Letter from embattled builder reveals man’s $53k pay disaster

A Sydney man was horrified when he received a letter in the mail about his company. Then things took another turn which left him in “shock”.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

EXCLUSIVE

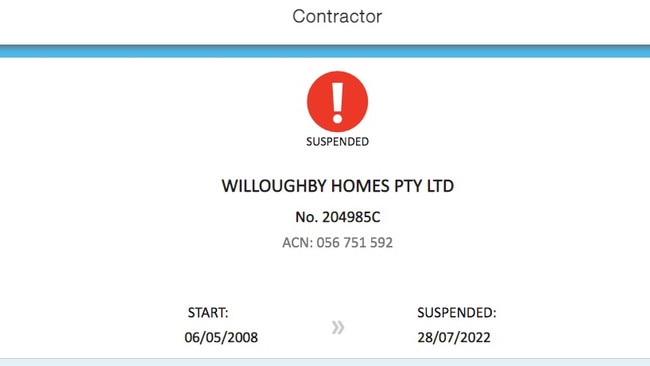

An embattled NSW builder has had its licence suspended after it couldn’t pay back debts totalling $115,000.

News.com.au can reveal that on Thursday, NSW Fair Trading automatically halted the licence of Sydney-based construction company Willoughby Homes Pty Ltd after it did not respond to court orders.

The NSW Civil and Administrative Tribunal (NCAT) ordered Willoughby Homes to pay back $76,837 to a customer on June 8 and then last week, on July 21, another homeowner was also awarded $38,456, payable immediately.

Without its licence, the company can no longer trade or enter into any more contracts.

It comes after a news.com.au investigation found that Willoughby Homes is under investigation by NSW Fair Trading from owing hundreds of thousands of dollars to subcontractors, construction sites languishing while also signing up new customers despite not having the insurance to complete works valued at over $20,000.

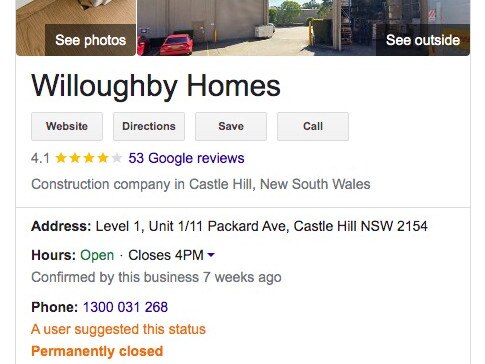

Earlier this week, it also emerged that Willoughby Homes has cleared out its Castle Hill offices, with the landlords, ASIC and customers unsure where the company relocated to. Their listed phone number also goes straight to a message bank.

The building firm is due in court next week after a contractor, Regno Trades, took legal action calling for Willoughby Homes to be “wound up in insolvency” after failing to pay back $184,310.

Two former staff members have now alleged that they weren’t paid their superannuation for months while working there, with one also claiming they are owed tens of thousands of dollars in unpaid final wages.

Xavier* worked in the sales department of Willoughby Homes for more than a year before he was made redundant in February 2021. The father-of-three claims he is still yet to be paid $53,000 from his commission fees. To recover the money, he’s spent around $5,000 on lawyers although his latest legal letter has gone ignored for months.

Stream more business news live & on demand with Flash. 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer ends 31 October, 2022 >

“Certain stuff I was seeing and hearing [while working there] was not kosher,” Xavier told news.com.au.

“There were breadcrumbs, I asked some questions, I was met with hostility each time.”

Tradies came into the office demanding payment, according to Xavier, and younger women at the front desk would be made to turn them away.

The 34-year-old grew even more concerned when he received an unusual letter in the mail.

“I got a letter from my superannuation fund saying if you don’t make a contribution, if you don’t make a contribution by this date, the account closes,” he explained.

“At the time I realised I hadn’t had a dollar of super deposited.”

He soon learned he was owed about $7000 in unpaid superannuation from Willoughby Homes. When he asked around, he discovered this was the case for other staff members.

“Everyone knew,” he added.

Things then took another turn when he was made redundant in February last year in what he said was a “shock”.

“On Monday morning I came in at 8am, by five past eight I was being walked out,” he recalled.

“It was insane.”

Xavier waited for his $53,000 in commission fees to appear in his bank account but they never did.

“I’m owed the equivalent of a year’s wage, it really set us back, my wife was pregnant at the time, it was quite a stressful period.”

More than a year later, he has yet to receive this money despite sending legal letters. The latest one has not garnered a response from Willoughby Homes.

“I feel so sorry for all these people that I sold homes to,” Xavier added. “I sold their dream to them, look what happened.”

