Lunch Wrap: ASX pops, IDP Education erases 40pc of market cap, Eclipse Metals doubles

The ASX opened strong as energy stocks rode an oil surge and gold jumped on fear. Wage hikes are also finally outpacing inflation.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX lifts as oil pops and wages outpace inflation

Eclipse Metals doubles on rare earth news

IDP Education craters 40pc, Eclipse Metals doubles

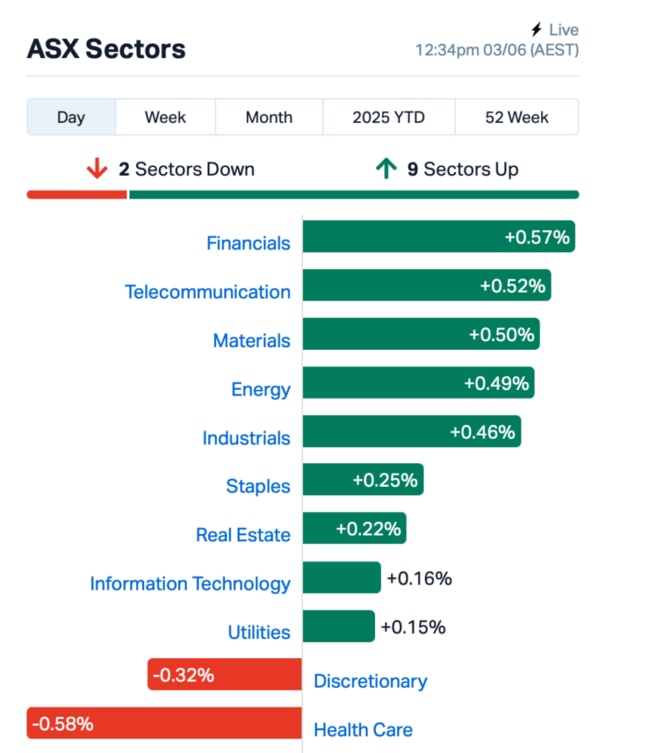

The ASX 200 was up 0.6% on Tuesday morning as banks, energy and miners led a mostly green board.

Not bad, considering we’re coming off a fresh flare-up in Trump-Xi tariff tension.

Overnight, US stocks took a shaky start in stride. The S&P 500 closed up 0.4%, Nasdaq rose 0.7%.

There was mud-slinging between Washington and Beijing, along with talk of a potential call between Trump and Xi this week to smooth things over; but let’s not hold our breath.

Crude oil prices surged as wildfires in Canada knocked out an estimated 7% of the country's oil production.

That news has boosted local energy players this morning. Woodside Energy Group (ASX:WDS) shot up 1.5%.

Gold also rallied hard, up 3%, on good old-fashioned fear.

The Aussie dollar found some swagger, too, climbing to almost US65c as the greenback weakened on trade nerves.

Back to the ASX, where IDP Education (ASX:IEL) was the biggest large cap mover this morning. Not in a good way.

The stock faceplanted with a 44% dip after warning that global student numbers are drying up fast – up to 30% less placements this year.

Language testing volumes are also expected to drop nearly 20%. The stock’s now at its lowest level since 2016, and let’s just say the market didn’t take the news well.

This is where things stood at around lunch time, AEST:

Still in the large caps space, Treasury Wine Estates (ASX:TWE)was down 0.3% after trimming its full-year earnings outlook slightly to $770m (down from $780m).

The Penfolds maker blamed lower-than-expected shipments, and the sudden exit of a key distributor in California.

And, Domino’s Pizza Enterprises (ASX:DMP) slipped 3% as it reshuffled leadership in Japan to try and get its operations back on track.

Wages go up; RBA plays it safe

Meanwhile, the Fair Work Commission is lifting minimum and award wages by 3.5% starting July 1. That takes the national minimum to just under $948 a week, or $24.95 an hour.

This is the first time in years that the increase has outpaced inflation (currently at 2.4%), which sounds like great news for workers.

But there’s a catch, experts said. It could add heat to consumer spending at a time when the RBA is trying to cool inflation down.

Speaking of the RBA, the May meeting minutes were released today, and the message is: "We could’ve cut rates more, but let’s not get ahead of ourselves."

The central bank said it went with 25 basis points, and not a bigger cut, because that level struck the right balance between caution and predictability.

The minutes also suggested that Trump’s tariffs haven’t really dented Australia just yet, and the board figured it would be riskier to overdo the cut now, and then have to slam on the brakes later.

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for June 3 :

