banks now have variable rates 0.25 per cent lower than the big four average.

One of the co-founders of the controversial reno series The Block has been handed $6.6 million after just 12 months completing a major project.

A huge number of Australian banks and lenders have yet to pass on the RBA’s historic rates cut. If your bank is on this list then you need to make a call.

A multimillion-dollar hospital housing deal has garnered a lot of attention — but what makes this regional accommodation so valuable, and who really benefits?

The RBA has finally cut the cash rate. But that doesn’t mean your repayments will reduce. Here’s how to fix it ASAP

A ban on foreigners buying existing Aussie homes has been shot down as ‘irrelevant’ before it’s even come into force, as experts warn a rampaging loophole has been left wide open.

A price dip in one of Australia’s most-recogisable areas has been caused by a grim statistic – and women aren’t taking the gamble.

Melbourne’s auction market is gaining momentum with buyer competition intensifying and clearance rates climbing as sellers take advantage of improving conditions.

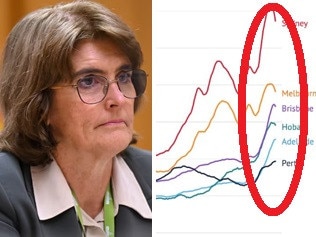

One of Australia’s biggest banks has laid out the expected impact on the housing market of the Reserve Bank cutting interest rates, and some are in for a shock.

Experts agree the RBA must cut in February, triggering massive flow-on effects for property prices, mortgage payments and bank competition. But is a cut good news for everyone?

Almost 1.6 million NSW households are at financial breaking point, according to staggering new figures. Is there a way out or will it get worse?

A rate cut could shake up Melbourne’s property market, and experts suggest buyers who wait may pay the price. Here’s why timing your sale could be the smartest move.

Aussies can save thousands of dollars by ignoring a rate cut by the RBA. Here’s why.

On a grim Valentine’s Day, the RBA’s obsessive relationship with its inflation target band could leave us all unlucky in love.

Original URL: https://www.themercury.com.au/real-estate/experts