Sydney hair salon Franck Provost co-founders under fire over $635k debt owed to friend

A fast friendship. The dream of a Maldives resort. A $400,000 personal loan. What could possibly go wrong? WARNING: DISTRESSING CONTENT

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

EXCLUSIVE

When Cyril De Baecque loaned $400,000 in life savings to a friend, he never imagined this decision would leave him destitute, cause him to lose his job and drive him to the brink of suicide.

Within a few months of arriving in Australia from France more than a decade ago, Cyril struck up a friendship with two men, a couple called Stephane Banasiak and Jean-Francois Carre.

The couple were well known entrepreneurs in Sydney’s French community through running a successful hairdressing business together.

They had previously borrowed money from their friends — including Cyril and other French nationals in Australia — then returned the cash with interest while also growing their company, JFS Hair Management. The two had several companies which all featured the name JFS, which stood for the initials of its founders, Jean-Francois and Stephane.

In 2016, Cyril loaned Banasiak the sum total of his life savings to help his friend with a new business venture, called JFS Resorts — a project to open a resort in the Maldives.

He signed a contract with JFS Hair Management and Banasiak, who also agreed to a personal guarantee.

But now, six years later, Cyril, 48, has still not been able to recover his money.

He took them to court and won his case where the loan was ordered to be paid back to him, but shortly after, the company went into liquidation. Banasiak returned to Paris while Carre established a new company.

“I’m not going to lie, I have been standing on the edge, I’ve been in very dark places,” the dad-of-two told news.com.au.

Carre has denied any involvement in a phoenix operation, which is when a company collapses then restarts under a different name and avoids its debt.

Phoenix activities directly cost the economy between $2.85 billion and $5.13 billion annually, according to a report commissioned by the Australian Taxation Office in 2018.

An estimated one out of 10 companies that collapse are the result of phoenix operations, according to experts.

Despite that, an independent analysis economist John Adams released about the financial regulator on October 6 found that less than one per cent of reports of financial misconduct are investigated.

Partly in response, several weeks later, on October 27, the senate passed a motion to hold a parliamentary inquiry into the regulator, the Australian Securities and Investments Commission (ASIC), to get to the bottom of it.

News.com.au is calling on impacted Australians to lodge a submission with the inquiry to share their horror stories about their dealings with ASIC.

Australians have three months until submissions close, until February 3 next year.

ASIC is not taking any action in this particular case.

Have a similar story? Get in touch | alex.turner-cohen@news.com.au

Banasiak only needed Cyril’s money for a month, according to the contract, to secure a lease for a plot of land in the Maldives to start building his resort.

But in a trail of emails seen by news.com.au, Banasiak gave various reasons as to why he couldn’t pay back the loan for two years, including that he was finalising global fundraising, negotiating the final loans against his guarantees and validating documents.

Cyril struggled to pay his bills and launched legal action in 2018. Most of the money to launch the case was borrowed from family as he could not afford it.

“On some occasions I had literally nothing in my bank accounts, I was begging him to send me money for my kids’ school,” Cyril said.

Cyril won his civil court case in August 2020, with a judge ordering Banasiak and JFS Hair Management to jointly pay back $501,000, which was the original loan amount plus interest.

He claims the total amount he was owed at the time was $635,000, because he spent $134,000 on lawyers.

But within months of the court order, in April last year, the company, which owed half the debt, went into liquidation.

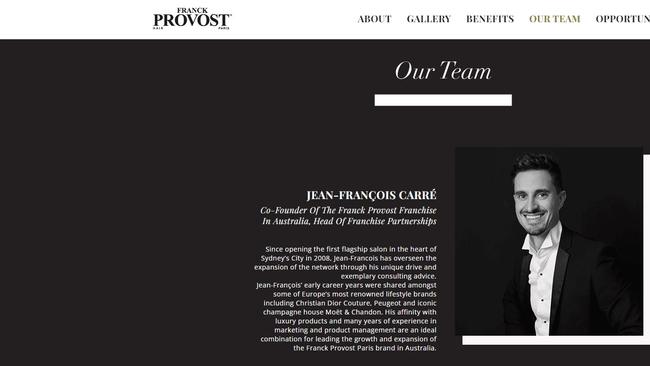

Banasiak has returned to Paris while Carre now runs the Australian branch of Franck Provost, a successful hair salon franchise in NSW, Victoria and Queensland.

JFS Hair Management was left with no assets, meaning there is now no way for Cyril to recoup his losses through the company.

“It took over two years to finally get a judgment that is useless to me,” Cyril lamented.

In August 2018, a month after Cyril served the statutory demand, Carre was involved in creating a new company called Martin Place Hair Management Pty Ltd.

Soon after, he transferred a salon that was part of JFS Hair Management to the new establishment, according to the liquidator’s report.

The transferred salon, referred to as the Macquarie St Salon in the liquidator’s report, was transferred to Martin Place Hair Management “with no written agreement” despite the company generating profits in that period of time.

The liquidators of JFS Hair Management said there appeared to be a kind of phoenixing operation, something that Carre has vehemently denied.

The company’s appointed liquidator, Steven Kugel of Insolvency Experts, filed a scathing report to ASIC about JFS Hair Management.

