ASX flat as investors eye inflation data

Australian shares were flat on Monday before important inflation data is released midweek.

Australian shares were flat on Monday before important inflation data is released midweek.

With family budgets coming under further strain, consumers heavily wound back on spending on non-essential items in April.

With family budgets coming under further strain, consumers heavily wound back on spending on non-essential items in April.

Jim Chalmers’ Treasury department has delivered a glimmer of hope for inflation crunched households ahead of the federal budget on Tuesday.

AT 2:30 this afternoon, Australians will be tuned in to the one piece of news that will affect everyone. So what should you expect?

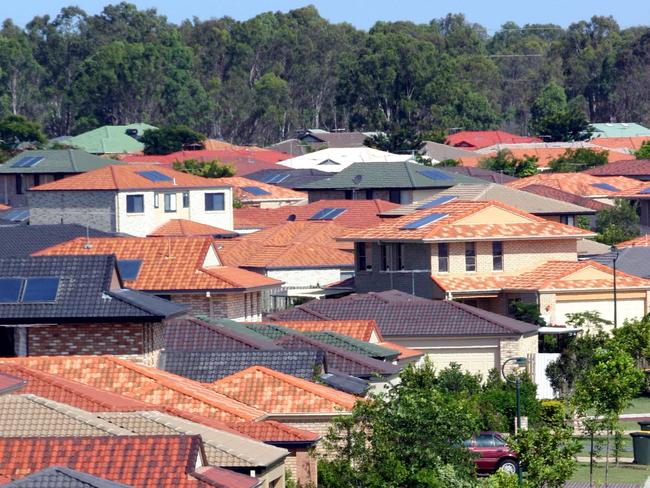

AUSTRALIA’S housing market is not immune from trouble — and things are about to get worse, a financial expert has warned.

THE RBA has kept rates steady, despite further signs the economy is deteriorating.

THE cash rate is tipped to continue its downward spiral and not only drop today but continue to fall to as low as 1.5 per cent.

ECONOMISTS have brought forward their forecasts and expect the Reserve Bank to cut interest rates again next month.

HOUSEHOLDS can make last week’s Reserve Bank interest rate cut work for them with one simple trick, which involves no effort whatsoever.

ECONOMISTS expect another interest rate cut, so is it worth fixing now or sticking with variable?

ECONOMISTS expect another interest rate cut, so is it worth fixing now or sticking with variable?

ANOTHER of the Big Four banks has announced it will pass on the full 25 basis points cut on its interest rates. Who’s the holdout?

AUSTRALIAN banks are continuing to reap massive profits on home loans, despite the Reserve Bank slashing interest rates to a record low.

Original URL: https://www.themercury.com.au/business/economy/interest-rates/page/112