Investors’ funds go down the drain: ‘Financially he will ruin you’

DISGRUNTLED investors are warning Tasmanians about a Queensland IT entrepreneur who left a trail of failed businesses in his wake before setting up in Hobart.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

DISGRUNTLED investors are warning Tasmanians about a Queensland IT entrepreneur who left a trail of failed businesses in his wake before setting up in Hobart.

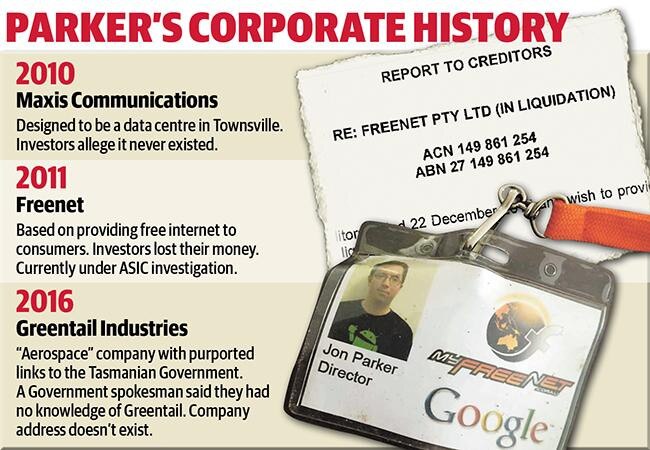

Jonathan William Parker is currently under investigation by the Australian Securities and Investments Commission.

But that hasn’t stopped the smooth talking operator from launching new ventures including an “aerospace” company in Hobart.

A Mercury investigation has discovered the company’s listed address in Hobart’s Technopark doesn’t exist and it’s purported links to the Tasmanian Government are denied by a spokesman.

A string of unhappy investors, damning forensic reports, legal demands and now an investigation by the corporate watchdog raise serious questions about Mr Parker’s corporate conduct.

In 2011 Mr Parker started Freenet — a business based on providing free internet to shoppers at places like supermarkets subsided by advertisers.

It was an idea that Mr Parker’s estranged wife said came to him while he was in bed.

In setting up the company he raised nearly $3 million in private share sales to investors that included family and business people.

Despite claims of a partnership with Google and Motorola, Freenet never got off the ground. And the millions of dollars went down the drain.

When the dust settled Townsville resident Marianne Agius lost more than $71,500 — money she had both saved and borrowed to invest with Mr Parker.

She would later learn that the shares she bought in Freenet were never registered with ASIC.

“That was my very first investment so I was fairly green to the idea,” she told the Mercury from her Townsville home.

“He promised us the world. We firmly believed in him, he was so convincing. We wanted to support him but in the meantime he promised us good returns.”

Compounding the matter, Ms Agius had convinced her brothers in Malta that Freenet was a good investment.

Like her they lost the lot.

“My younger brother ended up losing all his life savings and he has never made a full recovery from it,” she said.

“They haven’t talked to me ever since. I lost their faith and trust in me.”

Ms Agius’s former partner Sid Jackson, also Mr Parker’s father-in-law, was another investor who wished he’d never heard the name Freenet.

Mr Jackson remortgaged his home to stump up the money for an investment Parker told him would “take off”.

He invested nearly $115,000 but again the shares were never registered.

“I’m not really into the technology side of things. Being family we put a lot of trust in him that he was going to do the right thing,” he said.

“We haven’t seen any money from anybody.

“I did take a fairly large hit late in my life so we’re still struggling.”

It wasn’t just “mum and dad investors” like Mr Jackson and Ms Agius who were burnt. Property businessman Ben White lost about $900,000 on the venture.

He would later join the company as a director, install a financial controller and finally put the company into liquidation.

During this time a forensic analysis of transactions was conducted to find out what had happened at Freenet.

The report alleged more than $1.06 million in irregular transactions were found including large amounts sent to Mr Parker’s own bank account.

The information was taken to NSW Police but nothing eventuated.

A liquidator’s report to Freenet creditors lodged with ASIC in January confirmed Parker was being examined by the regulator.

“ASIC are conducting further investigations in relation to the matters raised in my report relating to the conduct of the former director Jonathan William Parker,” the liquidator said.

READ THE LIQUIDATOR’S REPORT HERE

“Run as far away as you can from him because there’s no good news. Financially he will ruin you.” – Freenet investor Marianne Agius’s advice against investing with Jonathan William Parker

A similar story has emerged from one of Mr Parker’s earlier ventures Maxis Communications.

Maxis was established in 2010 to build a data centre in Townsville. But two investors allege it never existed.

According to their solicitors, Mr Parker did not issue them shares until more than a year after they had coughed up $140,000 and only once they engaged lawyers.

A report prepared by their solicitors Dundas Lawyers, obtained by the Mercury, alleged Mr Parker diverted funds paid to Maxis into “a personal banking account”.

The investors got their money back and did not go to police.

Maxis was deregistered by ASIC in 2013.

Mr Parker is believed to have arrived in Tasmania late last year setting up Greentail Aerospace Industries with himself as a director.

The company’s website has since been taken down and Mr Parker no longer lives in the high-end Sandy Bay residence that was listed as Greentail’s registered address with ASIC.

A Greentail letterhead lists the company’s physical address as level 2, 36 Innovation Drive, Dowsing Point.

The address does not exist.

“To our knowledge, there are no links between Greentail and the Tasmanian Government,” a Government spokesman said.

“Consumers should be wary of a wide variety of scams and never deliver goods before confirming payment.”

Freenet investor Ms Agius’s advice to anyone who comes across Mr Parker’s business ventures was “to run”.

“Run as far away as you can from him because there’s no good news. Financially he will ruin you.”

Mr Parker could not be reached for comment.

In response to the Mercury’s questions an ASIC spokesman said the regulator “does not confirm if we are investigating particular entities or discuss the status of any investigations”.