Gold Coast family wake to chilling sight on their front doorstep

A Queensland mum-of-four woke up at 5am to find a startling sight greeting her on her doorstep. Now, a year later, the debacle is far from over.

Money

Don't miss out on the headlines from Money. Followed categories will be added to My News.

A Queensland family has been left devastated twice over after their new car was stolen and destroyed.

But while the theft was a blow, what happened next has left the family frustrated and further out of pocket.

Mum-of-four Jessica*, from the Gold Coast, recalled how she woke up at 5am last February to find the front door to her home open and the contents of her handbag strewn on the front lawn.

“That was the first sign that anything was wrong,” she said.

When she checked her garage, her heart sunk; the car was gone.

“They snuck in while we were asleep, grabbed the keys, grabbed the laptops,” Jessica told news.com.au. “That was really unsettling.”

The car was eventually found but it was deemed unsalvageable and Queensland Police told news.com.au they have since charged a 17-year-old boy over the crime. The matter remains before the courts.

What followed with her insurance company, however, proved to be the biggest headache of all, according to Jessica.

The 38-year-old said she had never owned a new car but in January last year, while she was pregnant with her fourth child, she and her husband were willing to splash out to prepare for a big family.

They purchased the car under finance but just three weeks later it was stolen and deemed “a total loss” when it was eventually recovered.

“They (the thieves) racked up $60,000 of damage,” Jessica explained. “It was a $70,000 car, I think the assessor stopped counting when they got to $60,000 worth of damage.”

Police told her the burglar was able to break in because they had scrambled the electronics on her old garage door.

The couple spent money increasing their security, adding cameras and alarms and upgrading their door so it wouldn’t happen again.

“We still had to make repayments on the car that we didn’t have. We were really worried, are we going to be left holding this debt for a car that we didn’t own?”

Luckily, her insurance company Virgin Money, who used Auto & General as underwriters, allowed the young family to acquire another car.

However, she says what followed left her frustrated with Auto & General.

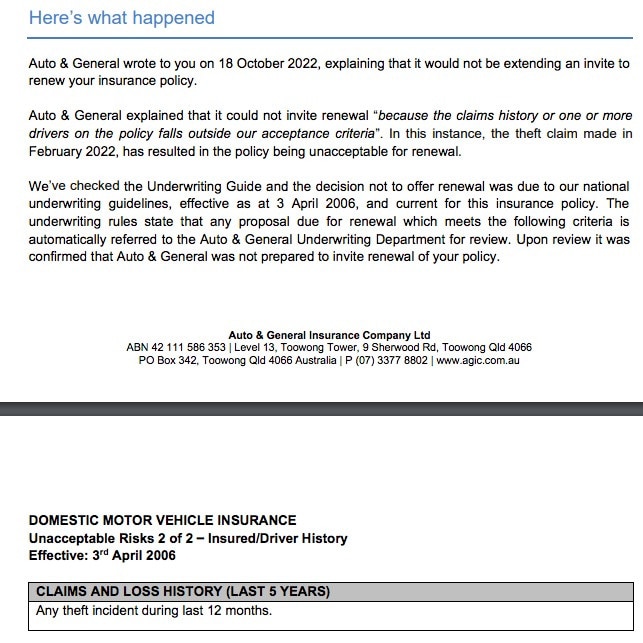

In October last year, the family received a letter from their insurer informing them that their insurance had been declined for renewal.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

The form stated that Jessica’s family were deemed too risky to insure, with “any theft incident during last 12 months” listed as the reason.

“It felt really punitive. I guess it felt like we’d somehow done something wrong to make ourselves a victim of crime, despite it being random,” Jessica said.

She also added that her home was more secure than ever, making the decision even more grating.

Jessica made an internal complaint against Auto & General which went nowhere.

She also lodged a complaint with the Australian Financial Complaints Authority (AFCA) which did not rule in her favour.

To make matters even worse, she then found it difficult for another insurance company to accept them as new customers.

Her insurance termination came with an important disclaimer that read: “The decision by Auto & General not to invite renewal of the policy is not a cancellation or refusal to insure, but rather, it is simply a decision not to offer another term of insurance.”

However, when Jessica began shopping around, she found this distinction didn’t matter.

“One of the questions the (big insurers) asked was ‘have you ever had a claim refused, policy cancelled or insurance renewal not offered?”

She found that her premiums had gone up, saying “We had to jump through a few more hoops.”

They eventually found a smaller insurer that didn’t ask the question but as a result, it doesn’t offer as widespread services across the state for their car.

When news.com.au contacted General & Auto for comment, they did not hide the fact that a random car theft was a mark against a customer.

The spokesperson said that they couldn’t comment on Jessica’s individual case due to privacy reasons but added “Auto & General prides itself on offering most customers lower prices for quality insurance coverage.

“Being able to do this means we cannot offer insurance to every customer.”

According to the spokesperson, if something bad happens to someone once, it is more likely to happen again.

“Experience tells us that people who have been the victim of car theft are, unfortunately, more likely to suffer another car theft, especially when the crime occurs at their home.

“To offer lower prices for most customers, it is reasonable for us not to offer insurance in the rare cases where a theft has occurred,” they said.

The insurer pointed out that the most recent statistics from the National Motor Vehicle Theft Reduction Council, in 2021, 0.23 per cent of cars were involved in some sort of theft.

* Name withheld over privacy concerns

alex.turner-cohen@news.com.au

Originally published as Gold Coast family wake to chilling sight on their front doorstep