Closing Bell: US-China trade talks push up ASX as energy stocks ride oil price higher

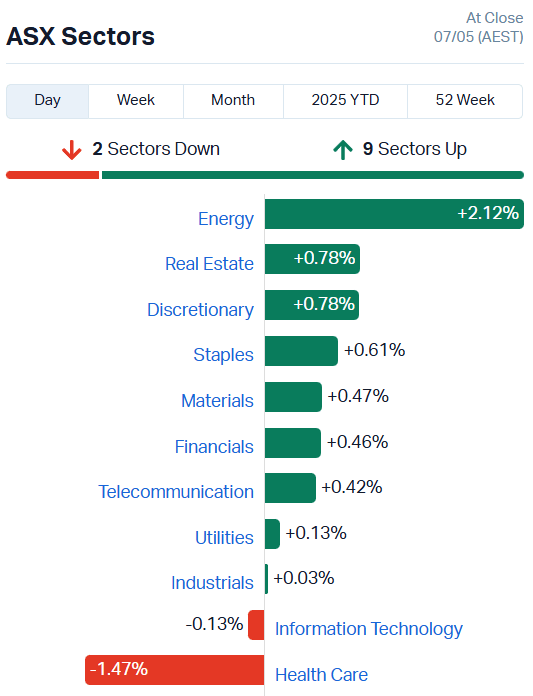

Renewed US-China trade talks and strong movements in the Energy sector have lifted the ASX 0.33pc.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

US Secretary of the Treasury Scott Bessent is expected to meet with senior Chinese officials on Thursday

Oil price hike lifts Energy sector more than 2pc

Healthcare weighs on market under tariff shadow, down more than 1pc

The ASX has bucked the global trend to rise 0.33% today, riding higher on strong movements in energy stocks and strength in resource indices.

Energy sector carries gains

Renewed demand from new buyers taking advantage of four-year lows kicked oil prices out of their slump, rising about 3% and boosting the Energy sector more than 2% in trading.

Woodside (ASX:WDS) lifted 1.65%, Santos (ASX:STO) 2.04% and Ampol (ASX:ALD) 2.77%.

As for mid caps, Viva Energy Group (ASX:VEA) jumped 2.79%, Beach Energy (ASX:BPT) 1.69% and Karoon Energy (ASX:KAR) 1.76%.

Uranium stocks also contributed to the sector’s gains, with several familiar names making moves today.

Boss Energy (ASX:BOE) jumped 12.43%, Lotus Resources (ASX:LOT) 11.43%, Deep Yellow (ASX:DYL) 7.59%, Nexgen Energy (ASX:NXG) 7.98% and small cap Energy Resources of Australia (ASX:ERA) soared 50% to $0.0015 a share.

Looking outside of resources, ZIP (ASX:ZIP)surged 13%, transport and tourism provider Kelsian Group (ASX:KLS) surged 18.28% and fund manager Magellan Financial Group (ASX:MFG) jumped 7.44%.

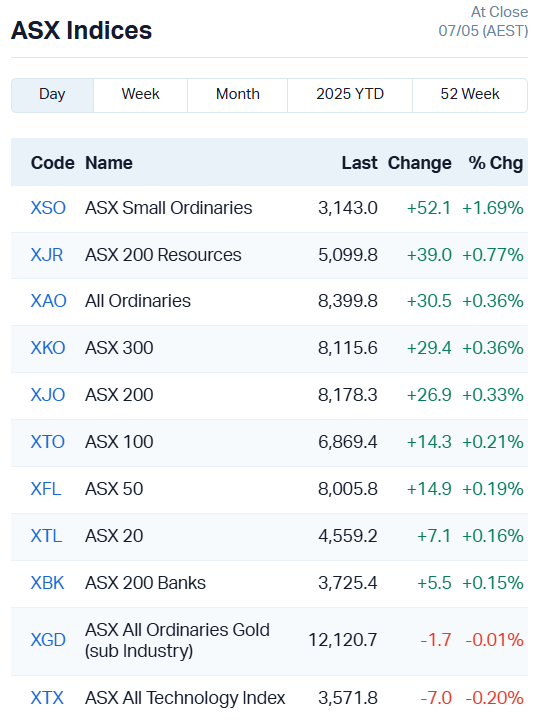

There isn’t too much to be said about the indices today – the ASX Small Ords has shot up 1.69%, and the ASX 200 Resources index 0.77% on strong movements in energy and mining stocks.

