Cruel new Facebook ‘fake deposit’ scam costing Australians thousands

Scammers have found a wild new way to extort unsuspecting Facebook users. Find out how to avoid the trap here.

SA News

Don't miss out on the headlines from SA News. Followed categories will be added to My News.

Scammers have found a new way to extort items from unsuspecting Facebook users by tricking sellers into thinking money has been successfully transferred into a bank account.

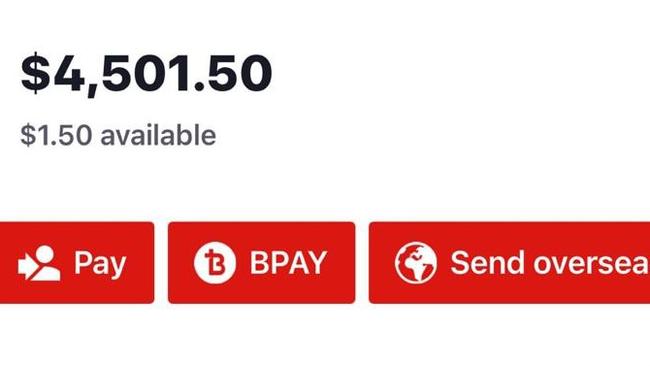

Adelaide resident Nathan, 73, told The Advertiser he was selling his MacBook Pro on Facebook Marketplace when a man contacted him online and offered to pay more than $4000 upfront for the product.

Nathan said the $4,051 appeared in his account but was not included in his available balance.

“The buyer was getting frustrated and kept saying ‘I’ve given you the money - so where is my laptop’?”

“I thought the payment had gone through because I saw the money in my account. There was no warning from the bank and it seemed like a normal transaction,” he said.

“The buyer was polite and didn’t raise any red flags.”

Later with the help of his neighbour and friend, University of Adelaide cybersecurity expert Sherif Haggag, Nathan realised the money was never really there and was just a pending transaction that got reversed once the bank detected the cheque was fake.

“I told him to ask for his address and deliver it to him once the funds clear out, but the funds disappeared” Dr Haggag said.

“These scams are happening like crazy at the moment.

“I see so many victims, it really breaks your heart because most of them don’t have much money to begin with.”

Australian Anti Scam Alliance director and special agent Evan Frangos said the fake deposit scam was also being used by scammers to gain access to people’s bank details and later used to withdraw money or sell those details on the darkweb.

It comes as scams data released by the ACCC shows that during 20

24, three people a day lost money to social media scams in South Australia.

The ACCC data shows that SA lost $14m in online scams reported to the federal government last year and $2.3m on social media scams with women aged 55 to 64 the most likely to be scammed.

Investment scams remain the most common type followed by romance and then classified scams.

Fake goods being sold online are the most common form of classifieds scams.

Carrickalinga man Russ Hewes learned this the hard way.

He saw an advert for a $5 Dyson vacuum cleaner from Bunnings on a Facebook ad.

He told The Advertiser he thought it was probably too good to be true - and it was.

After he made the online transaction, he found all his accounts had been blocked by his bank.

“The scammers had set up a $78 daily direct debit from my account, but luckily the ANZ bank stepped in and stopped it before they could take any money.”

A spokeswoman from the National Anti-Scam Centre, which is part of the ACCC, said people shouldn’t give money or personal information to anyone if they’re unsure.

“Scammers will create a sense of urgency. Don’t rush to act,” she said.

More Coverage

Originally published as Cruel new Facebook ‘fake deposit’ scam costing Australians thousands