Do you know more or have a similar story? Get in touch | alex.turner-cohen@news.com.au

Another ex-employee of Willoughby Homes, Eric*, worked as a construction site supervisor and was alarmed at the number of angry tradies he encountered who were owed money from the company.

“I had a random guy come over and said ‘oi f**khead, tell your boss to come and pay me,’ I didn’t even know who he was,” Eric told news.com.au.

It was difficult to do his job because whenever he gave a contractor instructions, they refused to work as they had unpaid debts.

Eric eventually resigned, saying: “I thought ‘All these ships are sailing and I need to jump on one.’”

However, the saga wasn’t over, as he discovered he hadn’t been paid nine months of superannuation, which amounted to $5000.

He had to report Willoughby Homes to the Australian Taxation Office who had to intercede on his behalf and get his money paid back in instalments. He says he is still owed around $1300 in superannuation.

To top that off, more than a year since leaving the company, Eric is still getting calls from creditors demanding payment.

“Trades are still calling me, the last call I had was a month ago, I’m the only person that picks up,” he explained.

David Baker, a consulting principal at Sydney-based KeyPoint Law, is representing three impacted customers of Willoughby Homes.

The fact their licence has been suspended licence makes the company’s collapse appear imminent, according to Mr Baker.

“Once you’ve had your licence suspended, unless you can come up with some pretty good reasons, it’s hard,” he told news.com.au. “In these circumstances they don’t have any arguments [that I can see].”

NSW Fair Trading has taken the drastic action using Section 42A of the Home Building Act 1989, which allows them to “automatically suspend a contractor licence where the holder fails to comply with an order by a court or the NSW Civil and Administrative Tribunal (NCAT) to pay money for a building claim by the due date”.

The suspension will remain until Willoughby Homes can cough up the cash to comply with the court orders or until their licence expires.

“The suspension will be recorded on the public register licence record indefinitely,” Fair Trading added.

Mr Baker said this was a blow to Willoughby Homes, as even if they can trade their way out of disaster, it will be a permit blight on their record.

“In NSW when you enter into a building contract, there’s a checklist,” he said. “One of the things that they advise you to do is they do a licence check on the builder.”

He previously told news.com.au that: “On the basis of the facts that we know so far, it looks like this company is going to fail.

“They haven’t paid their suppliers, they haven’t worked on jobs for eight to 10 months.”

At least 10 contractors are chasing Willoughby Homes over unpaid debts and more than a dozen customers have taken them to NCAT demanding their deposits or progress payments be returned as works have stalled.

It’s understood there are at least 30 homes in the pipeline to be built.

Although, Regno Trades has applied for Willoughby Homes to be placed into liquidation over a $184,310 payment, several other creditors have also taken legal action.

Five companies have applied for a default judgment over payments they claim is owed to them: H & R Interiors ($73,925), Prospa Advance Millers ($60,913), Scaffolding Australia ($22,794), ATF Services ($5658) and Green Resources Material Australia ($6,503).

Elba Kitchens claimed to news.com.au that they were owed around $80,000 from Willoughby Homes.

Trueform Frames and Trusses claim they are waiting on an outstanding payment from Willoughby Homes of $24,684 from an invoice issued more than six months ago while Finese Electrical and Air Conditioning claims it is owed $4531 from jobs done in February.

News.com.au knows of two other suppliers owed money.

News.com.au has previously spoken to eight sets of homeowners who are struggling financially after being strapped with rent and mortgages for months — or in some cases years — longer than expected.

Their situation is also made more difficult because they are now facing the prospect of starting with a new building company with rising building costs making it more expensive to go with another construction company.

Marice Hartono, 43, from North Ryde, was the customer that NCAT awarded $38,000 to last week.

Ms Hartono signed a contract with Willoughby Homes in May for a $644,000 home but soon learned she wasn’t insured.

NSW insurer iCare had not reinstated Willoughby Homes’ Home Builders Compensation Fund (HBCF) since April 2021, with the state body rejecting multiple applications, it confirmed to news.com.au.

That means legally the construction firm cannot begin any new projects that require HBCF — even though they signed Ms Hartono on just two months ago.

It also means Ms Hartono is not insured and if the company does collapse, she cannot receive any compensation from insurance.

A NSW Fair Trading spokesperson told news.com.au that “It is a breach of the Home Building Act for a builder to enter into a contract to complete residential building work above $20,000 without HBCF insurance.”

alex.turner-cohen@news.com.au

Originally published as Letter from embattled builder reveals man’s $53k pay disaster