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| ICU | Investor Centre Ltd | 0.002 | 100% | 90003 | $304,511 |

| YAR | Yari Minerals Ltd | 0.008 | 60% | 57400581 | $2,411,789 |

| EDE | Eden Inv Ltd | 0.0015 | 50% | 51752 | $4,109,881 |

| TMS | Tennant Minerals Ltd | 0.007 | 40% | 1826657 | $4,779,452 |

| IS3 | I Synergy Group Ltd | 0.004 | 33% | 126261 | $1,502,190 |

| NAE | New Age Exploration | 0.004 | 33% | 1926412 | $7,978,197 |

| PEB | Pacific Edge | 0.1 | 33% | 38052 | $60,893,698 |

| MDR | Medadvisor Limited | 0.13 | 30% | 1195245 | $59,771,564 |

| SRH | Saferoads Holdings | 0.26 | 30% | 1116579 | $8,741,081 |

| CXU | Cauldron Energy Ltd | 0.009 | 29% | 465955 | $10,229,832 |

| CR3 | Core Energy Minerals | 0.015 | 25% | 1873752 | $4,670,553 |

| ASR | Asra Minerals Ltd | 0.0025 | 25% | 1922945 | $5,412,094 |

| ENT | Enterprise Metals | 0.0025 | 25% | 1001627 | $2,356,635 |

| TYX | Tyranna Res Ltd | 0.005 | 25% | 3984948 | $13,151,701 |

| SNX | Sierra Nevada Gold | 0.021 | 24% | 59434 | $2,799,205 |

| PER | Percheron | 0.011 | 22% | 2111379 | $9,786,939 |

| ANR | Anatara Ls Ltd | 0.006 | 20% | 319625 | $1,066,919 |

| FAU | First Au Ltd | 0.003 | 20% | 932316 | $5,179,983 |

| ODE | Odessa Minerals Ltd | 0.006 | 20% | 3549362 | $7,997,663 |

| RDS | Redstone Resources | 0.006 | 20% | 676710 | $4,626,892 |

| SHP | South Harz Potash | 0.006 | 20% | 930000 | $5,412,894 |

| TMK | TMK Energy Limited | 0.003 | 20% | 7888848 | $25,555,958 |

| TMX | Terrain Minerals | 0.003 | 20% | 2300373 | $5,563,058 |

| BCB | Bowen Coal Limited | 0.485 | 20% | 768790 | $43,641,810 |

| BXN | Bioxyne Ltd | 0.026 | 18% | 4756733 | $47,626,232 |

Making news…

Yari Minerals (ASX:YAR) will be snapping up the Rolleston South coal project in Queensland’s Bowen Basin, with a 78.9Mt JORC inferred resource already confirmed. It’s surrounded by Glencore and Peabody mines, so infrastructure is top-notch.

Yari plans to start drilling soon, aiming for semi-soft metallurgical coal, and the deal includes a 19.9% shareholding and performance rights for a bigger resource. Yari’s CEO Anthony Italiano says it’s primed for growth with big exploration upside.

Telehealth company MedAdvisor (ASX:MDR) has received a non-binding letter of intent (LOI) from a major multinational software company to buy its ANZ business division for cash.

The offer is confidential for now, but MedAdvisor reckons it’s well above its current share price. The deal is part of MedAdvisor’s strategy to close the gap between its market value and what it thinks it’s really worth. MedAdvisor’s ANZ business pulled in a record $2.9 million in April.

TMK Energy (ASX:TMK) is eagerly awaiting the onset of gas flows at the Gurvantes XXXV coal seam gas project, where pressure levels are approaching critical desorption requirements.

The company says the well is already beginning to produce gas, meaning some of the coals are already at the desired pressure.

