ASX rebounds after inflation shock

An inflation sensitive Aussie stock market fell only slightly on Thursday as it rebounded in the wake of the surprising CPI jump this week.

An inflation sensitive Aussie stock market fell only slightly on Thursday as it rebounded in the wake of the surprising CPI jump this week.

The Australian sharemarket tumbled on Wednesday after a shock inflation print sparked fears of a possible rate hike.

The Australian sharemarket notched a powerful rebound rally on Tuesday on the back of iron ore and oil price rises and a surge in banking behemoth Commonwealth Bank.

CBA soars, sets itself to defend class action appeal. Ex-Seven boss joins tech micro-cap. KFC operator Collins Foods rises on earnings beat. Healius rebounds from downgrade falls.

Despite a surprise 1.2 per cent reacceleration of inflation in the September quarter, the Aussie share market closed flat.

Ansell job cuts, automation to deliver savings amid inventory reduction. ‘Commodity headwinds’ weigh on Bega Cheese. Investor nod for Yellow Brick Road delisting. US boost for shares in Zip, Bubs.

Losses in health and consumer stocks were offset by gains from miners and energy producers to send the benchmark higher on Tuesday.

Qantas’ frequent flyer overhaul after complaints. Treasury Wine lifts on potential China rebuild plans. South32 down on weak quarter. Propel Funerals gains on bid dismissals.

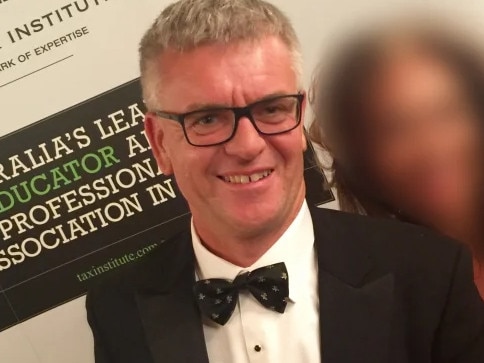

The man who leaked confidential government information to clients has been exiled from the world of Australian finance.

Fears of an escalation of the Israel-Hamas has shaved 1.2 per cent off the Australian share benchmark on Friday.

Former PwC international tax head Peter Collins cops eight year ASIC ban. Liontown tanks. Qantas airfares rise. BlueScope lifts despite weaker outlook. Insignia dives.

The latest report from the Reserve Bank of Australia shows how much money the men and women who determine your mortgage bill make each year.

Liontown in $365m equity raising, $760m debt funding. Consortium works on higher Origin offer. Qantas, Telix, Netwealth drop. 1200 jobs at risk at Alcoa Kwinana. AUD drops on jobs data.

There’s one big reason that the Australian dollar is so weak against the US dollar – but it could mean an investing opportunity for the brave.

Original URL: https://www.themercury.com.au/business/markets/page/70