Australia’s insurmountable housing shortage explained

It’s true that Australia is suffering from a massive housing problem. But the cause isn’t what most people think.

Economy

Don't miss out on the headlines from Economy. Followed categories will be added to My News.

This week, The AFR View published an editorial claiming “Australia’s housing affordability crisis is due to the supply side, stupid”.

That, it claimed, is the lesson policymakers must learn, according to research from former Reserve Bank economist Tony Richards, published in the paper.

The tenet of Mr Richards’ argument was that the rate of dwelling construction relative to population growth slowed significantly in the 20 years to 2021.

In turn, 1.3 million fewer dwellings were built than otherwise would have been had the rate of dwelling construction matched the 20 years to 2001.

The assertion from Richards’ research is that Australia has gotten worse at building homes, which has left the nation desperately short of housing, resulting in the current affordability crisis.

This ‘lack of supply’ view is frequently parroted by the media, the housing industry, and policy makers. Yet it is fundamentally wrong.

Australia is a world leader in home building

The OECD’s Affordable Housing Database shows that Australia has built significantly more dwellings per capita than most other OECD countries:

Australia ranked fourth in the OECD for housing construction in 2020.

Australia’s dwelling construction rate was also unchanged from 2011, according to the OECD.

The fundamental problem is not Australia’s ability to build homes, but that Australia has run one of the world’s largest immigration programs, thus ensuring that housing demand has always outpaced supply.

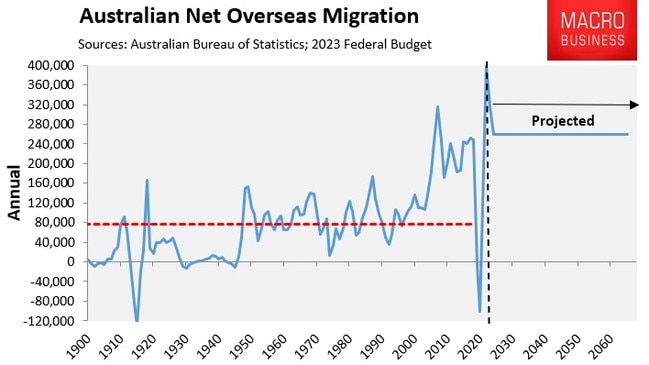

In the 20 years to 2001, Australia’s net overseas migration (NOM) averaged 95,000 people a year and population growth averaged 217,000 people a year.

In the 20 years to 2021, Australia’s NOM averaged 182,000 and population growth averaged 320,000 people a year. And this period includes the negative NOM experienced over the pandemic:

The housing supply situation will only worsen if the May federal budget’s aggressive immigration forecasts come to fruition.

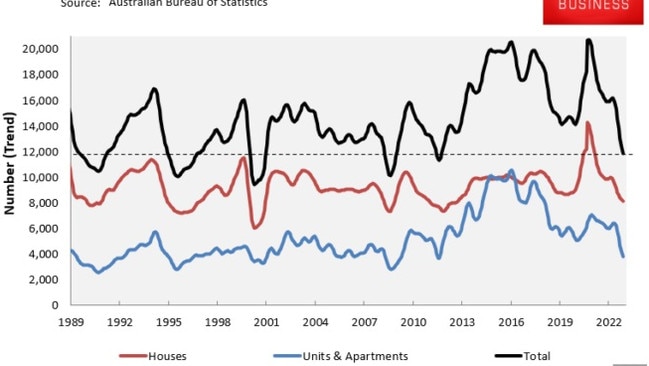

The Budget projects net overseas migration to reach 400,000 for the first time ever in 2022-23 before slowing to 315,000 in 2023-24. It will then moderate to an historically high 260,000, where it will remain over the forward projections.

The federal budget, therefore, projects a record 1.5 million net overseas migrants to arrive in Australia over the five years to 2026-27 – equivalent to an Adelaide’s worth of people.

