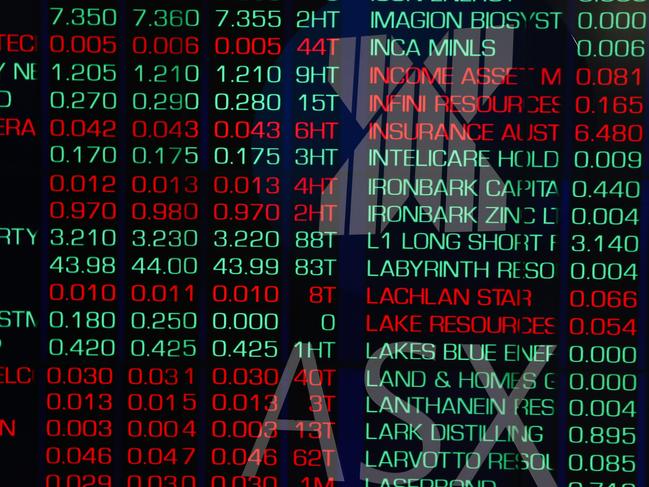

ASX closes down after record day

The ASX closed down on Wednesday as investors took advantage to take a profit following a record day of trading on Tuesday.

The ASX closed down on Wednesday as investors took advantage to take a profit following a record day of trading on Tuesday.

The ASX 200 is trading up 2.6 per cent for November during the traditionally strong trading period leading into the ‘Santa Claus’ rally in December.

The ASX 200 rose slightly during Monday’s trading, pushed higher largely by Australia’s resource companies.

The ASX 200 rose slightly during Friday’s trading, as the market had a benign broad based rally as Donald Trump announced more key appointments.

Snapping a two-day losing streak, the sharemarket rallied on Tuesday, propelled by financial and utilities stocks.

Shares got off to a poor start on Monday, with weak Chinese economic data adding further uncertainty to already cautious investors.

Wall St hit fresh highs overnight but it wasn’t enough to lift Aussie equities, with the ASX200 drifting lower on extended weakness in China.

Australian investors have reacted positively to better-than-expected US inflation data, with new hopes the Federal Reserve could cut rates soon.

Ahead of the US Fed’s meeting on rates, the Australian share market has recorded a loss for the second day in a row.

The share market shedded 1.3 per cent as investors awaited the Federal Reserve’s much anticipated meeting on Thursday for a signal on its interest rate path.

The Australian sharemarket is going into the long weekend on a high, after it recorded its best week of 2024.

After a tech-propelled rally on Wall Street overnight, the Australian share market followed suit.

Following a two-session rally, shares on the Australian stock market slipped as iron ore and oil prices tumbled.

The Australian share market has started the week in positive territory, as it extended its gains thanks to the big banks.

Original URL: https://www.themercury.com.au/business/markets/australian-dollar/page/20