Melbourne sex worker wins ‘debanking’ case against two Australian financial institutions

A Melbourne sex worker was asked over the phone about his occupation. What happened next shocked him.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

A gay male sex worker and advocate for sex workers’ rights has won a discrimination case against two Australian financial service providers — and in doing so helped protect others in the industry from becoming victims of “debanking”.

“Debanking” is when a bank or financial institution stops providing services like accounts, loans, or payment processing to a person or business because of what they do for a living.

Matthew Roberts, from Victoria, had been using a portable EFTPOS machine to process his clients payments for years, without issue, when in 2021 he was suddenly cut-off.

“I had been with Mint Payment services, using my EFTPOS machine to do sex work for a number of years without issue,” he said.

However, when Mint Payments changed their partner company from Bendigo Bank to First Data Merchant Solutions Australia in 2021, it meant Mr Roberts was required to reapply to use their services.

While attempting to re-register for the EFTPOS machine in 2o21, Mr Roberts said he was subjected to judgment and prejudice.

“I was asked about my occupation, there was a dead silence and then the phone hung up,” he said.

“Sex workers across the country face a dilemma. They can lie and be treated fairly, or tell the truth and almost certainly face discrimination.

“I chose to tell the truth and the discrimination came thick and fast. I was physically shaking. I felt humiliated and disrespected”.

However, Mr Roberts said it wasn’t “made clear to him” until he took the matter further and wrote a letter to the Chief Manager of Mint Payments that he was informed he was “banned” from using their services.

“I asked for confirmation about why I was banned and I received it in writing in 2021,” he said.

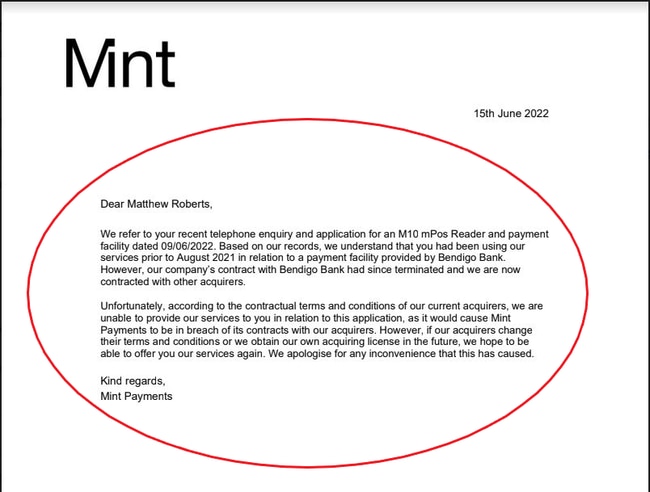

After reapplying for the Min Payments service in 2022, he received another letter from the company in June 2022, which stated “according to the contractual terms and conditions of our current acquirers, we are unable to provide our service to you”.

Following this letter in 2022, which became the foundation of his application, Maurice Blackburn filed an application on behalf of Mr Roberts against Mint Payments and its acquirer First Data Merchant Solutions Australia.

The legal action was based on “events which occurred in June 2022” onwards.

“Now that sex work has been decriminalised, financial service providers need to treat sex work seriously.

“When you’re filling out a business application form, you must be honest. There’s no reason that sex workers should have to lie in Victoria given that sex work is decriminalised and it’s legal,” he said.

In Victoria, it is unlawful to discriminate against someone on the basis of their profession, trade or occupation.

The Victorian Parliament passed laws decriminalising sex work in 2022.

NSW and Queensland are also among the states which have decriminalised sex work in Australia.

However, according to data from advocacy group, Scarlett Alliance, many states nationally still have different rules.

Some states give sex workers little or no protection from discrimination, where some states still consider sex work illegal.

For Matthew, he doesn’t blame the individual he spoke with on the call, but said it was a larger, systemic issue within the “culture of these companies”.

“It was a junior staff member who was young and new. I can’t comment on his views, but he was an employee of Mint Payments and he was acting in a way that he thought that his employer would want him to do,” he said.

“It makes you wonder what was the policy of the company are.

“Are they aware of any discrimination laws? How do they train their staff?”.

After his experience with the financial provider, Mr Roberts said the anger he felt was the fuel that kept him “motivated” to take legal action and spend years in the courts “fighting for justice”.

“The case was not about money for me,” he said.

Instead, Mr Roberts said the case was about “forcing cultural and policy change” in the financial services industry and not about a pay out.

In late 2023, Mr Roberts agreed to resolve his discrimination claim on the condition that the two companies not restrict services offered to people because they are engaged in lawful sex work and consider any applications for services from people engaged in lawful sex work on their merits.

Both companies also agreed to train their staff on any discrimination laws.

“This case is so significant because it reminds all companies that they need to be aware of their legal obligations under any discrimination laws, keep their staff trained and treat sex workers fairly”.

The advocate for sex workers rights, said he hopes the outcome of his case will “mark the beginning of a cultural shift in this country” on how sex workers are viewed and financial discrimination as a whole.

“Debanking is shrouded in secrecy and a lack of due process. In most cases when someone is debanked, they won’t give you a reason,” he said.

Mr Roberts said half his clients want to pay with card and the consequences of financial institutions blocking sex workers from being able to take card payments “is quite serious”, as it becomes a safety concern, if an individual has to store large amounts of cash at home.

“Some sex work businesses have actually closed down because of debanking and it also becomes a matter of safety,” he said.

“I’m in the industry because I love the work that I do and that’s never going to change,” Mr Roberts said.

Originally published as Melbourne sex worker wins ‘debanking’ case against two Australian financial institutions