Generation X now Australia’s wealthiest property owners as Boomers retire: KPMG

Generation X has become the property king and is on track to become the richest cohort of all, as the great wealth transfer starts.

Business

Don't miss out on the headlines from Business. Followed categories will be added to My News.

Generation X is poised to overtake baby boomers as the nation’s wealthiest generation, fuelled by a massive wealth transfer and surging gains in property and share markets.

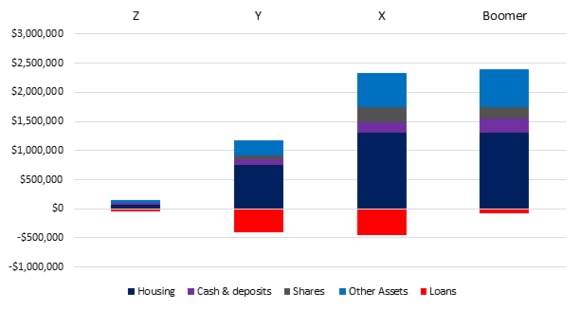

KPMG’s analysis of asset distribution across four generational cohorts shows baby boomers currently lead with an average net worth of $2.31m, followed by Gen X at $1.88m, millennials at $757,000, and Gen Z at $96,000.

But boomers were no longer kingmakers with housing, with Gen X now holding the most significant amount in housing at an average value of $1.31m compared to $1.3m by the older cohort.

It was no longer the case with shares, too, with Gen X having the largest portfolios at $256,000 compared to $206,000 as boomers derisk amid retirement.

Analysis noted inheritance of property is becoming more common among children of older baby boomers, with a clear disparity in housing wealth between older and younger generations.

In contrast, millennials and Gen Z have lower average wealth stored in housing with $750,000 and $69,000 respectively. Their share portfolios also had considerably lower amounts, with $51,000 and $7000 respectively.

KPMG urban economist Terry Rawnsley said boomers historically had been the largest holders of housing assets, but their transition to smaller homes or retirement villages would create opportunities for others.

“As the boomers age out and pass down the inheritance to the Gen X and millennials, we’ll start to see that wealth transfer coming through, which means more housing hitting the market as grandma and grandad pass away and their home comes up for sale,” he said.

“Boomers are also cashing out of housing and shares into cash, whereas Gen X are accumulating as much wealth as they can and paying down that debt.

“This provides opportunities for those young Aussies to get into the property market if they get a big inheritance from the older generation.”

In terms of cash and deposits, boomers had $242,000 followed by Gen X with $176,000, while millennials and Gen Z hold $104,000 and $26,000 respectively.

Analysis of Australian Bureau of Statistics data by KPMG was based on the midpoint age of 20 years for Gen X, 35 for millennials, 51 for Gen X and 69 for boomers.

The wealth transfer had implications for the Bank of Mum and Dad which is used by two in five first-home buyers, injecting $2.7bn into the property market.

Mr Rawnsley said this role would now be assumed by Gen X who would soon have the most wealth, while boomers would transition into the Bank of Grandma and Grandpa.

“Grandparents may be set up for retirement and see that their grandkids need a helping hand and transfer some funds before they die to assist with the housing market challenge,” he said. “Gen X is well placed to become the Bank of Mum and Dad as most become mortgage-free within the decade and will have significant wealth from being the first group to have had super throughout their entire working life.”

Other assets, which are mostly superannuation and business assets, show baby boomers and Gen X with comparable holdings, $641,000 and $586,000 respectively, indicating broad diversification in asset classes.

Millennials and Gen Z hold $260,000 and $43,000 in other assets, reflecting a more limited time to build up a business and add to their superannuation balances.

Loan balances show Gen X has the largest at $448,000, followed by millennials with $410,000, driven by home loans. Boomers have a relatively lower loan balance of $82,000, highlighting deleveraging ahead of retirement, while Gen Z has $49,000, reflecting HECS and credit card debt.

Originally published as Generation X now Australia’s wealthiest property owners as Boomers retire: KPMG