Lunch Wrap: ASX eyes lucky seven as Dateline Resources gets a shout from Trump

The ASX kept climbing as CBA hit a new high, US tech stayed wobbly, and whispers of a US-China trade thaw helped copper bounce back.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

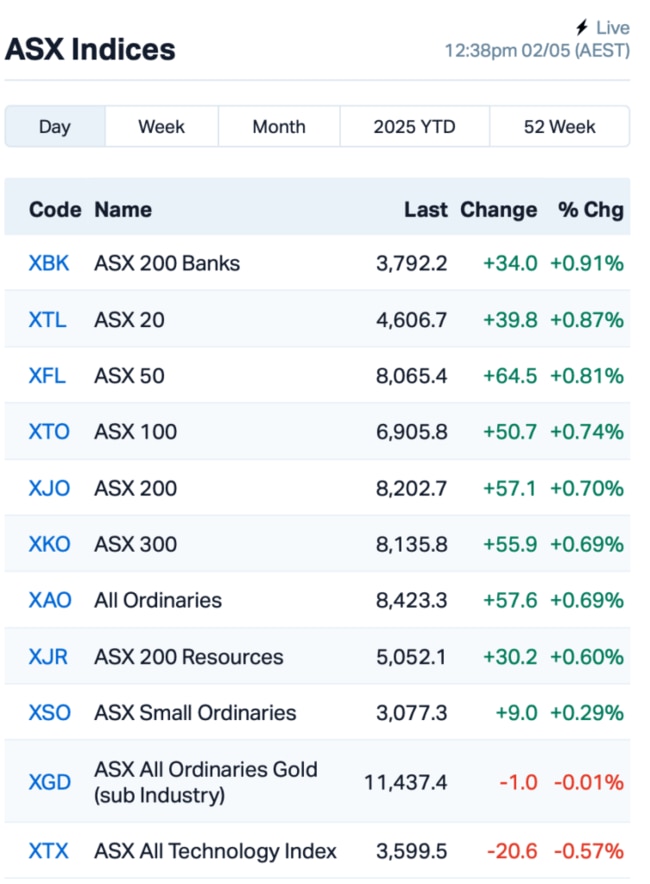

ASX eyes seven green days in a row

CBA breaks records, Block cops it hard

Dateline's US mines mentioned by Trump

The ASX kept its hot streak rolling on Friday, up about 0.65% by lunch and eyeing a seventh straight day in the green.

Aussie retail sales were up, but only just. The ABS reported a 0.3% lift in March this morning, just narrowly missing market consensus of a 0.4% gain.

Still, it’s not the kind of print that’s likely to get the RBA too excited, especially as the central bank watches for signs the economy is slowing enough to bring rates down.

Overnight on Wall Street, the Nasdaq surged 1.52%, while the S&P 500 climbed by 0.63% to clock its longest rally since August.

Microsoft and Meta's earnings both came in strong, easing fears that Big Tech might buckle under tariff pressure.

Apple also beat expectations on iPhone sales for the quarter, but warned of a looming US$1.4 billion hit from tariffs.

Meanwhile Afterpay-owner Block Inc plunged 18% on NYSE post-market after cutting its full-year profit forecast, and posting weaker-than-expected results.

Amid all this, signs emerged that the US and China might be ready to talk again.

China’s commerce ministry said it’s evaluating a US request for trade talks, the first real signal of potential thaw since Trump’s tariff blitz.

Beijing says it wants Washington to show “sincerity”, but markets took the news as a positive step, with US futures ticking higher this morning.

Meanwhile, Trump’s first 100 days have brought volatility into the markets, but that hasn’t stopped some retail investors from buying in.

Data from Bloomberg shows that Nvidia, despite dropping 21%, was the most bought stock on Wall Street during this period.

Back on the ASX, 10 out of 11 sectors were flashing green.

Energy stocks were the main winners as oil prices climbed over US$1, although WTI still couldn’t crack US$60 a barrel.

In the large caps space, Commonwealth Bank (ASX:CBA)briefly hit a new record of $169.27 a share before paring gains.

Block Inc's retail rival Zip Co (ASX:ZIP) got caught in the crossfire, dropping 7.5% after Block's profit downgrade in New York.

Corporate Travel Management (ASX:CTD) plunged 10% after warning tariffs were dampening international demand.

CTD pointed to slower growth in North America and Asia as clients pulled back on travel amid global economic jitters.

Not every large cap name was hurting, though.

Capstone Copper Corp (ASX:CSC) was one of the morning’s large cap standouts, jumping 5% after posting record March quarter revenue of $533.3 million.

Strong output from its Mantoverde and Mantos Blancos sites in Chile did the trick, and the miner reaffirmed its full-year guidance even as net losses edged higher year-on-year.