In turn, Australia’s population is projected to increase by a record 2.18 million people over the same five-year period – equivalent to adding five Canberra’s or one Perth to Australia’s current population.

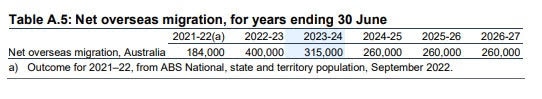

The enormity of Australia’s housing supply challenge is encapsulated in the following chart, which compares dwelling completions to actual and projected population increase as outlined in the federal budget:

As you can see, Australia’s rate of dwelling construction surged in the 2010s.

However, this construction boom was not enough to keep pace with the massive increase in immigration-driven population growth from the mid-2000s, which is projected to hit new heights going forward.

Australia’s housing shortage will worsen.

Building housing for such a massive rise in population is an impossible undertaking even under ideal housing conditions.

It is even worse when the entire housing construction sector is on its knees due to widespread insolvencies and skyrocketing materials and financing (interest rate) costs.

According to ASIC data to 14 May, 1872 home builders have declared bankruptcy so far in 2022-23, which is the largest number of insolvencies on record.

Among the insolvencies listed above are industry titans such as Porter Davis Homes, which went into administration in March with over 1500 homes partially constructed, as well as a slew of smaller firms.

Since 2021, it is estimated that builders responsible for about 5200 homes worth a total of $2.2 billion have gone bankrupt.

As a result, fewer builders are left to satisfy the nation’s housing needs in the face of unrelenting immigration demand.

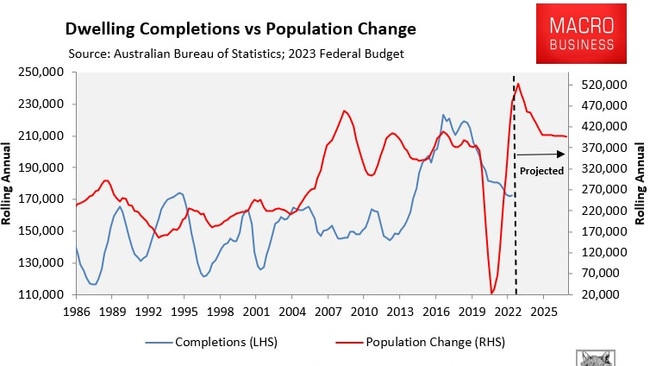

This week’s dwelling approvals data from the Australian Bureau of Statistics were an unmitigated disaster, with total approvals collapsing to a 13-year low:

To add further insult to injury, Treasury secretary Steven Kennedy told Senate Estimates this week that the downturn in dwelling approvals is expected to continue until 2025, with investment in new dwellings likely to contract by 2.5 per cent this year and a further 3.5 per cent in 2023‑24 and 1.5 per cent in 2024‑25.

Growing Australia’s population by between 400,000 and 500,000 people a year amid falling dwelling construction necessarily means Australia’s housing crisis will worsen, resulting in higher rents and increasing homelessness.

It’s the immigration, stupid!

Australia’s housing shortage is a direct result of nearly 20 years of excessive immigration, which is officially forecast to hit new heights.

Australia will never build enough homes so long as its population continues to grow at a rapid pace due to high levels of immigration.

We didn’t build enough homes in the 15 years of ‘Big Australia’ immigration leading up to the pandemic. And we certainly won’t under the record immigration deluge projected by the federal budget.

If the Albanese Government truly cared about ending the nation’s housing shortage, it would run an immigration program that was substantially lower than the overall expansion in the housing stock, not the other way around.

It is time to stop scapegoating a ‘lack of supply’ and start addressing the immigration elephant.

Leith van Onselen is co-founder of MacroBusiness.com.au and Chief Economist at the MB Fund and MB Super. Leith has previously worked at the Australian Treasury, Victorian Treasury and Goldman Sachs.

Originally published as Australia’s insurmountable housing shortage explained