Closing Bell: Gold hits record high, but CSL’s late sell-off drags ASX down

The ASX dropped as CSL slumped, gold miners soared and consumer sentiment stayed flat.

Stockhead

Don't miss out on the headlines from Stockhead. Followed categories will be added to My News.

Gold miners soar as prices hit new highs

ASX retreats as CSL drops on US vaccine sales hit

Consumer sentiment barely budges amid global unease

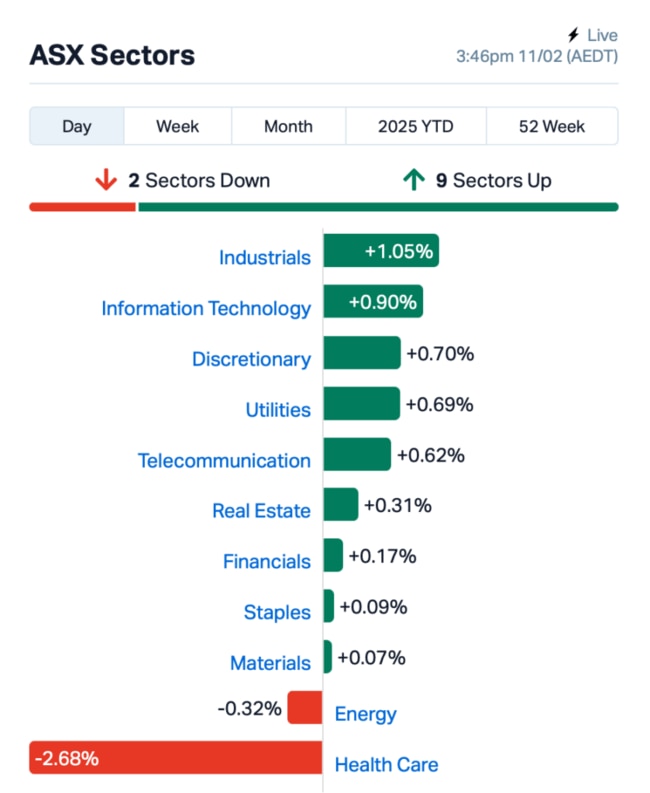

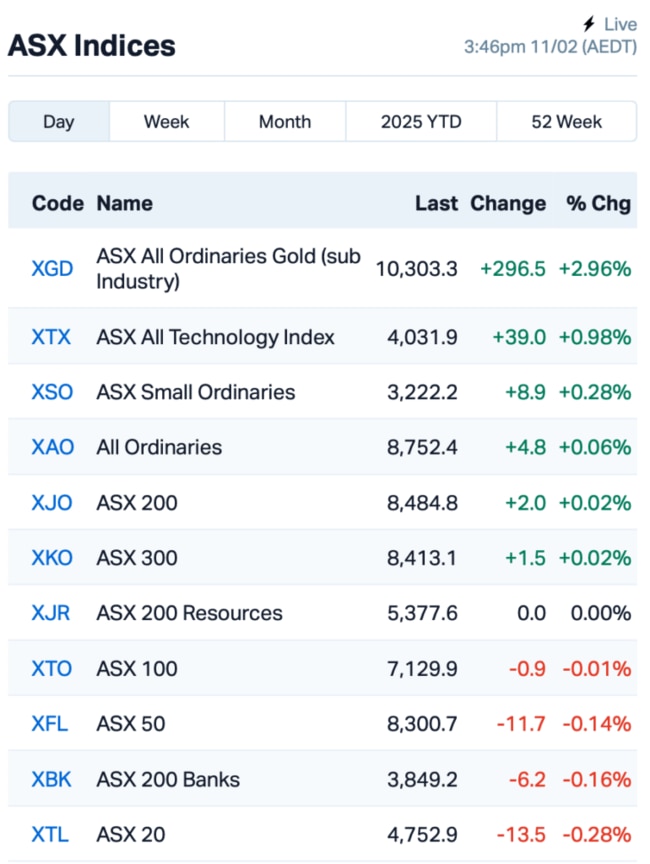

The ASX retreated from earlier gains and closed 0.25% lower on Tuesday, following a late-day tumble in pharma giant CSL (ASX:CSL), but gold miners were smiling more than Irish eyes as prices topped US$2900 for the first time ever.

CSL posted a 5% rise in NPATA, driven by strong growth in CSL Behring and Vifor, but shares tumbled over 5% after its vaccine business Seqirus took a hit from low flu vaccination rates in the US.

While CSL struggled, ASX gold producers had a great day. As gold prices hit new highs, stocks like Evolution Mining (ASX:EVN) and De Grey Mining (ASX:DEG) surged around 5%.

