‘Won’t go back to normal’: New data reveals Australia’s inflation nightmare

A new set of data has revealed worrying details about the state of the Aussie economy, with households set to be squeezed even further.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

ANALYSIS

Well, this is not great.

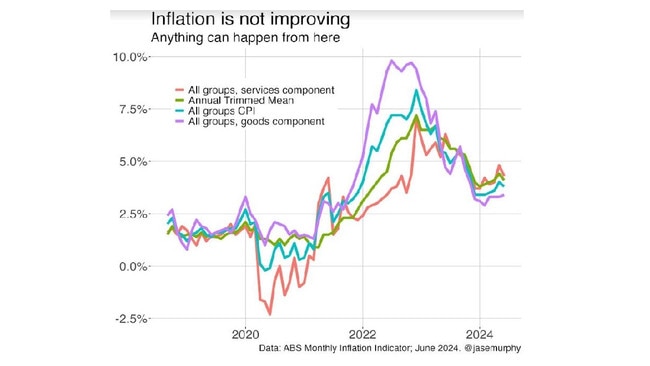

Inflation isn’t getting worse, exactly. But we need it to get better. And that is not happening.

The latest official data shows Australian inflation stuck at 3.8 per cent a year. That means prices on average are up 3.8 per cent compared to last year, which is much too high.

The rate of inflation is stuck at the exact same level it has been at for the past few months.

We got a lot of improvement in inflation in 2023, when it fell from very high to merely high.

But now it won’t go back to normal, back to the target range of 2 to 3 per cent a year.

As the next chart shows, prices are up about 4 per cent over the year before, with services up a bit more, and goods up a bit less.

Inflation measures how fast prices are rising in the economy.

Before this latest data came out, experts worried price rises might be fast and furious enough to goad the Reserve Bank of Australia into lifting interest rates again.

The RBA has already raised rates from basically zero to more than 4 per cent, causing mortgage interest rates to skyrocket and mortgage repayments to become a very large and uncomfortable part of household budgets.

Would they raise rates again, from 4.35 per cent to 4.7 per cent?

The answer, it now seems, is no. This data is bad – but not quite bad enough to make the central bank hike rates and deliver more pain to households.

The RBA likes to look at a particular kind of inflation data, called the “trimmed mean”. It excludes some of the things that have gone up the most and the least.

The trimmed mean measure of inflation fell in the most recent quarter and that is likely to give them hope that inflation will come back under 3 per cent before too long.

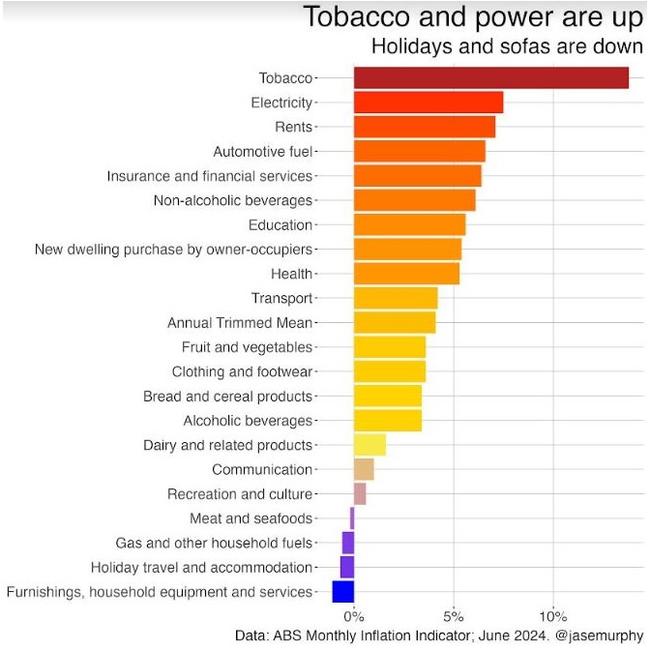

What’s up? And what’s down?

On the good news side of things, some supermarket items have got a bit cheaper recently.

Meat in particular costs a bit less, giving back some of the crazy price hikes we saw during the pandemic.

That is especially helpful, given the price of some other protein recently – a dozen eggs now costs a fortune.

The next chart shows the categories that have risen the most in the last year, and tobacco is number one. No wonder vaping is so popular now. Tobacco prices are all about taxes, and we are certainly taxing (legal) smokes into oblivion.

If you smoke, you’re probably going broke. But not everyone smokes.

Everyone uses electricity, however, and the electricity category is the second-fastest rising one. The price of power is up around 7 per cent over the last year, which is really unhelpful, especially for those who are also renting, and paying 7 per cent more in rent than they were last year.

Of course, the problem with inflation is that while the Bureau of Statistics likes to measure things versus a year ago, the rest of us don’t see it like that. We remember how much things used to cost at a certain point in the past. And that could be five years ago.

If you’re remembering how much things used to cost before the pandemic, then price rises of 4 or 5 per cent probably seem like underestimates. Many food items are up 20 or 30 per cent since the start of 2020. Butter and oils are especially expensive now, up more than 40 per cent since March 2020.

Price rises build on top of previous price rises in a compounding fashion. This is why it is imperative the RBA defeat inflation sooner rather than later – 4 per cent inflation every year for 10 years will lift prices by 48 per cent in the decade, while 2 per cent inflation every year for 10 years will lift prices by 21 per cent in the decade.

Fingers crossed the next inflation data goes the way the RBA wants, and they don’t find themselves simply raising rates later.

Jason Murphy is an economist | @jasemurphy. He is the author of the book Incentivology.

Originally published as ‘Won’t go back to normal’: New data reveals Australia’s inflation nightmare