Woman ‘traumatised’ by Auspost text scam draining $17k from Ubank

A mum, who thought she would never fall victim to fraud, was shocked when she uncovered the sinister way she had been tricked.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

A woman has been left “traumatised” after $17,000 was drained from her bank account, something she only discovered after she spending over an hour on the phone to the fraudster.

The saga began when Hannah* received a text message purporting to be from Australia Post asking her to supply an address for delivery of a package.

But when she clicked on the link, she got an error message saying that the page couldn’t be found.

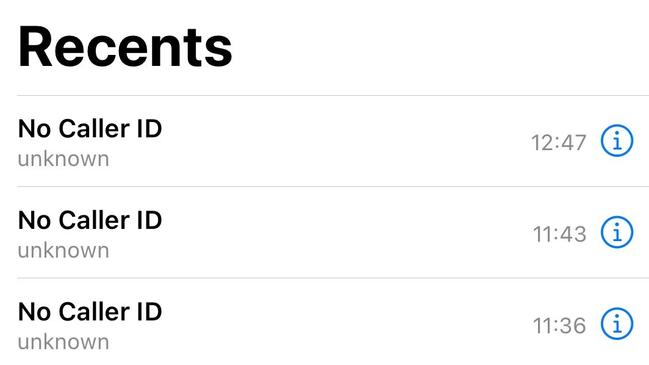

Later that day, she received a phone call from a private number with a man who stated he was from her bank’s fraud detection team.

He said he was reaching out from Ubank to see whether a transaction made in Perth for over $450 was fraudulent, a purchase the Melbourne mum hadn’t made.

The man also asked the 38-year-old if she had clicked on any links from Australia Post, Linkt or Toll, which are well-known scam texts.

Hannah had initially thought the Australia Post text message was legitimate as it didn’t request any credit card or banking details.

The man, who the mum described as having a strong Scottish or Irish accent, said he needed to lock down her bank account and remove malware the scam text had installed on her phone.

All of this was a lie.

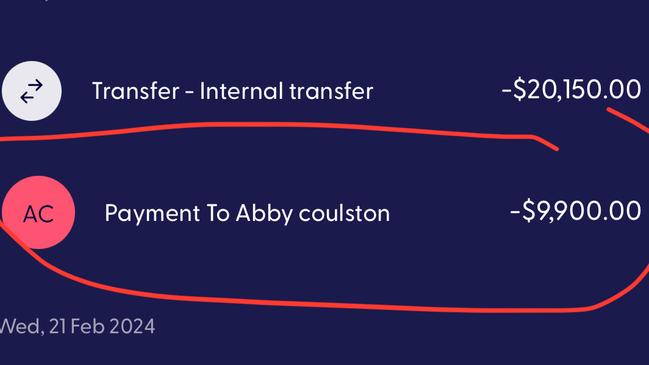

While she spent 75 minutes on the phone to him, mostly in silence except for reading out security codes generated by her bank and giving them to the stranger on the phone, the fraudster was stealing $17,000 from her account.

She even got a text message from Ubank asking if she had attempted to make a £7500 purchase at Christian Dior and she remembers feeling relieved she was already on the phone receiving help.

Do you have a similar story? Contact sarah.sharples@news.com.au

But when the scammer started asking personal questions about what she did for work and the phone call dropped, out she got suspicious.

She immediately called Ubank’s number directly and was shocked when she opened her banking app.

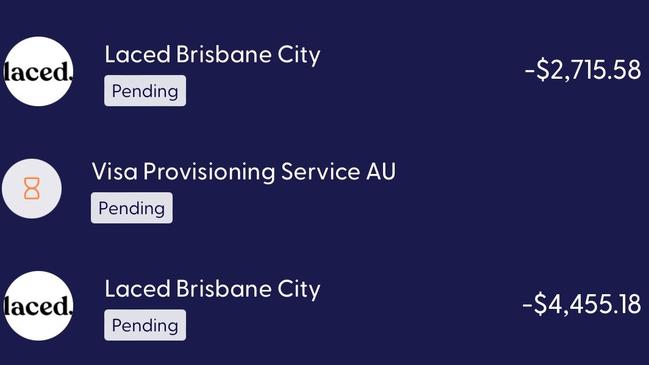

“I saw a huge amount had been moved from savings to my other account. There were two debits for a (shoe) retailer called Laced in Brisbane – one was for $2700 and the other $4400 and another was a transfer of $9900 to someone I don’t recognise,” she told news.com.au.

“I was like ‘what is going on?’ I’ve just been on phone to the Ubank fraud detection team’. I made contact with Ubank and I checked the phone timestamps and … the Ubank said no one from their team had reached out at that time and that was pretty shocking.”

Despite the charges from Laced still pending and having only been made 30 minutes prior, Hannah was told by Ubank that the transactions would still go through and could not be stopped.

The mum-of-one said she has been alarmed by Ubank’s response to her ordeal.

“I was about to get off the phone and I said ‘something wrong has happened it feels really wrong, it feels invasive, someone has committed a crime, shouldn’t I go to police?’ The woman on the phone sighed and said they would produce a report and the actions that would be taken and then they recommended filing a police report,” she recalled.