“Obviously the tariff war is behind the rise ; it just reflects more uncertainty and more tension in the global trade situation,” said Edward Meir at Marex.

A bunch of solid earnings updates couldn’t quite make up for the late-day selloff.

Macquarie Group (ASX:MQG) ticked up 2% after announcing it was on track to its hit full-year targets.

Seven West Media (ASX:SWM)jumped 6% even after its half-year profit slumped by two-thirds to $18 million. The company did, however, predict a turnaround in the ad market.

Turning to consumer sentiment, the Westpac-Melbourne Institute Consumer Sentiment Index released today inched up by just 0.1% in February, sitting at 92.2.

While there’s a bit more hope around rate cuts, the global economic uncertainty is keeping the Aussie spirit low.

This is where things stood leading up today’s close:

Meanwhile across Asia today, stock markets mostly slid as Trump's tariffs on steel and aluminium raised fresh concerns.

The US dollar saw gains versus major currencies, but all-in-all investors are nervous about the impact of these tariffs and the risk of a global trade war.

The market is also keeping an eye on upcoming US inflation data due to drop in tomorrow, along with Fed chair Jerome Powell's comments.

After slashing rates by 100 basis points from September to December, Powell has made it clear the central bank was "not in a rush" to cut rates any further.

"The tariffs are inflationary and could be quite negative for economic growth as well,” said James Knightley at ING.

“That uncertainty just means the Fed is sort of left waiting and wanting to see what actually does happen.”

ASX SMALL CAP LEADERS

Today’s best performing small cap stocks:

Security Description Last % Volume MktCap EVR Ev Resources Ltd 0.007 117% 46,458,167 $5,797,510 M2M Mt Malcolm Mines 0.024 57% 6,053,802 $3,397,134 RGL Riversgold 0.005 50% 89,454,759 $5,051,138 AOK Australian Oil. 0.003 50% 199,506 $2,003,566 RLL Rapid Lithium Ltd 0.003 50% 282,712 $1,591,820 TX3 Trinex Minerals Ltd 0.002 50% 1,000,000 $1,878,652 AVE Avecho Biotech Ltd 0.005 43% 7,578,815 $11,092,540 AS2 Askari Metals 0.015 43% 46,007,140 $2,795,420 E79 E79 Gold Mines 0.047 42% 28,722,779 $3,371,367 SLM Solis Minerals 0.085 35% 859,137 $4,850,927 CRB Carbine Resources 0.004 33% 279,574 $1,655,213 MMR Mec Resources 0.004 33% 370,796 $5,549,298 VAR Variscan Mines Ltd 0.012 33% 9,505,410 $7,045,719 RCR Rincon 0.017 31% 11,023,974 $3,803,312 CDR Codrus Minerals Ltd 0.020 25% 1,328,985 $2,646,200 FHS Freehill Mining Ltd. 0.005 25% 561,969 $12,314,111 GMN Gold Mountain Ltd 0.003 25% 87,234 $9,158,446 HCD Hydrocarbon Dynamics 0.003 25% 80,000 $2,156,219 SBR Sabre Resources 0.010 25% 89,170 $3,143,695 VMC Venus Metals Cor Ltd 0.093 22% 781,243 $14,905,780

EV Resources (ASX:EVR) said China’s export controls on molybdenum, which it produces nearly half of globally, could boost demand for the Parag copper-molybdenum project in Peru. EV Resources’ Parag project has already drilled high-grade molybdenum intersections, making it well-positioned to supply the US and Latin America. With molybdenum trading at nearly five times the price of copper, the project is attracting interest from roasters keen to source this key mineral.

Riversgold (ASX:RGL) is a step closer to converting its Kalgoorlie-based Northern Zone gold project into a mining lease, following the submission of its application on December 10, 2024. The company has confirmed that the Department of Energy, Mines and Industry Regulation and Safety (DEMIRS) has set the Section 29 closing date under the Native Title Act for May 29, 2025.

Askari Metals (ASX:AS2) announced an upgrade on its Burracoppin Gold Project in WA. The new JORC 2012 mineral resource estimate shows 2.14 million tonnes at 1.2g/t gold, which holds 82,700 ounces of gold, up 28% from the last estimate. The MRE now includes the Benbur-Christmas Gift, Easter Gift, and Lone Tree prospects, and there’s plenty of space for growth with more drilling between Benbur and Easter Gift. Askari said it had some drill hits too, like 3m at 17.41g/t from Easter Gift. The project’s generating a lot of interest, and talks are heating up with potential buyers.

E79 Gold Mines’s (ASX:E79) shares rose after KalGold’s recent drilling next door to E79’s Laverton South Project uncovered a potential gold discovery at Lighthorse. KalGold’s drill hits, including 8m at 2.29g/t Au and 17m at 4.81g/t Au, are close to E79’s tenement, and the mineralisation trends onto E79’s ground. E79’s already planning aircore drilling to test these fresh targets in the coming months.

