‘RBA has stuffed it up again’: Expert reveals dreaded interest rates prediction

The RBA will reveal its latest interest rates decision within hours - and an expert has shared his prediction which no Aussie will want to hear.

Interest Rates

Don't miss out on the headlines from Interest Rates. Followed categories will be added to My News.

COMMENT

Most Australians have been living in recession for two and a half years.

This is the worst run of falling living standards since the Great Depression.

Much of it is the Albanese government’s fault, given eminently avoidable rental and energy price shocks.

But blame also goes to the Reserve Bank of Australia, which has become increasingly incoherent as inflation has fallen away – yet it has refused to cut interest rates.

Who is to blame?

The moment it came to power, the Albanese government made two fateful inflationary errors.

It destroyed wage growth by dropping an immigration bomb on the labour market. This triggered a rent price shock.

It also ignored the consequences of the Ukraine war-profiteering of the East Coast gas export cartel, which delivered a huge spike in electricity prices.

OPINION:Why RBA must cut interest rates NOW

However, the bad management of these shocks has more recently swung to the RBA.

Just as it did last cycle, the RBA mistakenly assumed that wage growth would endure despite tearaway immigration levels.

For whatever reason – ideology or politicisation – the bank is unable to grasp that a permanent supply side shock of cheap foreign labour always lowers wage growth.

So now, top tier measures of wage growth are falling much faster than it expected. In a services economy like Australia’s, that means broad inflation will follow.

Weirdly, in recent speeches, the RBA has preferred to bury its head rather than mention its wages mistake.

This is a disturbing development from an RBA that used to, at least, follow the data when it was proved wrong.

MORE:Interest rates panic sparks mass gamble

Second, on energy, the RBA has consistently made the farcical argument that fiscal energy rebates don’t count as lowering inflation because they will roll off in 2025.

This political misjudgment will shortly be proven wrong when the government is certain to announce an extension of the rebates through 2026.

This will completely alter the RBA’s forecast inflation trajectory for 2025, and we have to ask – why did the central bank make such a stupid call that it wouldn’t happen, notably in an election year?

The answer is that the RBA has proven as inept as the Albanese government at handling the shocks of the day.

One more blunder for the road

Even more strangely, after the RBA’s overly hawkish destruction in the pre-Covid cycle, the central bank shifted its analytical framework to include more emphasis on structural economic measures, even though it can only control cyclic outcomes.

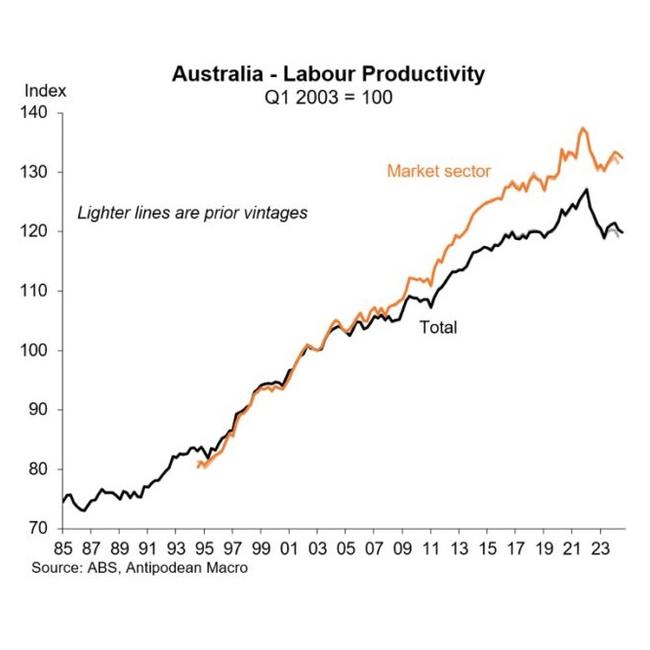

In particular, the bank has become fixated with productivity performance out of fear for, you guessed it, higher wages.

But productivity is a political and not a monetary policy issue. In particular, a government’s willingness to undertake economic reforms.

In theory, lower productivity threatens higher inflation, but in practice, the Australian economy is led by mass immigration which supplies its own cheap foreign labour – so worrying about wages is a waste of time, productivity or not.

Moreover, by holding rates too high for too long to kill non-existent wage pressures, the RBA has crushed the private sector economy from which all productivity gains emanate.

The central bank is literally crying wolf as it strangles the wolf to death.

Time to climb down and apologise

RBA governor Michele Bullock was put in charge after her predecessor, Phil Lowe, was so hawkish for so long that he ran inflation too low, putting hundreds of thousands out of work for no reason.

Now, Ms Bullock has made a whole series of new errors that will deliver the same outcome in 2025, if the bank does not climb down after the shocking run of recent data that includes the worst growth in three decades.

Economists do not expect the RBA to cut interest rates this afternoon - and the market is divided over what will happen in February, when the board next meets.

The cash rate should already be falling, and the RBA has stuffed it up again.

David Llewellyn-Smith is Chief Strategist at the MB Fund and MB Super. David is the founding publisher and editor of MacroBusiness and was the founding publisher and global economy editor of The Diplomat, the Asia Pacific’s leading geopolitics and economics portal. He is the co-author of The Great Crash of 2008 with Ross Garnaut and was the editor of the second Garnaut Climate Change Review.

More Coverage

Originally published as ‘RBA has stuffed it up again’: Expert reveals dreaded interest rates prediction