“But the investigation takes up to 180 days for transactions and 45 days for transfers, so why would I wait for 180 days to wait to file a report to police?

“I feel so vulnerable and feel really dumb.”

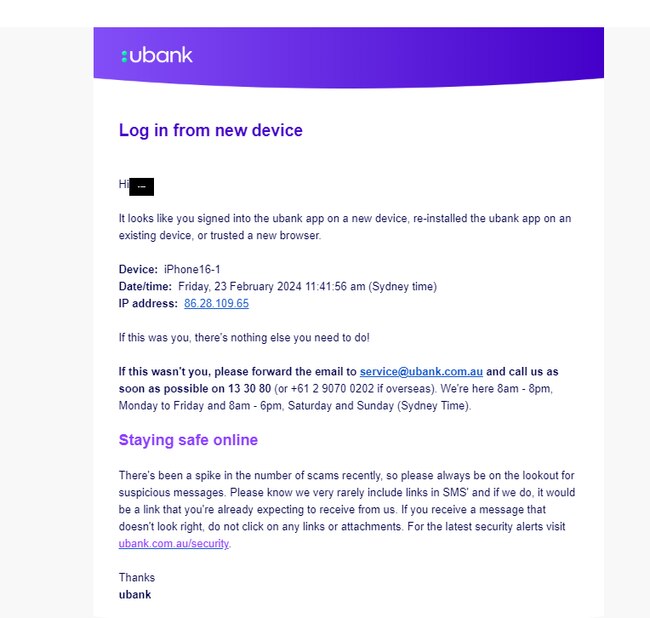

Hannah was forced to wipe her phone at the Apple store and then regained access to her bank account a week and a half later.

“The problem is when I reactivated my account every question the person asked is what the fraudulent person asked me pretty much word for word, so it was pretty traumatic to be asked things like my full name including my middle name and full address – it was blood curdling to do that,” she added.

A Ubank spokesperson said the team will always do whatever it can to get stolen money back. “However, in a lot of instances, this can be extremely difficult, given the sophistication of scams and the speed at which funds are moved. In the matter raised, this is an unfortunate example of a customer falling victim to an impersonation scam,” they said.

They said when a victim has authorised the payments and passed on all the authentication, password and token protections that a bank or service provider has put in place, such as one-time passwords, PINs, or other credentials, they’re unlikely to be refunded.

“Most banks, including Ubank, always include a message when they send a one-time password that tells the customer to never share the code with anyone, including their financial institution,” they added.

“This is because using a one-time password a fraudster can use this information for the wrong purposes like online transactions and purchases, transferring money, and identity theft.”

But Hannah said something needs to change with Australians being scammed daily.

“I just felt like there was nowhere to go and there is a gap in the system,” she said.

“If the investigation time is 180 days, yet the next day my money is getting distributed and spent and it feels like no one is working on it and I have to be a in a long queue.”

Text scams are on the rise too with a 37 per cent increase reported to the Australian Competition and Consumer Commission (ACCC) in 2023 compared to the previous year, with Aussies losing a whopping $26.9 million.

For bank scams in particular, Scamwatch received 14,603 reports of bank impersonation scams in 2022, resulting in more than $20 million in losses. Total losses to phone and text scams increased significantly with over $169 million lost.

Bizarre things have continued to happen with Hannah’s account too.

More than three weeks after she was scammed, her bank account was plunged into a negative balance as a transaction from a Brisbane retailer only settled in March.

“I had to call in to understand what was happening and was told a debit was just made by the vendor I recognised as fraudulent, while my account was supposedly locked,” she added.

The Ubank spokesperson said once they were advised of the event, Ubank acted quickly to freeze the remaining funds and report the disputed transfers to the receiving banks.

“Our recovery efforts are ongoing, but the reality is that when a customer shares passwords, the money is very often moved swiftly by the fraudster and recovery attempts are ineffective,” they said.

Since her experience, Hannah, who works as a consultant, has had clients share similar experiences, like a family member who had lost $120,000 over Christmas and only got $30,000 back and another who had lost their life savings.

“This happens a lot and you think it will never happen to you and you’re vigilant enough but it is getting quite sophisticated... but it’s quite traumatic,” she said.

“I try and tell everyone so they learn form my $17,000 mistake. I feel helpless, from February 23 I did everything I could from that moment.

“I’m told most of time the scammers convert the money to crypto and you never get it back – I can’t believe there is no system in place to prevent this.”

For now Hannah is waiting to see if she will see any of her money returned, with the scam cleaning out out a substantial amount of her emergency funds.

“I want to see something different. I don’t’want to see this story next year, it’s in the millions that people will get conned, someone needs to do something at the state, federal and international level,” she said.

“I work really hard for my money but I joke if I change my job I can make $20,000 in an hour and I’m not going to get caught.”

*Name changed for privacy reasons

sarah.sharples@news.com.au

Originally published as Woman ‘traumatised’ by Auspost text scam draining $17k from Ubank