As bullion booms ASX gold miners could soon be raking in $1 billion a quarter

With prices at all time highs, ASX gold miners could soon be adding more than $1 billion a quarter to their coffers.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

ASX gold miners are on the cusp of raking in +$1bn a quarter

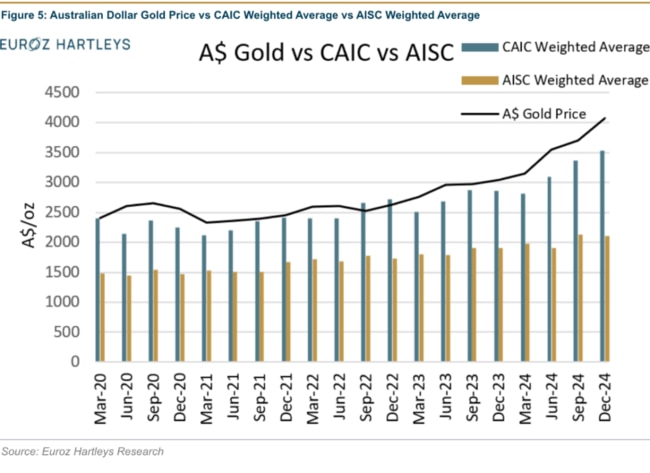

Even a strict cost accounting measure used by WA broker Euroz shows cash flows hit a record $960m in the December period

Euroz's Michael Scantlebury says Pantoro is "cheap" and lists Spartan and Antipa as "obvious" takeover targets

For years one of the most controversial aspects of mining investing has been the reporting of costs by companies and their proclivity to hide them in every nook and cranny regulators allow.

Similar to the metric of underlying earnings and profits, which enable companies to argue against the validity of a loss or profit not expected to occur again, the all in sustaining cost metric has been critiqued as the best of a bad lot when it comes to cost reporting for miners.

The biggest sleight of hand played by accountants cum financial magicians balancing the books at gold miners is practised in the permeable border between sustaining and development capital.

A company which develops a new decline each year to access a new underground mine, for instance, can claim that capital, essential for the mine's survival, is development rather than sustaining capex.

Legendary resources analyst John McDonald shone a light on this murky corner of mining investing with a new model called Corporate All In Cost.

It's still used by Euroz today to deliver a clear and concise summation of how profitable ASX gold miners actually are.

The latest rundown from analyst Michael Scantlebury takes a strict approach to gold producers' cost bases, even including the US$160m in settlement payments Resolute Mining (ASX:RSG) made to secure its Syama mine in politically fraught Mali.

Even so, the December quarter was a watershed moment for the ASX gold sector – reporting a record $960 million in free cash flow, up from $620m in the previous quarter.

Billionaire quarters

$1bn is now within reach, with a gold price of $4553/oz yesterday already 11.6% higher than the December quarter average of $4078/oz.

While typically half of the companies under its coverage would generate negative cash flows, record gold prices are spurring the sector to new heights.

Scantlebury said 15 of the 19 companies it includes in the analysis generated positive cash in December, after 17 completed that feat in the September quarter.

"(The price) covers up a lot of the misreporting, if you will, with the amount of cash and amount of margins (miners are generating)," Scantlebury said.

"It used to matter a whole lot more, what they included in the all in sustaining cost could be the difference between positive and negative cash flow."

Euroz's numbers can come across as harsh. Money spent by Northern Star Resources (ASX:NST) on its new Fimiston Mill at the Super Pit in Kalgoorlie and Resolute's Mali payments for instance will even out over time.

But the broader trend is of higher profitability as prices rise.

"As capex rolls off, as hedge books continue to roll off, because not a lot of (companies) are adding onto that ... and now gold is sitting at just over $4500/oz, so that cash flow is only going to increase again."

Scantlebury said a number of gold companies remain undervalued, with more upgrades likely to price targets from brokers and research firms.

