Staggering new average wealth for Aussies

Australia’s average wealth is growing to new and unprecedented highs. But this doesn’t mean everyone is getting richer.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

Average in Australia just got weird. Rising house prices, rising stock markets and even rising Bitcoin have pushed the wealth of Australians to another new record.

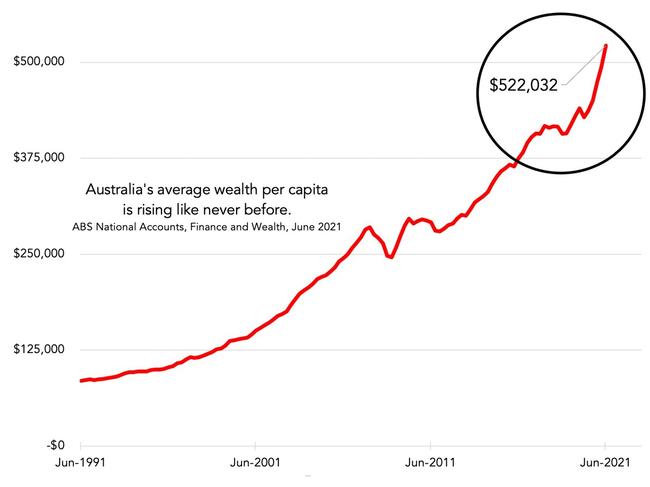

Australia’s average wealth just blew through the half a million mark. As you can see in the next graph, the wealth of Australians is rising almost vertically.

The last time wealth rose so fast was 2009, as we bounced back from the GFC. This is different as it’s not a bounce back to previous levels. This time wealth is growing to new and unprecedented highs.

Can we keep it up?

Half a million in wealth seems like a lot for an adult. What should blow your mind is that this calculation is per person, including every child.

Beware though — this is the average (or if you prefer more mathematical terminology, the mean). Averages can get pulled up by just a few people with big numbers — imagine how average wealth in your house would go up if Bill Gates walked in the door.

A rising average doesn’t necessarily mean everyone is getting richer. And not everyone in Australia is.

The biggest moving part in the wealth equation is house prices. If you’re not a homeowner it can easily feel like the wealth train has left the station without you on it. (Full disclosure- I finally bought my first home early this year. It feels like a big relief!)

The value of all the land and dwellings in Australia rose by $576 billion in the last three months, the Bureau of Statistics tells us. That’s roughly a $382 increase in wealth for homeowners each day on average; $0 for renters. The value of Aussies’ superannuation also went up, but by less. It rose $141 billion ($63 per person per day).

The above numbers are all net wealth. Debt is doing surprising things. Yes, Australian house buyers are take advantage of record low interest rates to borrow huge amounts and pile into the housing market. But total debt is not going up much because mortgage owners are paying off their loans fast.

Expect the unexpected

Aussie house prices have done crazy things in the pandemic. Unexpected things. I thought prices should fall (so did the experts at major banks!). Instead, they just kept on rising.

Turns out low interest rates and generous government payment schemes were more relevant to house prices than migration or a gigantic recession. But the helium-infused nature of house prices is starting to make people nervous again.

Two people you should listen to have been warning about the housing market in the last week.

1. The RBA assistant governor Michelle Bullock

2. The CEO of Australia’s biggest bank, Matt Comyn

The RBA has been pretty happy about rising house prices recently. But last week the assistant governor made a speech where they made it clear they are starting to get nervous about prices rising too fast, and people taking on too much debt.

“Rapid price rises can increase the likelihood that some new borrowers will overstretch their financial capacity in order to obtain a new loan, making them more likely to reduce their consumption in response to a shock to their incomes,” said Assistant Governor Michell Bullock. “ … [I]f rapid price rises ultimately prove to be unsustainable they could lead to sharp declines in price and turnover in the future.”

And the boss of Commonwealth Bank, Matt Comyn, also seems on edge. Here’s what he had to say.

“We think it would be important to take some modest steps sooner rather than later to take some of the heat out of the housing market,” Mr Comyn said.

Pay close attention to this. Comyn makes his bread and butter lending money to people to buy houses. If he wants to slow that down, it must mean he’s feeling real fear.

Still, the future of Aussie wealth depends mostly on house prices, which depend enormously on interest rates. The RBA has hinted it will keep interest rates low until 2024 at least. There might yet be time for average wealth to hit even higher records.

Originally published as Staggering new average wealth for Aussies