Inflation data key to rate cut clues

All eyes will be on fresh inflation data to be released on Wednesday which will be critical to the Reserve Bank’s deliberations on rate cuts.

All eyes will be on fresh inflation data to be released on Wednesday which will be critical to the Reserve Bank’s deliberations on rate cuts.

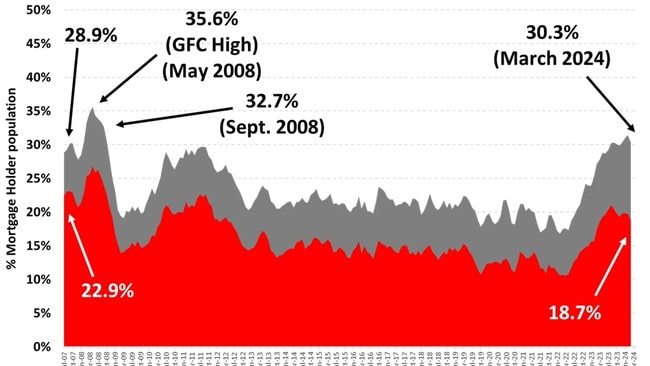

Over a million Aussies are already in mortgage stress and now there are fears there is even more trouble ahead.

Income tax receipts gushed into Treasury coffers last year to a record high, fresh ABS data has revealed.

Markets regained their composure on Monday after an apparent easing in hostilities between Iran and Israel.

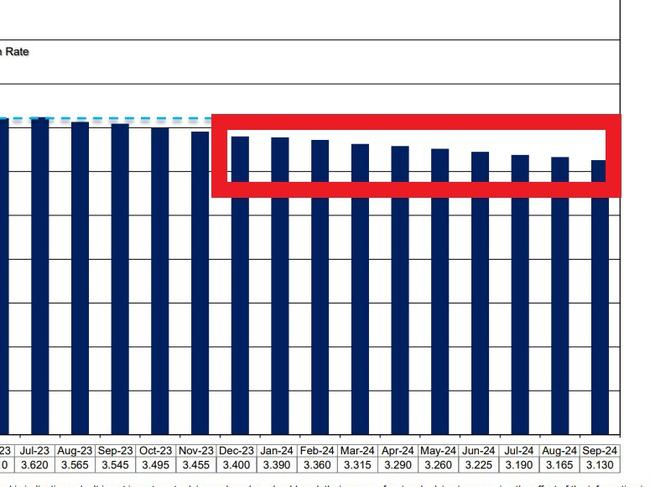

A major Aussie bank has shocked customers in their latest interest rate update after the Reserve Bank offered some relief.

The RBA has paused the cash rate for the first time in 10 months. And there are strong signs of what could happen next.

Homeowners were delivered some welcome relief this month but there are warnings they shouldn’t get comfortable with more “pain” coming.

The Reserve Bank of Australia has handed down its call on whether to lift rates for the 11th straight month.

The Reserve Bank of Australia has handed down its call on whether to lift rates for the 11th straight month.

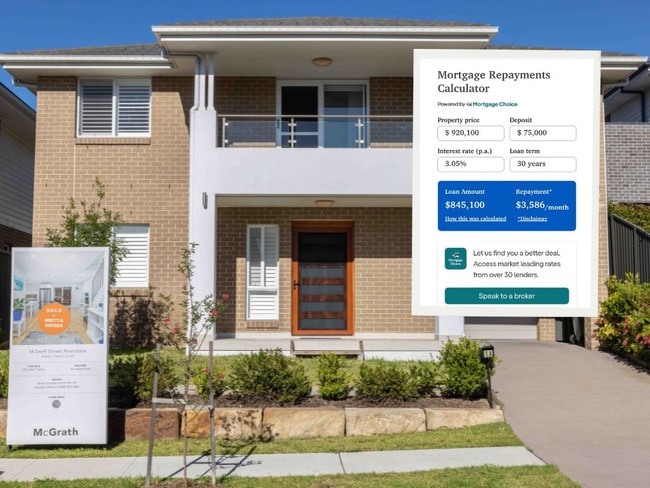

As the RBA pauses rates, savvy homeowners, buyers and investors can save plenty over the course of their loan. See the best deals and use our calculator to work out how much you will pay.

Homeowners can rejoice as they have been given a brief reprieve after the central bank paused interest rates for the first time in nearly a year.

Nearly 900,000 Australians are facing a big shock as their cheap fixed-rate home loan period expires – regardless of what the RBA does today.

The signs are already there that higher interest rates are going to come sooner than expected.

Original URL: https://www.themercury.com.au/business/economy/interest-rates/page/86