| Security | Description | Last | % | Volume | MktCap |

|---|---|---|---|---|---|

| EPM | Eclipse Metals | 0.012 | 140% | 44,462,844 | $14,329,095 |

| VAR | Variscan Mines Ltd | 0.007 | 40% | 70,007 | $3,914,289 |

| BMO | Bastion Minerals | 0.002 | 33% | 50,750 | $1,355,441 |

| BYH | Bryah Resources Ltd | 0.014 | 27% | 24,733,813 | $9,569,489 |

| NC1 | Nico Resources | 0.092 | 26% | 242,015 | $8,008,142 |

| WCE | West Coast Silver | 0.078 | 26% | 2,882,262 | $16,127,501 |

| ION | Iondrive Limited | 0.025 | 25% | 9,792,040 | $23,656,727 |

| CAV | Carnavale Resources | 0.005 | 25% | 1,133,878 | $16,360,874 |

| ERA | Energy Resources | 0.003 | 25% | 2,577,920 | $810,792,482 |

| EVR | Ev Resources Ltd | 0.005 | 25% | 423,614 | $7,943,347 |

| MEM | Memphasys Ltd | 0.005 | 25% | 499,000 | $7,934,392 |

| WYX | Western Yilgarn NL | 0.033 | 22% | 113,076 | $3,714,149 |

| FTL | Firetail Resources | 0.091 | 21% | 1,997,393 | $28,502,098 |

| MPW | Metal Powdworks Ltd | 1.120 | 20% | 274,652 | $94,822,106 |

| AN1 | Anagenics Limited | 0.006 | 20% | 100,000 | $2,481,602 |

| GGE | Grand Gulf Energy | 0.003 | 20% | 439,921 | $7,051,062 |

| NES | Nelson Resources. | 0.003 | 20% | 2,700,000 | $5,429,819 |

| SLS | Solsticeminerals | 0.245 | 20% | 1,145,637 | $21,305,777 |

| PEB | Pacific Edge | 0.089 | 19% | 18,968 | $60,893,698 |

| FXG | Felix Gold Limited | 0.160 | 19% | 3,371,970 | $55,477,952 |

| ALM | Alma Metals Ltd | 0.004 | 17% | 300,000 | $4,759,036 |

| FGH | Foresta Group | 0.007 | 17% | 68,000 | $15,917,439 |

| RNX | Renegade Exploration | 0.004 | 17% | 3,510,002 | $3,865,090 |

| SHP | South Harz Potash | 0.004 | 17% | 20,000 | $3,308,186 |

Eclipse Metals (ASX:EPM) unveiled a massive 89 million tonne rare earths resource at its Grønnedal project in southwest Greenland. The updated estimate shows grades averaging over 6,300ppm TREO, including high-value magnet metals like neodymium, praseodymium, dysprosium and terbium – key ingredients for EVs and wind turbines. That puts it among the highest-grade rare earth deposits in the world. This new figure is more than 70 times bigger than the previous estimate, and the mineralisation still looks to extend in every direction, said EPM.

Western Yilgarn (ASX:WYX) has snapped up the Cardea 3 Bauxite Project in WA’s Darling Range, just 17km from its big Julimar West deposit. It paid a modest $5k upfront, and will tip in more cash and shares once the exploration licence is granted. Previous drilling at Cardea 3 shows high-grade bauxite, with standout results like 7.5m at over 48% total alumina and low reactive silica.

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for June 3 :

| Code | Name | Price | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| OB1 | Orbminco Limited | 0.001 | -50% | 81,733 | $4,795,136 |

| IEL | Idp Education Ltd | 4.430 | -41% | 12,916,496 | $2,079,171,496 |

| EEL | Enrg Elements Ltd | 0.001 | -33% | 1 | $4,880,668 |

| OVT | Ovanti Limited | 0.002 | -33% | 7,374,999 | $8,380,545 |

| RCM | Rapid Critical | 0.002 | -33% | 7,719,243 | $3,734,834 |

| VML | Vital Metals Limited | 0.002 | -33% | 1,372,063 | $17,685,201 |

| DTR | Dateline Resources | 0.105 | -28% | 62,441,707 | $414,441,555 |

| DGR | DGR Global Ltd | 0.003 | -25% | 1,225,000 | $4,174,784 |

| MTB | Mount Burgess Mining | 0.003 | -25% | 492,539 | $1,406,811 |

| RAN | Range International | 0.002 | -25% | 4,050 | $1,878,581 |

| WGR | Western Gold | 0.051 | -23% | 1,376,233 | $14,149,167 |

| RMI | Resource Mining Corp | 0.022 | -21% | 5,330,601 | $20,564,694 |

| PRX | Prodigy Gold NL | 0.002 | -20% | 2,693,864 | $7,937,639 |

| AJL | AJ Lucas Group | 0.005 | -17% | 7,861 | $8,254,378 |

| EAT | Entertainment | 0.005 | -17% | 151,516 | $7,852,716 |

| FBR | FBR Ltd | 0.005 | -17% | 736,437 | $34,136,713 |

| PIL | Peppermint Inv Ltd | 0.003 | -17% | 2,000,011 | $6,828,269 |

| TEG | Triangle Energy Ltd | 0.003 | -17% | 713,575 | $6,267,702 |

| MKL | Mighty Kingdom Ltd | 0.011 | -15% | 12,021 | $6,319,842 |

| OSLDA | Oncosil Medical | 1.020 | -15% | 7,725 | $13,819,740 |

| ODE | Odessa Minerals Ltd | 0.006 | -14% | 910,604 | $11,196,728 |

| SP8 | Streamplay Studio | 0.006 | -14% | 277,925 | $8,969,552 |

| EXT | Excite Technology | 0.010 | -14% | 1,372,089 | $22,799,061 |

IN CASE YOU MISSED IT

Titanium Sands (ASX:TSL) has finalised a corporate funding solution for the Mannar heavy mineral project, whereby CPS Capital Group will provide up to $600,000 in loan funding in two tranches. The funding will be used to finalise environmental studies, advance an industrial mining licence for the project, and for general working capital.

ADX Energy (ASX:ADX) has tapped David Gilbert as non-executive director, replacing John Begg as he steps down from the board of directors. Gilbert has held senior positions in companies based in Austria and Romania, locations highly relevant to ADX’s operations as the company holds projects in both countries.

At Stockhead, we tell it like it is. While Titanium Sands and ADX Energy are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Lunch Wrap: ASX pops, IDP Education erases 40pc of market cap, Eclipse Metals doubles