Gold price decks, especially those derived from consensus forecasts, now appear conservative.

It's not all sunshine and rainbows. Stock specific risks still remain.

Bellevue Gold (ASX:BGL) took a major hit when it went back to the market for more equity in August last year and later downgrade guidance from its mine of the same name in the Northern Goldfields.

Westgold Resources (ASX:WGX) copped a 12.6% hammering on Monday as it chopped FY25 guidance from its Beta Hunt and Bluebird-South Junction mines in WA, cutting overall output from 400,000-420,000oz at AISC of $2000-2300/oz to 330,000-350,000oz at $2400-2600/oz, an announcement Scantlebury noted had been predicted – to a lesser degree – for months by Euroz analyst Kyle De Souza.

Who generated the most cash in 2024?

In general however, Euroz's research shows margins against both AISC and its stricter CAIC measure are expanding as prices rise, with the inflationary pressures post-Covid beginning to flatten out.

According to Euroz, the top two cash generators on its assessment in 2024 were Ramelius Resources (ASX:RMS) followed by Regis Resources (ASX:RRL), with the former generating $518m in FCF in calendar 2024, Euroz's lowest cost producer a a CAIC of $1978/oz.

That saw it bank or payout over 20% of its EV, yielding 22.6%, while Regis yielded 17.5% and generated $149m in free cash in the December quarter after paying $98m to close a prohibitive hedge book in March.

Cambodian gold producer Emerald Resources (ASX:EMR) ran the lowest CAIC in the December quarter at $1653/oz, generating $77m in free cash.

At the same time, those firms aren't necessarily the value play in the ASX gold space.

For that, he points to the relatively "cheap" $700m capped Pantoro (ASX:PNR). Scantlebury expects to see its $9m FCF mark in the December quarter increase as production lifts at the Norseman gold mine.

"I've pointed out Pantoro as one that's kind of missed the rally," he said.

"That's the key pick in the short term for a bit of a value catch up.

"More broadly we view gold equities as cheap, but there are a few that have underperformed because of ramp-up issues and miscommunication to the market of growth plans as well."

M&A on the cards

One major theme pointed to by the oodles of cash printed by Australian gold miners is M&A.

It's something we've already seen in recent times, notably with Northern Star's $5bn scrip bid for Hemi gold project owner De Grey Mining (ASX:DEG).

Cashed up Regis, which copped a hit to its growth plans when an Aboriginal heritage ruling last year halted its McPhillamys project in New South Wales, established a new $300m revolving credit facility on Monday as it builds a war chest for future deals.

There's more to come, especially with small caps trailing far behind their large-cap peers on valuation.

"We're definitely calling an increase, it's a no brainer, it's a consensus call that more M&A is on the cards," Scantlebury said.

"You're not seeing a rerate in the small explorers or resources that don't have mine plans ... and then you've seen the cash balances grow in these mid-tier gold miners."

Dalgaranga gold project owner Spartan Resources (ASX:SPR), which has Ramelius as its major shareholder, is an obvious takeover target, Scantlebury said.

He also thinks Antipa Minerals (ASX:AZY) is a plain target for Greatland Gold, which recently bought Newmont's Telfer gold mine in a US$475m and is already spitting out cash there.

AZY owns the 2.3Moz Minyari Dome asset, potentially a key cog if Greatland hopes to fill the hungry Telfer mill.

"You've got something like a Pantoro – if they don't rerate someone will take them," Scantlebury added.

"Then you've got assets probably coming out of Northern Star, which is a different story but that could still play out."

Scantlebury said investors will be looking for continued cash flows and increased shareholder returns "which companies haven't really delivered in recent years".

Those could come in the form of buybacks or fully-franked dividends, he said.

At Stockhead, we tell it like it is. While Spartan Resources and Antipa Minerals are Stockhead advertisers, they did not sponsor this article.

Originally published as As bullion booms ASX gold miners could soon be raking in $1 billion a quarter