How homeowners are allowing banks to rip them off by up to $10,000 a year

Homeowners are blindly allowing the banks to rip them off by up to $10,000 a year by failing to do one crucial thing.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

Homeowners are blindly allowing the banks to rip them off by up to $10,000 a year by failing to shop around for a better interest rate.

As major banks and lenders forecast the Reserve Bank of Australia (RBA) to slash interest rates at next week’s meeting, new figures have revealed the savings thousands of families are missing out on by not shopping around or haggling for a better deal.

Compare the Market’s Economic Director and former Sunrise host David Koch warned that while the RBA lowering the cash rate would be a good thing, it’s not guaranteed that all banks or lenders will pass on the reduced rate.

For that reason, homeowners still had to be their own best advocate by ensuring they had the best interest rate deal on offer.

“The fact of the matter is some banks may not pass on a rate cut right away, while some may not pass it on at all,” Mr Koch said.

“This is why Australians have to be on the ball, push to be moved onto better rates or move to a lender who is offering a better deal. Your loyalty could be costing you. It simply doesn’t make sense to be paying a cent more than you need to.

“If you’re planning on haggling with your current lender, ensure you know what their current lowest advertised rate is. Often, the banks are going to reserve the best offers for new customers.

“If you are comparing with other lenders, look at their rates, as well as any cashback offers or incentives that are available. While cashback offers aren’t as prominent as they once were, some great deals are still available.”

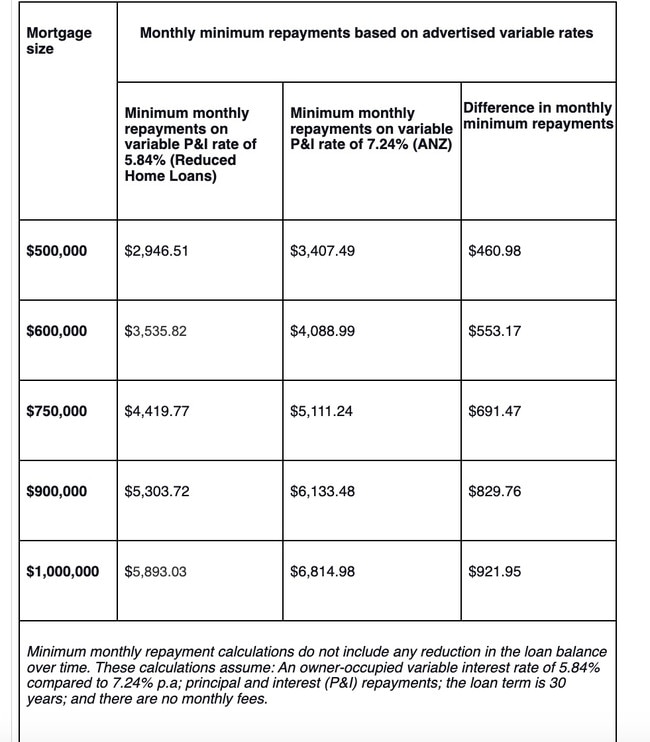

Compare the Market’s analysis, conducted in February, found a 1.4 per cent difference between the highest (7.24 per cent) and lowest (5.84 per cent) advertised rates for some variable loans.

That means some families are missing out on huge savings.

These calculations assume: An owner-occupied variable interest rate of 5.84 per cent compared to 7.24 per cent p.a; principal and interest (P & I) repayments; the loan term is 30 years; and there are no monthly fees.

On that basis a family with a home loan of $500,000 could be paying $2,946.51 with the cheaper home loan rate instead of $3,407.49

That’s a saving of $460.98 a month or $5,520 a year. But the savings naturally increase depending on the size of your loan.

For a $750,000 loan you could be saving $750,000 around $691 a month or $8,292.

For families on a $1 million loan, someone with a set-and-forget loan at the higher rate is paying the big banks nearly $1000 a month more than they need to or a whopping $11,000 a year.

However, Koch cautioned that there are costs involved in moving between lenders. In some cases, families can stay put with their lender but negotiate a better deal by threatening to leave.

“If you are interested in refinancing, be aware that there usually are some costs involved, so make sure the savings to switch outweigh these fees,” Mr Koch said.

“While new lenders may try to lure you with deals, incentives, cashbacks or rewards, also make sure these are actually giving you bang for your buck.”

Mortgage pain

Homeowners have been slugged a whopping $54,000 in extra repayments on their mortgages in Sydney as a result of interest rate rises since the election of the Albanese Government but can only expect relief of around $115 a month if the RBA cuts rates next week.

While the Albanese Government is cautiously confident that the RBA will cut rates next week for the first time since the Covid-19 pandemic, there are fears that it won’t be enough to ease cost of living pressures for families.

That will require several rate cuts, which most banks are confident will occur over the next 12 months if inflation remains under control.

If the RBA does cut next week, it will be the first decrease in the cash rate in over four years, since November 2020 during the Covid-19 pandemic.

The election of Prime Minister Anthony Albanese coincided with a worldwide trend of central banks lifting rates to tackle inflation, and that understandably proved a political headache for the government.

Why some families paid $54,000 in extra home loan repayments since 2022

For families in Sydney, successive rate hikes delivered a $54,000 hike based on the average mortgage being $780,000 in 2022.

In Victoria, families have been hit with an additional $44,000 in interest based on a $640,000 home loan, while Queenslanders with a $540,000 home loan have paid $37,000 extra, and South Australians with a $460,000 mortgage have forked out $35,000 more.

In Tasmania, where the average mortgage was $450,000, the extra interest cost households $29,000 each.

Rates started increasing in May 2022, going up a grinding 13 times over the next 15 months to the current level of 4.35 per cent.

Economists at the nation’s big four banks are now united in predicting the RBA will cut next week.

ANZ predicts that a cut will occur when the bank’s board meets with further cuts to follow.

Commonwealth Bank economists are optimistic that homeowners will get four cuts over the next year or so.

NAB predicts that we will get five cuts in the next cycle and Westpac currently four cuts in the next cycle.

Originally published as How homeowners are allowing banks to rip them off by up to $10,000 a year