‘Not time’: Why the RBA took a cautious approach to rate cuts

The fallout from US President Donald Trump’s tariffs could have a severe impact on the Australian economy, worst-case modelling from the RBA reveals.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

Global uncertainty on the back of US President Donald Trump’s tariffs played a part in the RBA’s most recent rate cut decision, as minutes from the meeting reveal how seriously the central bank is taking the threat of a trade war.

While the Reserve Bank models all scenarios, minutes from the May 20 meeting showed the board had agreed to convey the bank was “well placed to respond decisively to international developments” if they were to affect economic activity and inflation.

This was described in the severe downside scenario set out in the May statement on monetary policy.

Under this scenario there would be a permanent and large tariff that surprises the financial markets, businesses and households, triggering a large global confidence shock.

The RBA says in this scenario asset prices such as bonds, house prices, shares and superannaution funds would all sharply decline.

They also predict in this scenario Australia’s major trading partners, including China, would see GDP fall to around 4 per cent lower than the baseline forecast.

Under one of these scenarios, the RBA says “a re-escalation of the trade conflict that primarily weakens demand could lead to a slowing in domestic activity, a sharp rise in the unemployment rate and a decrease in inflation”.

“If the trade conflict causes material supply-side disruptions, inflation could move in the other direction.”

The central bank said while nervous about the extent of the impact Mr Trump’s trade policy could have on Australia’s economy, it intended to move “cautiously and predictably” in line with market expectations.

As such, households were not given an outsized “insurance against global growth” 50 basis point rate cut last month.

Instead, the bank highlighted the need for monetary policy settings to remain “predictable at a time of heightened uncertainty”.

“(The board) agreed that developments in the domestic economy on their own justified a reduction in the cash rate target and that the case for that action was strengthened by developments in global trade policy,” the minutes reveal.

Independent economist Saul Eslake told NewsWire reading the statement shows the Reserve Bank made the right decision, as the smaller cut helped restore confidence for home owners.

“These are my words not theirs, but if they were to cut rates by outside 50 basis points, people’s reaction might be ‘what do they know that we don’t?’,” he said.

“If they are worried enough to cut rates by more then they normally would, then should I be worried as well.”

Mr Eslake said his interpretation of the minutes was that the RBA wanted to show they were conscious of downside risks and if those risks materialise they are willing to act.

“If they actually started cutting rates by more, on speculation things might turn out bad, then they don’t have as much ammunition if things turn pessimistic,” he said.

“You could say they were trying to build confidence by saying ‘yes we know bad stuff could happen, but hey it hasn’t happened yet and if it does we can deal with it’.”

Ultimately though, the board agreed the case for a 25 basis point rate cut was “the stronger one” as members were not persuaded that weakening global growth and domestic factors warranted an outsized rate cut.

In a silver lining for households, should the impacts of global uncertainty materialise, the RBA board agreed it would need to move to “expansionary settings” meaning there would be more cuts to the cash rate.

The board judged in May however that there was not enough data around the impacts of any global uncertainty to switch to a more expansive monetary policy setting.

“They also judged it was not yet time to move monetary policy to an expansionary stance, taking account of the range of estimates involved, given that inflation was yet to return sustainably to the midpoint of the target range and the staff’s assessment that the labour market was still tight,” the minutes read.

The board also highlighted they had the firepower left to kickstart growth should the worst of global uncertainty impact the local economy.

“In finalising the policy statement, members agreed that it was appropriate to convey their commitment to both of the Board’s objectives,” the board said.

“They also agreed to convey that policy was well placed to respond decisively to international developments if they were to have material implications for activity and inflation of the kind described in the severe downside scenario set out in the May Statement on Monetary Policy.”

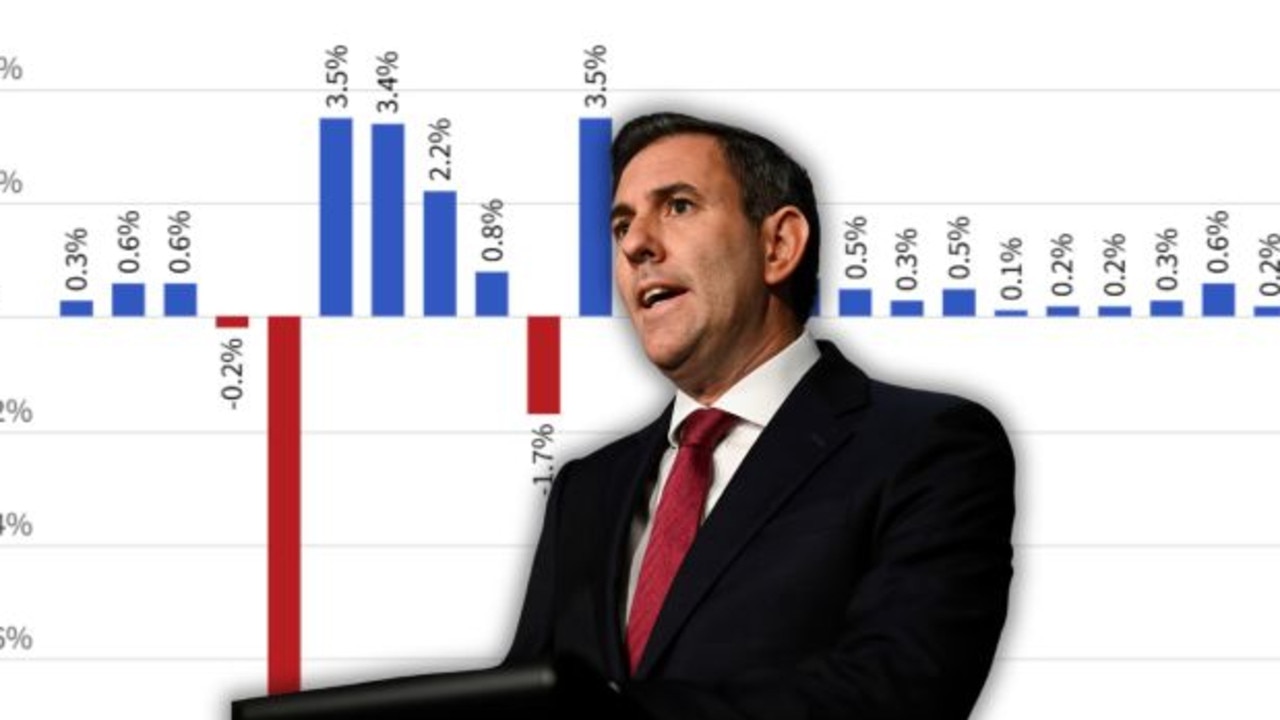

Meeting for the second time under its new dual-board structure, the RBA cut the national cash rate by 25 basis points, from 4.10 to 3.85 per cent, but RBA governor Michele Bullock revealed a 50 basis point cut had been debated.

“There was an argument and we did debate it (a 50 basis point cut) but it wasn’t the strongest argument in the room,” Ms Bullock said at the time.

She stressed “inflation hurts everyone”, particularly those on lower incomes and renters.

Responding to a question from NewsWire on whether households could expect further relief, and what message she had for those doing it tough, she acknowledged Australians had gone through a “really rough few years”, accentuated by sharp rises in everyday prices.

“I would say that bringing inflation down is the best thing we can do to help them, while keeping employment strong,” she said.

“At the moment we are on track to deliver that. I know you’re doing it tough, but conditions are improving.”

Originally published as ‘Not time’: Why the RBA took a cautious approach to rate cuts