NSW construction company Willoughby Homes in financial strife

Customers and creditors of a NSW building firm fear for the company’s future as debts blow out and building sites languish.

Companies

Don't miss out on the headlines from Companies. Followed categories will be added to My News.

EXCLUSIVE

Customers and creditors of a NSW building firm fear the company is in financial difficulty following months of unpaid debts while construction sites languish.

News.com.au can reveal that Sydney-based residential builder Willoughby Homes Pty Ltd is under scrutiny after creditors brought the firm to court four times in six months when payments blew out to more than 90 days.

NSW insurer iCare has not reinstated the company’s Home Builders Compensation Fund (HBCF) for over a year, with the state body rejecting multiple applications, it confirmed to news.com.au.

Legally the construction firm cannot begin any new projects that will cost more than $20,000 without insurance.

A private credit report from CreditorWatch has painted a damning picture of Willoughby Homes, saying it is “high risk”.

Fair Trading NSW is investigating the company, it told news.com.au. And news.com.au understands at least 29 customers have lodged formal complaints against the builder and several are taking it further, to the NSW Civil and Administrative Tribunal (NCAT).

News.com.au has called, texted, emailed and left voicemails for Willoughby Homes and its director, Steve Willoughby. Mr Willoughby did not arrive at an arranged meeting between him and news.com.au. He had also provided no official comment on behalf of the company by time of publication.

Customers left out in the cold

Cherry Cobrador-Wong, 33, and her husband Logan Wong, 35, from Sydney’s west, who recently had a baby, are behind in mortgage and rent because they claim their house has been left untouched since November when it was nearing its final stages.

Willoughby Homes “have put us under a bus and run over us,” Ms Cobrador-Wong told news.com.au.

“I’m behind in rent, I’m behind in my mortgage, we expected this house to be done,” Ms Cobrador-Wong continued.

“I’m crying all the time. I’m emotionally saddened and destroyed.”

She and her husband snapped up a plot of land in the Sydney suburb of Marsden Park in October 2020 and a month later had signed Willoughby Homes as their builder.

At first things went smoothly on the $219,000 three-bedroom build, with pre-construction plans being drawn up and work getting under way just a month later, in December 2020.

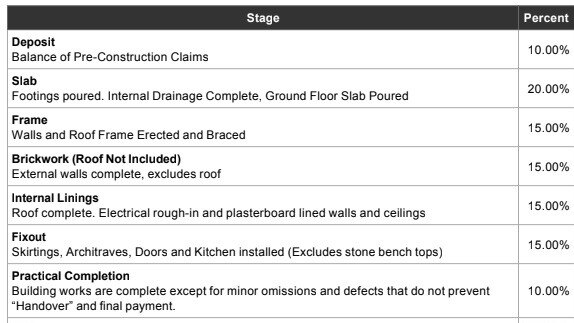

The house progressed to each new stage of the build “consistently”, with the slab, frame, brickwork and internal linings being built within two months of the previous step.

But then in November last year, builders reached the “fixout” stage of the build where the skirtings, architraves, doors and kitchen needed to be done. The Wongs forked out more than $30,000 as a progress payment.

And since then, nothing.

Their site has not been touched for eight months, according to the Sydneysider, as debts mount.

In the contract, the build wasn’t supposed to take longer than 40 weeks but it has now been 18 months, or 78 weeks, since it first started.

“This has been such a disaster,” Ms Cobrador-Wong said. “I don’t know what to do.”

Do you know more or have a similar story? Get in touch | alex.turner-cohen@news.com.au

Their build is taking so long in fact, that the married couple have had a baby in the meantime, adding another layer of financial pressure.

Ms Cobrador-Wong claims multiple calls to the company have gone ignored and when she visited the Castle Hill head office for Willoughby Homes with her crying baby, staff assured her the home would be finished soon but it still remains untouched.

“I’ve done a [NSW] Fair Trading complaint, I need this to be escalated, we can’t afford for the banks to be chasing us.”

They’ve paid for 90 per cent of the build — around $200,000 — prompting them to worry what will happen if the builder collapses.

Struggling to pay back debts

Court and credit documents show Willoughby Homes has been chased to pay several supplier’s bills for several months.

Creditors have initiated two default judgments and two winding up orders against the embattled company in the last six months.

Although both liquidation proceedings were discontinued as the debts were paid before the final hearing, creditors say it is a “very unusual” situation.

At least three suppliers claim they are still owed thousands of dollars and several trades are refusing to do business with Willoughby Homes unless they are given cash on delivery while others have sworn off them until their bills are paid.

In December last year, a creditor by the name of Pawar Kamaljit took Willoughby Homes to the NSW Supreme Court to force a liquidation order but the case was discontinued because Willoughby Homes paid.

Then in February, Kingspan Water & Energy Pty Ltd started a Victorian Supreme court case applying for Willoughby Homes “to be wound up in insolvency”. Two other creditors jumped on board and they were eventually paid, so the case was discontinued.

