ASX falls as US election nerves take over

The Australian sharemarket slipped on Tuesday ahead of Wednesday’s seismic US Presidential election.

The Australian sharemarket slipped on Tuesday ahead of Wednesday’s seismic US Presidential election.

The Reserve Bank of Australia has been blasted over its latest refusal to cut interest rates, with claims the move “makes no sense”.

Aussies have reduced spending in line with Reserve Bank expectations, but it’s not enough to spark a rate cut.

Aussies have reduced spending in line with Reserve Bank expectations, but it’s not enough to spark a rate cut.

Inflation is coming down but experts are warning it isn’t yet time for Aussies to pop the champagne bottles to celebrate a rate cut.

The Aussie sharemarket dipped lower on Wednesday as bank stocks tumbled.

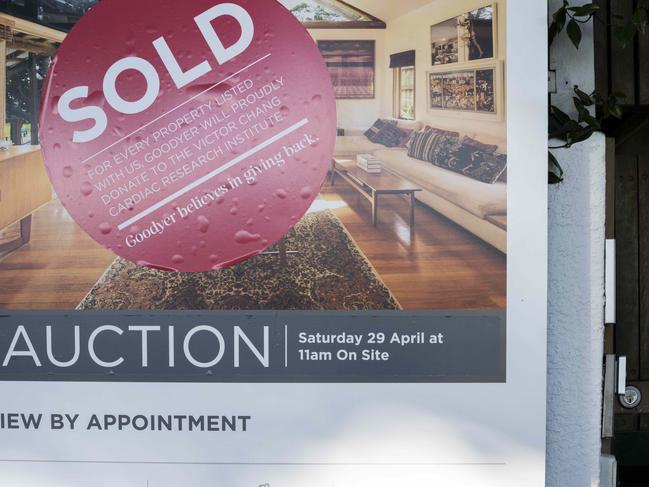

Australians wanting the security of home ownership will be rocked by these figures showing just how easier it was a decade ago.

RBA Governor Michele Bullock has taken a thinly veiled shot at the government after yesterday’s decision to keep interest rates on hold.

Experts have issued a warning as shocking figures expose just how hard it is for Aussies to get ahead during the cost-of-living crisis.

The Reserve Bank is sticking to its guns not to cut the official cash rate while inflation remains too high, despite growing pressure to do so.

The Reserve Bank is sticking to its guns not to cut the official cash rate while inflation remains too high, despite growing pressure to do so.

Holding rates at 4.35 per cent, RBA governor Michele Bullock has said what needs to be done for interest rates to come down, hinting it won’t be any time soon.

The sharemarket dipped lower on Tuesday as the RBA delivered some hawkish rhetoric on interest rates, even as the miners boomed on fresh Chinese support.

Homeowners struggling after missing out on a rate cut from the Reserve Bank today have been urged to “create their own rate cut”.

Original URL: https://www.themercury.com.au/business/economy/interest-rates/page/8