Solis Minerals (ASX:SLM) has just announced solid progress at the Cinto Project in Peru, confirming copper porphyry mineralisation. Rock and channel sampling revealed 23.4m at 0.88% copper. The project, just 15km from the Toquepala mine, shows strong potential with similar mineralisation styles. With a large magnetic anomaly and geochemical results backing it up, Solis is planning drilling for 2025 while also moving forward with drilling at other projects later this year. Things are looking good for Solis’s copper portfolio.

ASX SMALL CAP LAGGARDS

Today’s worst performing small cap stocks:

Code Name Price % Change Volume Market Cap AXP AXP Energy Ltd 0.001 -50% 41,787 $11,649,361 CT1 Constellation Tech 0.001 -50% 60,000 $2,949,467 OCT Octava Minerals 0.047 -40% 3,298,309 $4,758,726 NRZ Neurizer Ltd 0.002 -33% 18,286,155 $9,674,012 YOW Yowie Group 0.014 -30% 403,505 $4,587,358 GGE Grand Gulf Energy 0.002 -25% 121,424 $4,900,774 JAV Javelin Minerals Ltd 0.003 -25% 4,766,152 $24,149,766 GLL Galilee Energy Ltd 0.007 -22% 1,543,442 $5,014,736 NOR Norwood Systems Ltd. 0.020 -20% 231,776 $11,923,629 AKN Auking Mining Ltd 0.004 -20% 1,890,968 $2,873,894 AUK Aumake Limited 0.004 -20% 11,550 $15,053,461 CUL Cullen Resources 0.004 -20% 154,600 $3,467,009 PR1 Pureresourceslimited 0.105 -19% 32,692 $5,981,143 NWM Norwest Minerals 0.013 -19% 722,108 $7,761,912 AJL AJ Lucas Group 0.009 -18% 188,738 $15,133,026 BP8 Bph Global Ltd 0.003 -17% 255,961 $1,449,924 C7A Clara Resources 0.005 -17% 27,862 $2,860,496 ERA Energy Resources 0.003 -17% 274,437 $1,216,188,722 LNR Lanthanein Resources 0.003 -17% 228,875 $7,330,908 TEM Tempest Minerals 0.005 -17% 2,641,786 $3,807,179 WOA Wide Open Agricultur 0.005 -17% 20,491 $3,202,120 HYD Hydrix Limited 0.021 -16% 2,278,010 $6,819,221

IN CASE YOU MISSED IT

Drilling has commenced at Belararox’s (ASX:BRX) Malambo copper-gold porphyry target within its TMT project in Argentina’s San Juan Province. This follows ongoing drilling at Tambo South, where copper sulphides have been observed in core. The first hole at Malambo is planned to reach a total depth of 1200 metres.

Vertex Minerals (ASX:VTX) has strengthened its board with the appointment of experienced mining executive Sean Richardson as an independent non-executive director. With 30 years of experience spanning operations, consultancy, and managerial roles across Australia, North America, Africa, and Asia, Richardson has held senior positions at several ASX-listed companies, including MD of Empire Resources, COO of Bardoc Gold, and operations manager for Shaw River Manganese.

Artemis Resources (ASX:ARV)has launched into RC and diamond drilling over untested gold targets at its Karratha project in the northern Pilbara – with hopes of growing the 374,000oz Carlow resource. The targets lie within a 4km-long zone centred around the existing resource, with the company of the belief each could hold potential for discovery.

Also kickstarting drilling is Koonenberry Gold (ASX:KNB), commencing a maiden program at the highly prospective Sunnyside prospect within its Enmore gold project in NSW. Drilling will follow-up on historical drill hits including 174m grading 1.83g/t gold. The company is also carrying out further exploration to upgrade other targets to drill-ready status.

Hot Chilli (ASX:HCH) has struck more broad zones of copper-gold mineralisation at La Verde in Chile through the latest drilling. Results highlight the potential for the company’s next major copper-gold discovery and assays are pending for a further seven holes while step-out drilling is underway.

Challenger Gold (ASX:CEL) has completed open pit mine design and scheduling for toll milling at its Hualilan project in Argentina, optimising high-grade ore delivery and improving operational flexibility. With a PFS on track for March and secured funding, the company plans to use initial cash flow to support a larger standalone development, creating around 500 jobs in the region.

At Stockhead, we tell it like it is. While Artemis Resources, Koonenberry Gold, Hot Chilli, Challenger Gold, Riversgold, Belararox and Vertex Minerals are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Originally published as Closing Bell: Gold hits record high, but CSL’s late sell-off drags ASX down