Last month, two other creditors took them to court seeking default judgment hearing.

High risk

Based on its analysis CreditorWatch has deemed Willoughby Homes as “highly vulnerable” and “high risk”, scoring a D or 517 points out of 850 for its risk score, lower than the industry average.

Their research shows there have been 374 credit inquiries into Willoughby Homes in the last five years, but 261 of those have been over the last 12 months.

One customer took Willoughby Homes to NCAT according to records, with the tribunal ruling in the customer’s favour. On 8 June NCAT ordered the company pay back $76,837.00. The payment was due on Tuesday.

To make matters more difficult, their Home Builders Compensation Fund (HBCF) has not been reinstated for more than a year, meaning they cannot begin new projects requiring insurance under the fund.

On the NSW government register, it states that since April 14 last year, a “condition” has been placed on Willoughby Homes which means they can build “only for contracts not requiring insurance under the Home Building Compensation Fund”.

An iCare spokesperson told news.com.au: “As per the guidelines, iCare HBCF eligibility assessments are generally completed within no more than 30 business of days of the submission of relevant information.

“This builder was suspended from being eligible to purchase HBCF insurance in April 2021, following the outcome of their renewal assessment.

“All further engagement has been the builder making subsequent applications, which to date have not been accepted.”

In a statement to news.com.au, a NSW Fair Trading spokesperson said: “The investigation into Willoughby Homes Pty Ltd is ongoing and no comment can be made at this time.

“NSW Fair Trading encourages anyone who has contracted with this trader to call 13 32 20.”

‘A bloody nightmare’

Greg Denton is another Willoughby Homes customer with an empty plot of land to show for his new home even though building work should have started almost a year ago.

“It’s a bloody nightmare,” he told news.com.au.

Mr Denton and his wife signed a building contract with the company in July last year for a four-bedroom, two-storey house in NSW’s Central Coast.

But Willoughby Homes were unable to provide the required homeowners insurance certificate, which put everything on hold.

Staff at the building firm assured him it was a minor delay but as months passed by, he grew concerned.

When he looked into it further he discovered the “condition” iCare had put on Willoughby Homes.

“What’s really bad is they didn’t tell us about this condition,” Mr Denton said.

“When we made the acceptance payment in May they didn’t tell us at all that this condition was in place, which I think is unethical.

“Later when we signed the contract they requested our deposit without being able to provide a homeowners insurance certificate.”

Then in November last year, excavators were brought onto his site and cut the land in preparation of the build.

A NSW Fair Trading spokesperson told news.com.au that “It is a breach of the Home Building Act for a builder to enter into a contract to complete residential building work above $20,000 without HBCF insurance.”

Excavating a property also isn’t allowed without proper insurance.

“Excavation work in conjunction with the construction of a property would be considered part of the contract to build, therefore residential building work and HBCF would need to be in place before any work commenced,” the spokesperson added.

Mr Denton says “over the past 6 months the communication [from Willoughby Homes] has been terrible” as his emails, phone calls and text messages have gone unanswered.

“When we have received responses they turned out to be empty words and more broken promises,” he continued.

‘I don’t want more people to go through this’

His home should have been finished in May this year at the latest but now he and his wife are facing starting again with a new builder and will be lucky to move in before 2024.

“We’re having to pay rent, we’re paying the mortgage on the land and are being hit with increased construction costs of around $60,000.”

He has lodged a complaint with Fair Trading and plans to take Willoughby Homes to NCAT to seek compensation if the situation cannot be resolved with the builder.

‘Stitched me up’

Milan and Deanna Milosev run Finese Electrical and Air Conditioning and refuse to work with Willoughby Homes until they pay them.

“They stitched me up,” Mr Milosev told news.com.au, adding the whole situation was “very unusual”.

In February, Willoughby Homes approached them asking if they would install some airconditioning units in a Newcastle site.

Mr Milosev, whose family business has 10 employees, was surprised to hear from the builder because they hadn’t worked with them before.

He was told the other airconditioning company “didn’t want to do the job”.

Finese Electrical and Air Conditioning completed the job and the builder asked them to do more contracts, so they lined up a bulk buy deal for more than a dozen air conditioners.

But as they still hadn’t received payment for the first purchase, the couple decided to wait.

This turned out to be a good decision as the money they were owed never arrived.

“If we went ahead with that we would have been screwed big time,” Mrs Milosev, who oversees the aircon company’s finances, told news.com.au.

Her husband explained: “I called them [Willoughby Homes], no answer, left a voicemail, no answer. No call back. It’s been more than 90 days.

They say Willoughby Homes owes them $4531, which, as a small business, Mr Milosev said “That’s big money for us”.

They sent debt collection letters which never received a response.

“It’s an eye opener and people have got to be wary,” Mrs Milosev added.