Kugel said his investigation found that Cyril was the largest creditor. In all, the hairdressing business collapsed owing $928,000, according to liquidation documents. The tax office was another creditor.

The company’s collapse “involved the movement of a profitable and seemingly valuable trading business from one entity, controlled by Carre, to another entity he also controlled, with knowledge of the significant claim against the company by De Baecque (Cyril) and the ATO; and is what might be described as... (a) phoenix operation,” the liquidator wrote.

The liquidator, Kugel, told news.com.au that Carre’s transfer of business assets “was unusual and wrong, straight up wrong, I stand beside everything we have to say in this report”.

The matter was reported to ASIC but no action has been taken. There is no suggestion of any involvement in phoenixing by Banasiak.

Carre was able to continue leading another one of his businesses that he started with Banasiak, Australian hair franchise chain Franck Provost, which has stores in nine Sydney suburbs, including Breakfast Point, Chatswood, Crows Nest, Manly and Mosman. There is also a store in Townsville, Queensland, and in Melbourne.

Carre claimed in court that JFS Hair Management shouldn’t have to pay the hefty debt because Banasiak had entered into the agreement outside the company’s authority and he had never signed a contract.

This argument was thrown out by the judge because they found it was reasonable to assume the loan was authorised by the company.

On the Franck Provost website, it states that Carre is the co-founder of the franchise while all reference of Banasiak has been removed as he is no longer involved with the company.

Banasiak assured news.com.au that Cyril and several other investors would get their money back one day but he couldn’t say when.

He claims to have signed a sale and purchase agreement for a project under development in the Maldives.

“I am a genuine honest person,” Banasiak said.

According to him, he’s worked on four Maldives resorts since the original project. “Unfortunately the project has been delayed many many times,” he said.

He also admitted that although he told Cyril he was using the $400,000 loan to secure a lease for the resort, he actually spent that money paying for office space, wages, trips to the Maldives and due diligence fees.

Banasiak insisted he would return to Australia but did not provide a specific date.

Carre told news.com.au when asked about Cyril’s loan: “I’m completely not responsible for that, I’ve been one of the collateral casualties (too)”.

He said JFS Hair Management spent over $100,000 on legal fees in the belief they would win the case as they should not be liable for the debt. When the judge ruled in Cyril’s favour, “my only option” was to shut down the company, Carre said.

Carre claimed he transferred the Macquarie St Salon out of JFS Hair Management because all his companies were being restructured after a bad acquisition. “That way if one of your businesses failed, it wouldn’t take the whole business with it,” he said and added this was how he ran his entire operation. “When a new salon would open, a new entity would be created.”

The Macquarie St Salon “was not a profitable salon, it still isn’t,” he continued.

Carre was the sole director at the time because Banasiak had returned to France and said he was no longer a shareholder by the time JFS Hair Management collapsed.

The presiding judge, SC Smith of the NSW District Court, painted a damning picture of Banasiak and Carre in the courtroom.

In a bizarre turn of events, Banasiak admitted to forging a document to further his own case.

A large part of the civil case hinged on whether JFS Hair Management should be liable to pay the debt because the contract was only signed by Banasiak, and not Carre.

The pair tried to claim that other loans had required both their signatures and pointed to another contract where both men had signed — although this turned out to be fake.

Banasiak later admitted in an email to the judge that he paid a computer graphics expert to superimpose a signature over the document.

SC Smith wrote in his judgment: “Banasiak is a self-confessed liar and fraud … He ultimately admitted that the document was a forgery. This might be seen as an admission of wrongdoing that could be favourable to his credit — a lightning bolt moment where he sees the error of his ways. The problem is he kept lying.”

This didn’t reflect favourably on Carre either, with the judge stating: “He, too, must have realised that it was a forgery and yet he allowed it to be used and put forward in an attempt to mislead the court”.

Carre told news.com.au that he genuinely did not know it was a forgery.

Banasiak said to news.com.au that he knew he’d made a “mistake” by forging the document but insisted “I am not a compulsive liar”.

He said he felt compelled to create a fake document because he claimed a contract really did exist with both men’s signatures, though he was unable to find it.

Cyril said his mental health suffered and he was eventually let go from his job because his productivity dropped as he stressed over the money.

The Frenchman, who is now an Australian citizen, said the situation was “even more heartbreaking” because he felt like he had been personally let down by both men.

“These guys used to be close friends, they used to come to dinner at my place, they knew my kids,” he explained.

Cyril and his partner broke up around the same time Banasiak and Carre ended their relationship.

As a result, he and Carre would “get drinks and be single together”.

“We still have friends in common who didn’t want to get involved,” he added. “I’ve been excluded from the same social events.”

Cyril learned at the end of the liquidation proceedings he would need to pay a further $50,000 for a public examination to personally pursue Carre, who is the only director left in Australia.

But he can’t afford to sink thousands into a new case, with little hope of success.

He is currently trying to force the sale of a property jointly owned by Banasiak and Carre in Sydney.

A freezing order has been placed on the property. Carre said Banasiak has not paid mortgage on the property for a number of years.

Cyril has since landed back on his feet, picking up another job and is now married to a new partner.

alex.turner-cohen@news.com.au

Originally published as Sydney hair salon Franck Provost co-founders under fire over $635k debt owed to friend