This comes as copper prices clawed back ground, rising above $US9,200 a tonne overnight, with hopes rising the US and China might actually sit down and talk.

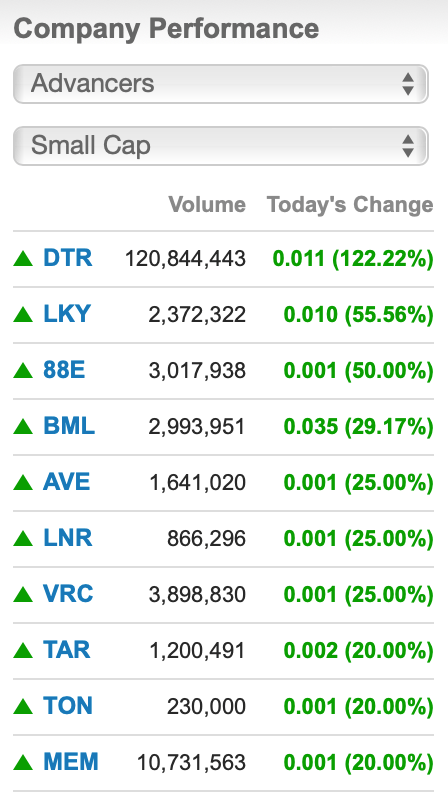

ASX SMALL CAP WINNERS

Here are the best performing ASX small cap stocks for May 2 :

Dateline Resources (ASX:DTR) is gearing up to list on the US OTCQB to give American investors better access to its shares. Dateline already trades on the OTC Pink market under the code DTREF, but this upgrade will boost visibility while keeping its main listing on the ASX.

Its Colosseum project in California has just got a presidential nod after Trump highlighted Colosseum in his official Truth Social weekly update, stating:

“The Colosseum Mine, America’s second rare earths mine, has been approved after years of stalled permitting.”

The US government says the mine will help secure critical minerals and reduce reliance on China.

Colosseum has got 1.1 million ounces of gold, and rare earths now firmly in the exploration mix. A full feasibility study is underway, and with rising US interest, Dateline’s shaping up as a serious player in America’s critical minerals push, the company said.

Codrus Minerals (ASX:CDR) has just locked in a drilling permit for its high-grade Bull Run gold project in Oregon, with plans to punch in up to 14,000 metres across 10 sites. It’s a historic gold patch, the old Record Mine pumped out gold back in the 1930s, and past drilling has pulled up hits like 20.5 metres at 3.53g/t, including a juicy 6.9 metres at 9.31g/t. Gold has also been named a critical mineral in a Trump executive order, good timing as Codrus gears up to drill and unlock what it reckons could be a major find.

Viking Mines (ASX:VKA) has hit visible gold at its Riverina East project, pulling up 2 metres at 23.6g/t from 124 metres, a promising result in a spot with no drilling for over a kilometre in either direction. The find sits in a juicy gold zone hosted in dolerite, the same rock type as the multi-million ounce St Ives deposit. The mineralisation’s open in all directions, and with more assays rolling in from its Phase 2 drill program, Viking said it was gearing up for follow-up drilling to chase it down.

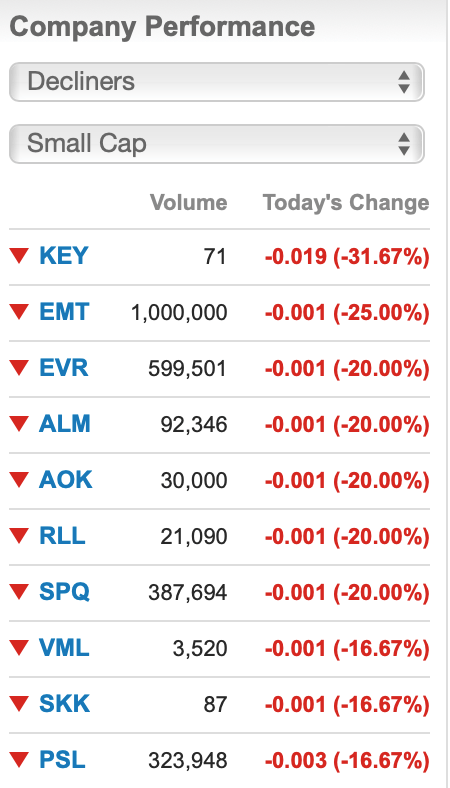

ASX SMALL CAP LOSERS

Here are the worst performing ASX small cap stocks for May 2 :

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.

Originally published as Lunch Wrap: ASX eyes lucky seven as Dateline Resources gets a shout from Trump