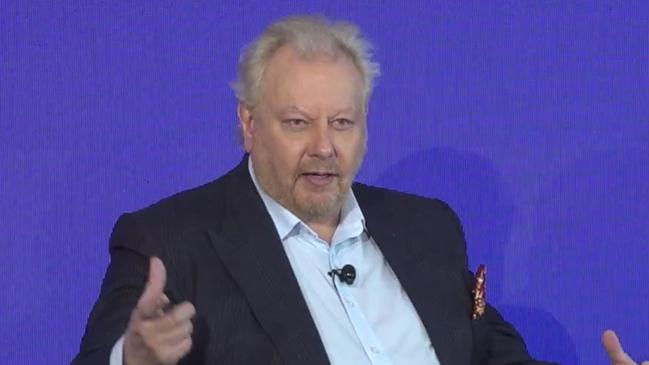

Richard White-led WiseTech deepens US foray by buying e2open in $3.25bn deal

The Richard White-led tech group will borrow $3.25bn to take over New York-listed logistics software company e2open, as it deepens its US expansion and attempts to move on from a sex scandal.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

WiseTech will borrow $3.25bn to take over New York-listed logistics software company e2open, as it deepens its American expansion and attempts to move on from a sex scandal.

As this masthead reported last month, WiseTech – which has a market value of $33.48bn – announced on Monday that it would acquire e2open in a fully debt-funded deal.

WiseTech will pay $US3.30 ($5.11) a share for the company, equating to an enterprise value of $US2.1bn.

Founder and executive chairman Richard White says the deal was a “strategically significant step in achieving our expanded vision to be the operating system for global trade and logistics”.

Mr White said it would expand WiseTech’s customer base via a network of “500,000 connected enterprises”. This includes about 5,600 direct customers and “250-plus blue-chip customers”.

“E2open brings to WiseTech several well established complementary products. This will enable WiseTech to create a multi-sided marketplace that connects all trade and logistics stakeholders to efficiently offer and acquire services, removing complex disconnected processes and driving visibility, predictability and cost savings through the value chain,” Mr White said.

“E2open also expands WiseTech’s product capabilities with an experienced team of people with industry expertise and innovative product development skills that will further accelerate our organic growth capability.

“In bringing the two companies together, we see tremendous opportunity for synergies, efficiencies, economies of scale and enhanced customer benefits, which unlocks the potential in e2open’s suite of products. This is a great deal for WiseTech’s business and e2open’s shareholders, for all our customers, the industry and ultimately the end consumer.”

Mr White said the transaction was expected to be earnings per share accretive in year one, before accounting for synergies and other cost savings.

Andrew Appel, e2open’s executive said the two companies were also a natural fit.

“E2open and WiseTech have complementary products across transport, logistics, supply and demand ecosystems, and both organisations are committed to improving the efficiency, productivity and security of global supply chains through better use of technology, data, automation and artificial intelligence,” he said.

“This strategic combination empowers our people, and our customers who make, move, and sell goods and services to unlock new levels of efficiency and sustainability. As the connected supply chain platform, we are excited to join forces with WiseTech to create a truly global, intelligent logistics ecosystem as we jointly lead the digital transformation of our industry.”

E2open’s shares had rallied more than 20 per cent to $US2.57 in the past month since WiseTech expressed interest in taking over the company.

In April, it reported that it slashed its annual net loss to $US725.8m from $US1.12bn as it “launched innovations in global trade compliance technology to help companies address new and evolving challenges”.

“The new AI (artificial intelligence) capabilities and enhancements to e2open’s proven Global Trade software are designed to ease compliance and increase productivity for clients by streamlining classifications, global trade content, due diligence, and unstructured document processing,” e2open said.

WiseTech will fund the deal from a new syndicated debt facility through a lender group composed of a “well-diversified mix of leading domestic and international banks”. Undrawn debt and cash on hand provides significant liquidity for future growth, Mr White said.

WiseTech has bought several companies amid Mr White’s return to its board as executive chairman.

Mr White, who founded the company 30 years ago, was forced to step down as chief executive and as a director last October following allegations that he exchanged business advice for sex, sparking a corporate governance review.

He crowned himself executive chairman in February after half the board, including all of its independent directors, resigned in protest of his new $1m a year consulting role.

Mr White has since appointed himself chief innovation officer and is overseeing the search for a new chief executive, prompting calls from one its biggest external investors, super fund HESTA, for the company to appoint more independent directors.

Originally published as Richard White-led WiseTech deepens US foray by buying e2open in $3.25bn deal