Australia hit by $50b bomb in global panic

The global economy has been hit hard by a huge call in the US and Australia has been firmly in the firing line.

Australian Dollar

Don't miss out on the headlines from Australian Dollar. Followed categories will be added to My News.

The Australian stock market has suffered its worst day in three months amid global panic over a US interest rates call for the coming year.

The S&P/ASX 200 index closed down 1.7 per cent at 8168.2 points after falling to 8125.7. That means more than $50 billion was wiped off the market cap of Australia’s biggest companies.

The Aussie dollar has also plummeted to a one-year low after the US cut interest rates again but signalled a slower pace of cuts ahead, triggering a sell-off in financial markets and causing the US dollar to rally.

The US Federal Reserve on Wednesday voted 11-1 to cut interest rates by a quarter point to lower the central bank’s key lending rate to between 4.25 per cent and 4.5 per cent, as expected.

However they also made a huge forecast about 2025 that has sent shockwaves through the global economy today. They halved the number of quarter-point cuts they expect next year, from an average of four back in September to just two on Wednesday, catching the markets by surprise.

All three major indices on Wall Street finished firmly lower, while the yields on US Treasurys surged as traders digested the prospect of higher interest rates over the next couple of years.

The US dollar surged to a two-year high, rising by more than 1 per cent against the pound and the euro and 2 per cent against the Australian dollar.

The Aussie dollar is trading at around 62 US cents, its lowest level since October 2023.

The Aussie dollar could face more volatility with policy meetings by the Bank of England and Bank of Japan on Thursday.

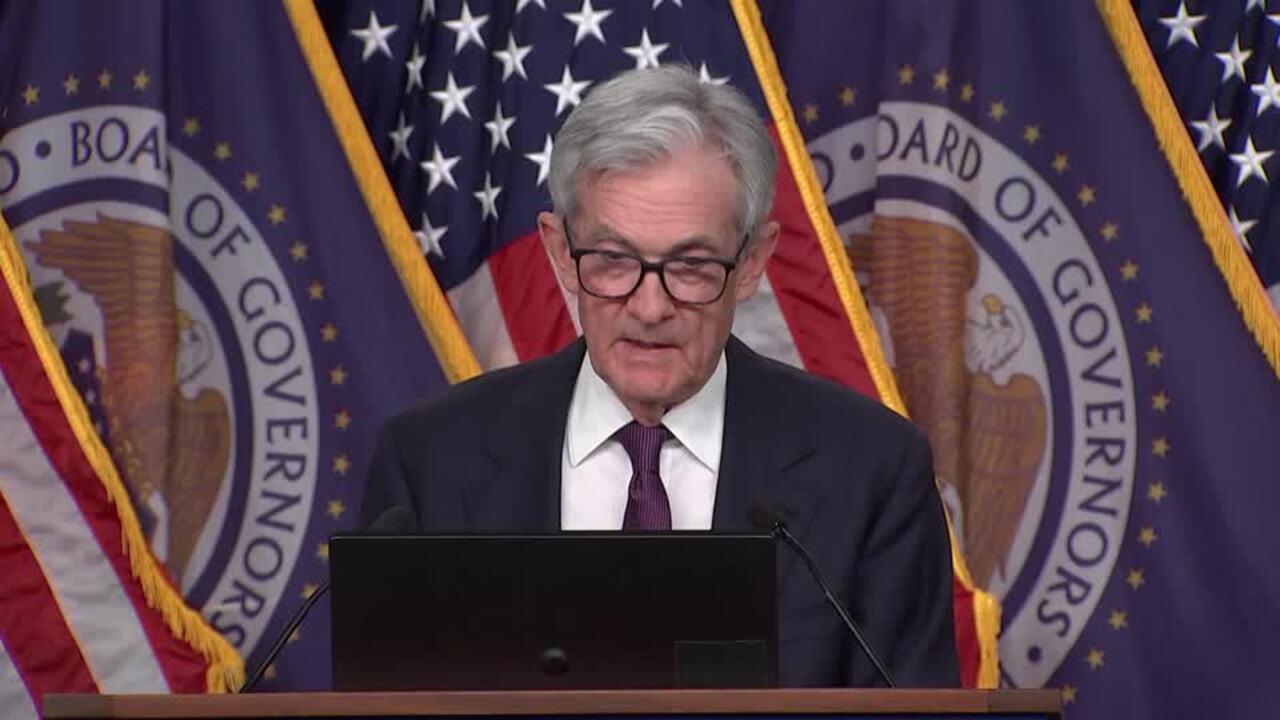

Federal Reserve Chair Jerome Powell told reporters that while inflation had “eased significantly”, the level remained “somewhat elevated” compared to the Fed’s long-term target of 2 per cent.

He said he remained “very optimistic” about the state of the US economy, adding that the Fed was now “significantly closer” to the end of its current easing cycle.

It was the final planned rate decision before outgoing Democratic President Joe Biden makes way for Republican Donald Trump, whose economic proposals include tariff hikes and the mass deportation of millions of undocumented workers.

The nonpartisan Congressional Budget Office (CBO) estimates that imposing fresh tariffs would cut economic growth and push up inflation.

Following Mr Trump’s victory in November’s election, some analysts had already pared back the number of rate cuts they expected in 2025, warning that the Fed may be forced to keep rates higher for longer.

The Fed has made progress tackling inflation through interest rate hikes in the last two years without dealing a knockout blow to either growth or unemployment, and recently began cutting rates to boost demand in the economy and support the labour market.

But in past months, the Fed’s favoured inflation measure has ticked higher, moving away from the bank’s target and raising concerns that the inflation fight is not over.

Members of the Fed’s rate-setting Federal Open Market Committee (FOMC) now “need to see additional improvements in inflation to continue to cut rates — full stop”, KPMG chief economist Diane Swonk wrote in a note published after the decision.

In updated economic forecasts published alongside the rate decision, members of the 19-member FOMC pencilled in just two quarter-point rate cuts in 2025, on average, halving the number of cuts they now expect.

They also hiked their outlook for headline US inflation next year to 2.5 per cent, and do not see it returning to 2 per cent before 2027.

In some good news for the world’s largest economy, FOMC members raised their outlook for growth this year to 2.5 per cent, and to 2.1 per cent in 2025.

Policymakers expect the unemployment rate to be slightly lower this year than previously predicted at 4.2 per cent, before ticking up slightly to 4.3 per cent in 2025 and 2026 — a figure at least one analyst said was overly optimistic.

“Rate cuts will come faster than the Fed expects, as unemployment tops the new forecast,” Pantheon Macroeconomics chief US economist Samuel Tombs wrote in a note to clients published after the decision.

The Wall Street sell-off saw the S&P500 index finish 3 per cent lower, while the Dow closed down 2.6 per cent.

“Seeing the kind of decline we are experiencing right now indicates that the Fed took the market quite by surprise,” said CFRA Research’s Sam Stovall.

Although stocks often enjoy a late-year bounce referred to as the “Santa Claus rally,” Mr Stovall said the depth of Wednesday’s drop could spur more selling if traders take profits.

“Maybe Santa is already on vacation,” he said.

Originally published as Australia hit by $50b bomb in global panic