‘Very rare’

Then there’s Steelbuilders Pty Ltd, who claim they were owed under $100,000 and due to obligations under their insurance policy referred Willoughby Homes to their insurers who commenced debt collection after their bill went unpaid beyond the threshold of 90 days.

General Manager of Steelbuilders, Ian Head, told news.com.au “In the last two years, we haven’t had a lot of problems with companies, legal action is very rare, although not entirely uncommon.”

However, as the payment drew out, the company’s insurer gave them no choice but to pursue Willoughby Homes.

After 60 days of not receiving payment, Steelbuilders’ insurance policy stipulates they must stop supplying the builder. After 60 days has passed they send a notice and the insurance company commences legal action if the wait blows out to more than 90 days as part of the terms of their insurance policy.

They have been paid back but now due to the insurer withdrawing cover on the builder next time they deal with the builder, it will have to be on a non account basis, Mr Head said.

Prospa Advance Pty Ltd, which gives out business loans, waited more than 90 days for $60,913 from the builder while ATF Services Pty Ltd, a fencing company, commenced legal proceedings for a $5658 bill. They have since been paid.

Trueform Frames and Trusses is still waiting on an outstanding payment from Willoughby Homes of $24,684 from an invoice they say was issued more than six months ago.

The frame company’s owner, Mark Twitchen, told news.com.au if they do ever receive payment, they will not be dealing with the building firm again.

This isn’t the first time they’ve had issues getting their money back from Willoughby Homes, they claim.

The builder “was on a cash on delivery basis but we let that one slip through,” he said.

“They did originally have an account and they got in trouble so they came up with a payment plan and they paid it off. From that time we started doing cash on delivery.”

He’s cut off services, adding “We’ve actually got a job half-complete at the moment.

“It’s a two-storey house, they’ve paid for the ground floor frames but they haven‘t received the top frame or the trusses [from us]. Big alarm bells there.”

News.com.au knows of one other supplier owed money.

‘Can’t get money back’

Kenneth Hor, 39, is another customer anxiously awaiting an outcome after his plot of land remains completely empty after more than a year since signing his contract with Willoughby Homes.

“We can’t get back our money and the builders keep on avoiding our calls, they’re not answering,” he told news.com.au.

“We wanted a dream house but we got nothing.”

He and his wife had their land in Marsden Park titled and signed with Willoughby Homes not long after in February.

“We’ve waited for more than one year now, no news, nothing. We talked to the front desk, and even the general manager, they can’t give us any information.”

They’ve paid a five per cent deposit for their $340,000 build but are looking at another builder with costs now at least $50,000 more.

Their house was meant to be finished by April this year.

Mr Hor left a negative review online and Willoughby Homes asked him to take it down but he refused. “I’m very angry,” he added.

Another customer, Sally*, is paying $6000 from both rent and mortgage as she waits to move into her home after nearly two years.

She left a negative review online about Willoughby Homes and claims the company threatened her with legal action.

“The slab went in April 2021, from that time onwards it was so slow, it was snail pace,” she told news.com.au. Like Ms Cobrador-Wong, her build has stalled on the kitchen and inner fittings stage.

Sally has also spent about $9000 on legal fees and has paid 60 per cent of her loan.

“A few tradies we spoke to said they had not been paid,” she added.

“Fair Trading visited our site and they said there are 28 projects they are investigating under their name.”

Australia’s construction industry in crisis

Australia’s building industry is in crisis, with many companies going into liquidation so far this year amid rising costs for construction materials and ongoing supply chain issues, putting them out of business.

Then two major Australian construction companies, Gold Coast-based Condev and industry giant Probuild, already went into liquidation earlier this year.

And that grim list has continued to grow as a number of other high profile companies also collapsed, including Hotondo Homes Hobart, Inside Out Construction, Dyldam Developments, Home Innovation Builders, ABG Group, New Sensation Homes, Next, Pindan and ABD Group.

At the end of last month, two firms from Queensland collapsed just days apart, Pivotal Homes and Solido Builders.

Last week, news.com.au reported on Melbourne builder Snowdon Developments Pty Ltd, who is also believed to be on the brink of collapse, with sources revealing employees haven’t received their superannuation since October as well as creditors owed millions and building works stalling for more than a year.

Last Friday, Victorian building firm Waterford Homes appointed liquidators while this Wednesday, two NSW building firms, Affordable Modular Homes and Statement Builders also went bust.

An industry insider told news.com.au earlier this year that half of Australia’s building companies are on the brink of collapse as they trade insolvent.

There are between 10,000 to 12,000 residential building companies in Australia undertaking new homes or large renovation projects, a figure estimated by the Association of Professional Builders.

A healthy construction industry is vital to a strong economy and ongoing growth, with the sector accounting for the employment of almost nine per cent of Australian workers and 7.5 per cent of Australia’s GDP, according to CreditorWatch.

*Names withheld over privacy concerns

alex.turner-cohen@news.com.au

Originally published as NSW construction company Willoughby Homes in financial strife