‘Doesn’t have to be like that’: Huge clue about where interest rates are headed

The tide is turning against the RBA, with experts from Australia’s biggest bank claiming the Board’s major interest rates excuse is “overdone”.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

When will these accursed rate cuts come?

Headline inflation is back in the target range, underlying inflation is moving ever closer to target, and yet the Reserve Bank of Australia remains stone-faced, the monolith of Martin Place. No rate cuts for you!

Could they be stuffing up everything?

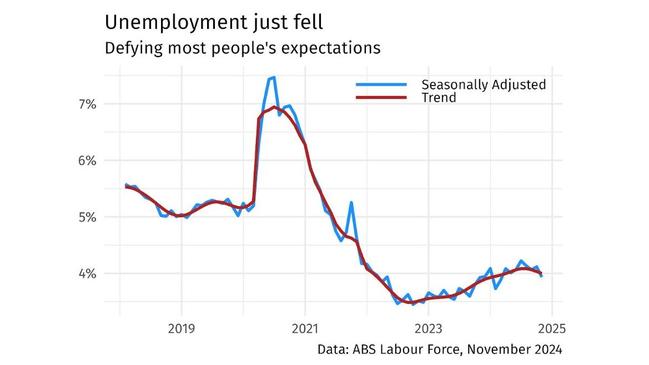

The RBA says it can’t cut rates, not yet. Not with unemployment so low.

MORE: Sign RBA is creating ticking time bomb

“[T]he labour market remains tighter than full employment,” it says, suggesting more of us need to be out of work for the inflation dragon to be slain.

The idea is that if unemployment is very, very low, it’s expensive to hire people and hard to fill jobs. Businesses can’t hire easily, can’t get things done easily, and the path of least resistance for them is to just do less and charge higher prices. Those higher prices are what we call inflation.

OPINION:Why RBA must cut interest rates NOW

The RBA reckons we need unemployment to rise to somewhere around 4.5 per cent from where it is now. That would mean tens of thousands more people looking for work. Not a pleasant prospect.

But Commonwealth Bank economists say nope. It just doesn’t have to be like that.

“The unemployment rate has tracked sideways at ~4.1 per cent for the past six months and we are sceptical that it needs to trend higher for inflation to return sustainably to the target range,” they wrote in a note to clients in late November.

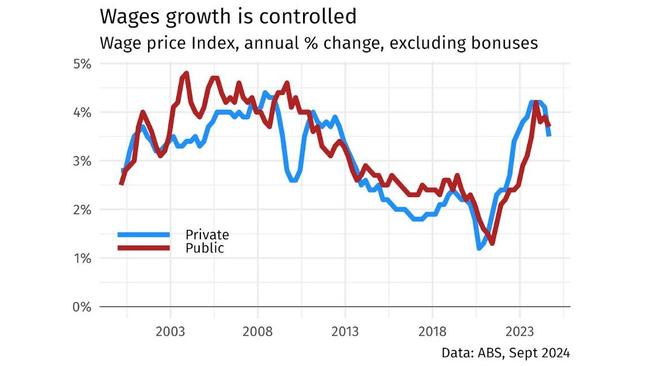

The CommBank wonks say we don’t need higher unemployment and they point to wages as the reason why. Wages growth is already falling. And it’s wages growth that is really the feedback loop from low unemployment to high inflation.

“The RBA has likely over-estimated the strength of wages growth in the economy. By extension, this means the Board’s continued concerns around sticky services inflation appear overdone,” writes CBA head of Australian economics Gareth Aird.

“The faster decline in wages growth should give the RBA more confidence that the rate of inflation will continue to decelerate and that upside risks to the inflation outlook are dissipating.”

And just look at wages – the bank is right that growth has begun falling, especially in the private sector.

But it has to be said that unemployment is confounding everyone. The RBA is supposedly choking the economy half to death, but the latest data came out and it shows the unemployment rate actually fell as the economy added 53,000 full time jobs. That’s a lot.

Unemployment is now back under 4 per cent. That was rare in the before times, as the next chart shows.

This is great news. The more people that have jobs, the wealthier our society is, both now and into the future. Low unemployment is a double win, because it means people are not just making money, but getting valuable work experience and building their skills, which will pay off for the country for years to come.

Why can’t we have zero unemployment?

It’s a good question. Are we cruel?

Long term unemployment is rarer now than it was, but 21 per cent of the unemployed have been unemployed for more than a year. For them, unemployment is a bitter everyday reality. But the vast majority of people don’t experience long term unemployment.

But, I’d say that four per cent unemployment isn’t that much. Imagine a society where you look for a job for six months, then hold that job for 12 years. Or another society where you look for a job for two weeks, and have that job for 12 months. They both result in four per cent unemployment.

Four per cent unemployment does not mean the same four per cent of people doomed to suffer for eternity; a lot is people looking for jobs and looking successfully.

You’re unemployed, typically, for about 14 weeks (three months), then you find your next job.

Looking for a job for a while can be good – it means you get one you actually want, not just taking the first thing that comes along. It also means that if a business wants to expand, it can hire without robbing another business of a worker.

But how do interest rates really work anyway?

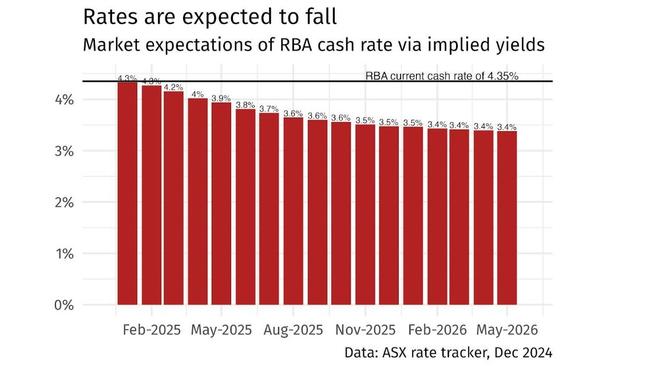

Interest rates have sat at 4.35 per cent now for more than a year as inflation has fallen.

High interest rates grind down inflation. But they don’t do it directly. They operate through us (at least partly). Any Aussie with a variable mortgage or other loan has to pay more to the bank each month to pay off their loan. Note that the bank doesn’t make that profit – they (mostly) have to fund themselves at the higher rate too.

When we pay more to the bank, we have less to spend at the shops and the cafe. If less people are coming to the cafe, the cafe owner can’t easily put up prices. And that’s what they call the transmission of monetary policy. To reiterate: we have less disposable income, so private business can’t put up prices easily. That’s how you beat inflation.

There are other ways higher interest rates work too, but they all hurt local business.

1. Higher rates should reduce asset prices, making people feel poorer so they spend less.

2. Via the exchange rate: A higher Aussie dollar makes it cheaper to buy imports, so we spend less at local businesses.

3. The same effect as consumers but for businesses – businesses should borrow and spend

less if their loans are expensive.

We can see what is expected to happen to interest rates by looking at the futures markets.

That’s where finance guys buy and sell contracts that depend on what the official cash rate will be in future. We can use the prices they use to figure out what the market on average thinks the future interest rate will be. It is revealing: rates are expected to fall, but not fast.

Only by April is a full rate cut priced as a certainty. By June, two rate cuts should have been delivered, if the market pricing is right.

Jason Murphy is an economist | @jasemurphy.bsky.social. He is the author of the book Incentivology

More Coverage

Originally published as ‘Doesn’t have to be like that’: Huge clue about where interest rates are headed