Nicholas Zak considers selling family home as land taxes almost triple

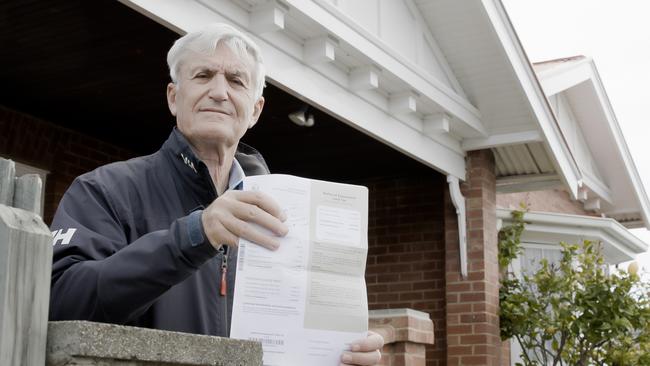

A Battery Point landlord says he’ll likely be forced to sell his family home after the government hiked his land taxes to a whopping $11,600 a year.

Tasmania

Don't miss out on the headlines from Tasmania. Followed categories will be added to My News.

A Battery Point landlord says he’ll likely be forced to sell his family home after the government hiked his land taxes nearly three-fold in an act of “daylight robbery”.

Nicholas Zak said he thought there must be some sort of mistake when he saw his land tax had been hiked from $4075 to $11,600 per year.

He was told that the land-valuer general had reassessed the value of his land from $360,000 to $1.15 million, more than triple in one go.

“I think it’s just a money grab, and I don’t understand the rationale of this land tax when you have people absolutely screaming out for rental properties at reasonable prices,” he said.

Mr Zak said he charged $550 per week for his rental property, but would need to increase rents by $150 per week to break even.

However Mr Zak said that option was off the table, since nobody would be willing to pay such “crazy” rent for a two-bedroom property in Battery Point.

Mr Zak said he would likely sell the house, which he grew up in, since it would be more financially viable to keep the money in a term deposit than rent it out.

He said he was sure other rental properties which would be pushed beyond the point of financial viability.

Hobart homeowner ‘horrified’ as land tax hiked 283%

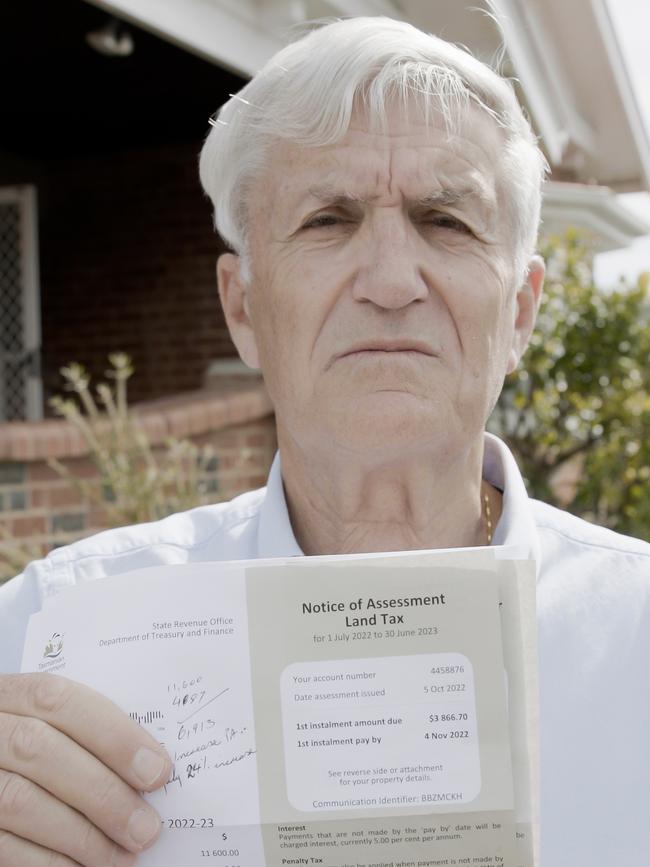

A “horrified” homeowner was sent reeling after being told his Hobart apartment would see a 283 per cent land tax hike this year.

Dr Amin Sadruddin said he heard the news from the State Revenue Office, which told him it would increase from $1056.25 to $2992.96 for the 2022/23 period.

The GP said this $160 per month additional tax was on top of recent increases to insurance premiums, council rates, owners corporation levies and mortgage interest rates.

Dr Sadruddin said these piling costs were undoubtedly fuelling Hobart’s housing unaffordability crisis.

“A 283% increase in land tax in a single year is grossly unfair, cruel, heartless and hypocritical by any standards,” Dr Sadruddin said.

“The Tasmanian Government purports to seriously want to address the housing affordability issue in Tasmania.

“I think it is time for the state government to step in and take some responsibility for its role in fuelling the current housing affordability crisis.”

Treasurer Michael Ferguson said increases in land tax assessments for 2022/23 reflected an increase in the assessed value of individual properties.

He said properties in the Hobart City Council area were revaluated by the valuer-general this year, although he said he was unable to comment on specific properties.

Mr Ferguson said assessment was based on sales information, current rental data and a range of relevant market evidence specific to a municipality.

“The Tasmanian Liberal Government consistently strives to strike a balance between revenues required to fund essential public services and infrastructure, and taxation arrangements that are fair and equitable for Tasmanians,” he said.

“In recent years, in response to the strong growth in the Tasmanian property market, the government has amended land tax rates and thresholds recognising that while people’s property values had increased significantly, their capacity to pay land tax had not increased commensurately.”

As of 1 July 2022 Tasmania’s highest land tax bracket had increased to $500,000 amid the statewide surge in land values during the pandemic.

The non taxable threshold increased from $50,000 to $100,000, with the tax rate cut from 0.55 per cent to 0.45 per cent for the low land tax bracket.

However even with the land tax rates cut, the vast majority of homeowners can expect to pay higher taxes due to the spike of assessable land values across the state.

Parts of the state have seen their residential land value evaluations skyrocket, such as Waratah which tripled and Derby which quintupled.

Have your say on land tax in the comments below.