ASX Trader: Silver on course for catch-up rally in wake of explosive gold price surge

For decades, an enduring partnership between two precious metals has produced a powerful correlation that traders can’t afford to ignore, writes ASX Trader.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

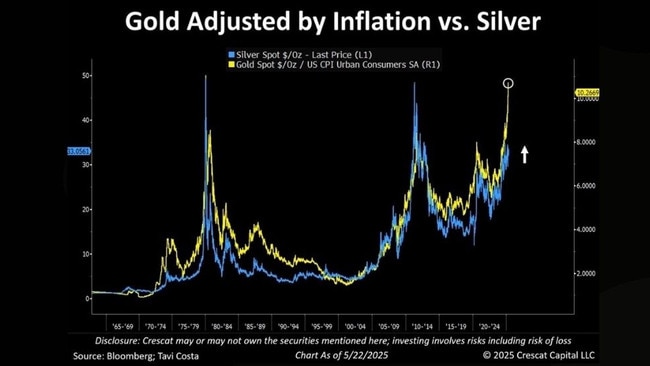

For decades, silver has been the loyal shadow of gold, tracing its movements with remarkable precision when adjusted for inflation. This enduring partnership has produced a powerful correlation that traders can’t afford to ignore. Whenever gold has surged, silver has inevitably played catch-up and often with breathtaking speed.

Today, this long-term relationship is once again flashing a major buy signal. The inflation-adjusted ratio between gold and silver is now at a level that has historically preceded massive silver rallies. But that’s just one piece of the puzzle.

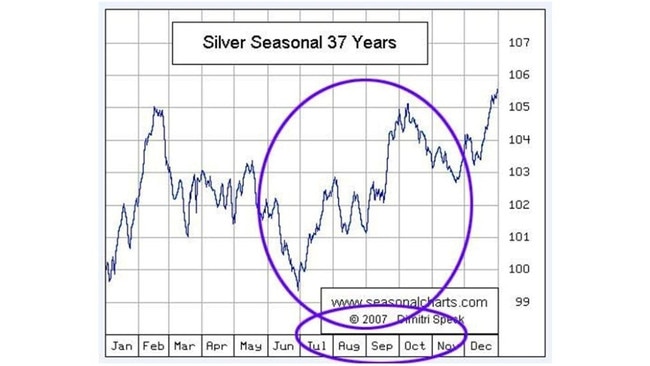

Markets have seasons just like nature

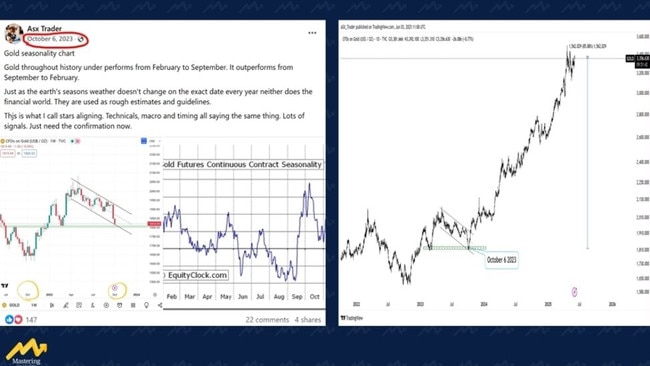

Just as fishermen know when the fish are biting, seasoned traders understand that markets and asset classes also have their seasons. In 2022, I used these same seasonal patterns to identify the bottom in gold before its major breakout. It bottomed the very next day and has nearly doubled since then. Now, the same setup is coming together for silver.

Decades of data show that silver tends to bottom out in June before launching a powerful move in July. If past patterns repeat, silver’s typical “rocket” ignition is just around the corner.

With that seasonality in mind, the countdown is on. Traders and investors now have at most a month before silver’s breakout likely accelerates. If silver clears the key psychological level of $35, something that appears highly likely, expect a swift, forceful surge.

We’ve already seen how quickly these kinds of breakouts can happen. Just last week, platinum took off in a similar fashion, triggering forced short-covering and an instant price spike. Silver’s setup looks uncannily similar.

The gold-silver ratio: A classic mean reversion setup

One of the most powerful signals in the precious metals market is the Gold/Silver ratio. This ratio measures how many ounces of silver are needed to buy one ounce of gold. Historically, the ratio has oscillated within a broad but fairly predictable range, with long-term averages over a century hovering around 55. When the ratio climbs significantly above that range, it has tended to mean-revert and often with silver staging explosive outperformance.

Currently, the ratio remains extremely elevated at 97.70, signalling that silver is deeply undervalued relative to gold. Every time this ratio has reached similar extremes in the past, particularly when adjusted for inflation and real yields, it has preceded a major silver rally. The ratio isn’t just a number on a chart; it’s a loud, flashing beacon for value-focused traders.

Think of it as a stretched rubber band. The wider the gap, the more violent the snapback tends to be. And silver, being the more volatile of the two metals, tends to benefit the most from these rebalancing moves. The current setup is a textbook mean reversion opportunity: high ratio, confirmed seasonal strength, and supportive macro tailwinds.

For traders who understand the rhythm of the market, this is not the time to wait, it’s the time to position. The Gold/Silver ratio is not just a statistic. It’s a strategic edge.

Sentiment and the accumulation phase: Exactly where it should be

Right now, the sentiment around silver is exactly what you’d expect at the end of an accumulation phase — and that’s the point. People are mocking it. Joking that it “never moves.” Saying it’s another “fake rally.”

But that is precisely what healthy accumulation looks like.

I saw the exact same sentiment when I was pounding the table on gold below $2000. People were laughing at the idea of a gold breakout. Yet what followed was one of the most explosive moves in recent memory.

Markets are designed to wear you out before they pay you out. And silver is doing just that — grinding sideways, frustrating everyone, and building a launch pad beneath the surface.

If you wait for headlines and hype, you’ll be buying someone else’s breakout. Right now is the zone where serious capital quietly accumulates while retail gives up. When the move begins, it won’t come with a warning.

Final warning

For anyone watching from the sidelines, consider this your final heads-up. Silver is notorious for explosive catch-up moves. Once this breakout ignites, there may be no second chances just like with gold.

If history and seasonality repeat, we’re on the cusp of silver’s next great run. And if you’re on the wrong side of the trade, you might find yourself racing to cover as silver shoots past $35 and perhaps even higher.

Originally published as ASX Trader: Silver on course for catch-up rally in wake of explosive gold price surge