Aussie investor reveals how he got $65m in property using clever buying strategy

An investor who owns $65m in real estate has revealed the cunning way he gets properties for well below market value - and he says anyone with dedication can do it.

Property

Don't miss out on the headlines from Property. Followed categories will be added to My News.

A 32-year-old Aussie who recently bought his 100th home claims to have found a way to consistently get properties for well below their market value – and it shows how well-funded buyers have an extreme advantage.

But there are also some lessons for everyday buyers.

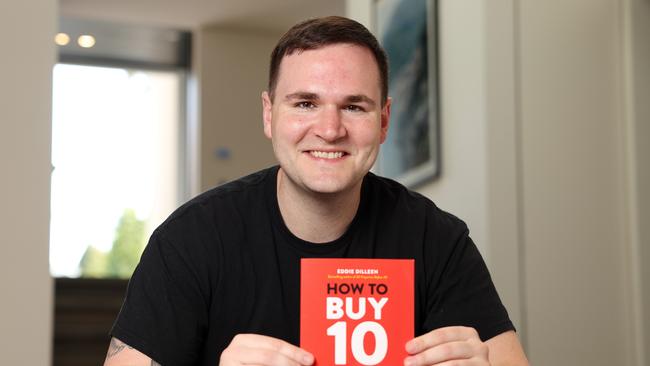

Eddie Dilleen started investing as an 18-year-old with funds he saved while working numerous menial jobs, including at McDonald’s, and gradually turned his investments into a $65 million property empire spread across the country.

He bought his first home aged 18 while earning about $24,000 a year - equivalent to about $36,000 in today’s money - and used a combination of rapid equity gains and refinancing deals to purchase subsequent homes.

The investor, who grew up in housing comission, revealed one property buying strategy turbocharged the growth in his portfolio by allowing him to get quality properties for up to $130,000 below their market value.

The strategy is simple, but takes work to pull off, Mr Dilleen said, adding that investors on regular incomes could follow the strategy in certain circumstances, including if they entered joint ventures.

“There’s a few parts to it,” he said. “I buy in bulk. You get properties for a lot cheaper than if you bought them (alone).

“There are also some key things you can use to spot a property that is selling for below market.”

Mr Dilleen said a telltale sign of an opportunity to purchase below market value was if the selling agent wasn’t normally active in the area and put little effort into marketing.

“Often these are smaller name agencies with few listings in the area,” he said. “You can see from the listing if its bad marketing. The copywriting will be sloppy and the photos will be old or just bad.

“An example is when you see the top of the listing say ‘best investment opportunity ever’ and then they only list two or three small things about the property.

“Why this matters is because not every agent knows the true value of what they’re selling. A common question they ask their sellers is ‘what do you want for it’ and that’s all they go on. The sellers don’t know either.”

Mr Dilleen added that the next part of the process was doing a comparative analysis of the property against comparable homes that have recently sold.

“This is the hardest part, actually,” he said. “It takes a lot of time and experience. Anyone can do it, but you have to be able to put in a lot of hours of research.”

Mr Dilleen pointed to a recent townhouse complex purchase in Queensland as an example of how to get properties for less.

He had noticed comparable townhouses in the area were selling for about $500,000 and, realising he could get the block of six for $2.2m or $370,000 for each unit, proceeded with the purchase.

“So I got them for about 30 per cent cheaper than buying them individually,” Mr Dilleen said, adding that a bank valuation soon after purchase confirmed his assessment of the true value was correct.

He explained that discounts were often on offer for bulk buyers because it normally saved both the property seller and their representing agent time – and money.

“You have to have a higher borrowing capacity to be able to do it, but I know of plenty of other investors who get involved in these deals by joining forces with other buyers. Buying together you can get (discounts).”

The circumstances of many bulk property sales also lent themselves to undervalue deals, the buyer’s agent said.

He pointed to another purchase in Perth where he scored the properties for about $80,000 below market value (later confirmed by a bank valuation), because they were on one title.

“To sell them separately you had to strata title them. If the sellers had time, it would have been in their best interest to do that, but they didn’t have the time and it would be difficult because each unit was tenanted … in fact, you can often get tenanted properties for cheaper because the (pool) of people willing to buy them is smaller.”

Mr Dilleen added that he didn’t believe there was anything wrong with investors snapping up multiple properties, even if there were many first homebuyers unable to land a foot on the property ladder.

The investor, who grew up in housing commission in Western Sydney, said he was proof of how anyone could get into the market with drive and dedication.

“There’s a positive way to look at it and a negative way,” he said.

“I grew up poor and broke. Some think I am taking opportunities away from others, but at end of day investors are providing rental homes. Government needs this.

“I know from childhood that there aren’t enough government homes. We waited 10 years for social housing. If there weren’t investors, where would all the people who can’t get bank loans live?

• How to own 20 homes before you turn 30

• Epic collapse that’s killing housing supply

“The economy needs investors at the end of the day. I was negative at first too. I thought f*** this s***: the rich get rich, the poor get poor. But I’ve learned not to hate the player or the game. Learn the game. Learn the rules. Figure out how to play it and win it.”

.

Originally published as Aussie investor reveals how he got $65m in property using clever buying strategy