Targeting an initial mineral resource for early to mid-2026, Terrain Minerals (ASX:TMX) is poised to begin resource expansion drilling at the Lightning and Monza prospects within the Smokebush gold project.

The company is targeting some promising areas that have already revealed solid gold and silver mineralisation, up to 11m at 6.03 g/t gold and 43.5 g/t silver from 75m.

ASX SMALL CAP LAGGARDS

Today’s worse performing small cap stocks:

| Security | Name | Last | % Change | Volume | Market Cap |

|---|---|---|---|---|---|

| 88E | 88 Energy Ltd | 0.001 | -50% | 67025322 | $57,867,624 |

| HCF | Hghighconviction | 0.02 | -33% | 864429 | $582,194 |

| MOM | Moab Minerals Ltd | 0.001 | -33% | 234888 | $2,600,499 |

| HIQ | Hitiq Limited | 0.022 | -27% | 3466766 | $11,026,874 |

| BNL | Blue Star Helium Ltd | 0.006 | -25% | 2449702 | $21,559,082 |

| EEL | Enrg Elements Ltd | 0.0015 | -25% | 2537936 | $6,507,557 |

| FFF | Forbidden Foods | 0.006 | -25% | 5492203 | $5,696,816 |

| MTB | Mount Burgess Mining | 0.003 | -25% | 13843544 | $1,406,811 |

| OVT | Ovanti Limited | 0.003 | -25% | 4591797 | $10,806,191 |

| AEV | Avenira Limited | 0.007 | -22% | 785255 | $28,598,797 |

| NPM | Newpeak Metals | 0.012 | -20% | 135578 | $4,831,076 |

| VBS | Vectus Biosystems | 0.06 | -20% | 12665 | $3,995,873 |

| CR9 | Corellares | 0.002 | -20% | 200000 | $2,342,915 |

| MRD | Mount Ridley Mines | 0.002 | -20% | 1254340 | $1,946,223 |

| RLG | Roolife Group Ltd | 0.004 | -20% | 2174755 | $7,480,156 |

| VRC | Volt Resources Ltd | 0.004 | -20% | 1000440 | $23,423,890 |

| XPN | Xpon Technologies | 0.017 | -19% | 4657411 | $7,611,271 |

| MIO | Macarthur Minerals | 0.022 | -19% | 577628 | $5,390,969 |

| CHM | Chimeric Therapeutic | 0.005 | -17% | 1025648 | $10,904,117 |

| FRX | Flexiroam Limited | 0.005 | -17% | 236172 | $9,104,392 |

| MEM | Memphasys Ltd | 0.005 | -17% | 338947 | $11,901,589 |

| MKL | Mighty Kingdom Ltd | 0.005 | -17% | 2254795 | $2,190,327 |

| RFA | Rare Foods Australia | 0.005 | -17% | 223216 | $1,631,899 |

| SKK | Stakk Limited | 0.005 | -17% | 86523 | $12,450,478 |

| IBX | Imagion Biosys Ltd | 0.011 | -15% | 377929 | $2,617,438 |

IN CASE YOU MISSED IT

Future Metals (ASX:FME) has kicked off a 1-for-3 non-renounceable offer to raise up to $2.64m before costs, partially underwritten by CPS Capital Group Pty Ltd.

The company intends to use the funds to advance the Eileen Bore copper-nickel-platinum group metal project, which has generated results up to 120m at 0.73% copper, 0.29% nickel and 0.86 g/t platinum group metals from surface.

Trading Halts

Augustus Minerals (ASX:AUG) – acquisition

Catalyst Metals (ASX:CYL) – potential asset acquisition

Culpeo Minerals (ASX:CPO) – cap raise

Highfield Resources (ASX:HFR) – proposed organisational and governance change

MedAdvisor (ASX:MDR) – acquisition

Metgasco (ASX:MEL) – cap raise

Wide Open Agriculture (ASX:WOA) – cap raise

At Stockhead, we tell it like it is. While Future Metals is a Stockhead advertiser, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: US-China trade talks push up ASX as energy stocks ride oil price higher