Bottled water sales booming in Australia

AUSSIES may be moving away from sugary soft drinks and juices, but the health revolution has boosted the fortunes of the most ridiculous product.

Retail

Don't miss out on the headlines from Retail. Followed categories will be added to My News.

AUSSIES may be moving away from sugary soft drinks and juices, but the health revolution has boosted the fortunes of the most ridiculous product we’re still paying for.

Yes, people are still buying bottled water in record numbers.

In 2015, about 5.3 million people, or 27.1 per cent of the population, drank bottled water in any given week, according to Roy Morgan. That was an increase on 4.9 million bottled water drinkers in 2014.

Mount Franklin, made by bottling company Coca-Cola Amatil, is by far the most popular brand, consumed by nearly 40 per cent of bottled water drinkers, followed by Coles Natural Spring Water on 14 per cent and Pump Pure Water on 12.8 per cent.

According to market research firm IBISWorld, the bottled water industry is worth $736 million and is projected to grow at an annualised rate of 2.4 per cent over the next five years to reach $826.8 million.

Coca-Cola Amatil dominates with just under 50 per cent market share, according to IBISWorld, followed by Asahi — maker of the fourth most popular Cool Ridge — which holds a 14.5 per cent market share.

Data from Euromonitor tells a slightly different story. It puts Coca-Cola Amatil on 37 per cent share of retail value, followed by Asahi on 17 per cent.

Euromonitor says sales of bottled water rose 8 per cent in 2015, with private label products leading by share of volume with 28 per cent. The research firm says while still bottled water makes up 74 per cent, sales of carbonated water are increasing.

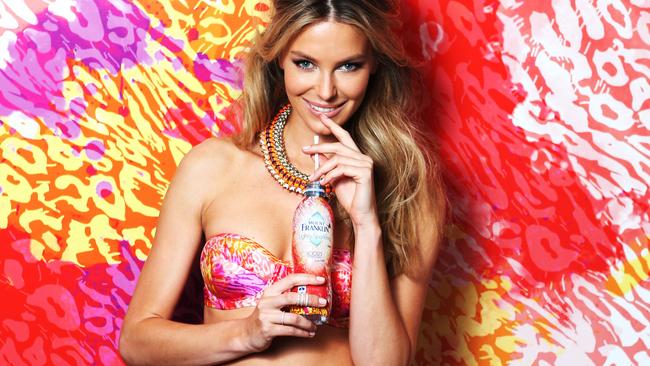

You can thank Jennifer Hawkins for that, apparently.

“Mount Franklin is known as Australia’s number one bottled water brand, and its ‘lightly sparkling’ ambassador and former Miss Universe, Jennifer Hawkins, helped generate interest in flavoured bottled water,” Euromonitor says.

The good news? The average retail unit price of bottled water continues to face downward pressure, falling by 1 per cent in 2015 “largely due to strong promotional activity and the strength of private label products”.

Euromonitor warns the “premiumisation” of bottled water is set to accelerate.

“Australia is behind American consumers as Australians are said to have a very limited water palate and much to learn about the different taste profiles of water,” the firm says.

“Although new players such as nakd, Nu Pure, blk, Fuji made a mark in the country, in the US water sommeliers, much like a sommelier of wine, have been present since 2013 to help discern the different tastes of water.

“In Australia, consumers are still more than willing to drink tap water, and Sydney Water Corporation is driving the ‘tap’ campaign in New South Wales, encouraging local consumers to drink tap water.”

IBISWorld says as disposable income increases in the next few years, consumers will begin shifting back to premium brands, slowing the private supermarket label trend.

“Compared with many foreign countries, Australia still consumes a significantly lower volume of bottled water annually, which presents an opportunity for industry growth,” IBISWorld says.

“Poor tap-water quality has been a persistent issue in some areas, particularly in South Australia and Western Australia. This has increased these states’ reliance on bottled water. Population growth in these states is expected to contribute to rising bottled water use for general home consumption.”

Originally published as Bottled water sales booming in Australia