‘I’ve been left with not even a dollar to my name because of my bank’

A simple transaction has seen a Sydney woman treated like a “criminal” and left without access to any money for days. Now other providers are chasing her for payment.

Matilda* was left in tears and “overwhelmed” with stress when she was told her only bank account was being immediately closed – locking her out of access to the $40,000 in her account.

The 31-year-old had held an account with Ubank, an Australian digital bank owned by National Australia Bank (NAB), and had already gone through the arduous process of having her BSB, account number and new debit card changed as part of a merger with another bank.

It's a process that has been slammed by hundreds of Ubank customers, who have described the changes as “disgusting” after they were locked out of their accounts and could not access their money for days.

But things have been even worse for Matilda, who has been through an “absolutely awful” experience that made her feel like a “criminal”, which has left her “with not even a dollar” to her name.

The Sydney woman said it all began last week when her partner deposited $20,000 into her account. He wanted her to use her account with financial company Wise to transfer the money to his family in Colombia.

Want to stream your news? Flash lets you stream 25+ news channels in 1 place. New to Flash? Try 1 month free. Offer available for a limited time only >

‘Complete disregard for my situation’

The money was in her account for a short amount of time before she authorised the transfer, which she understood can look “suspicious” but she said her explanations to Ubank fell on deaf ears.

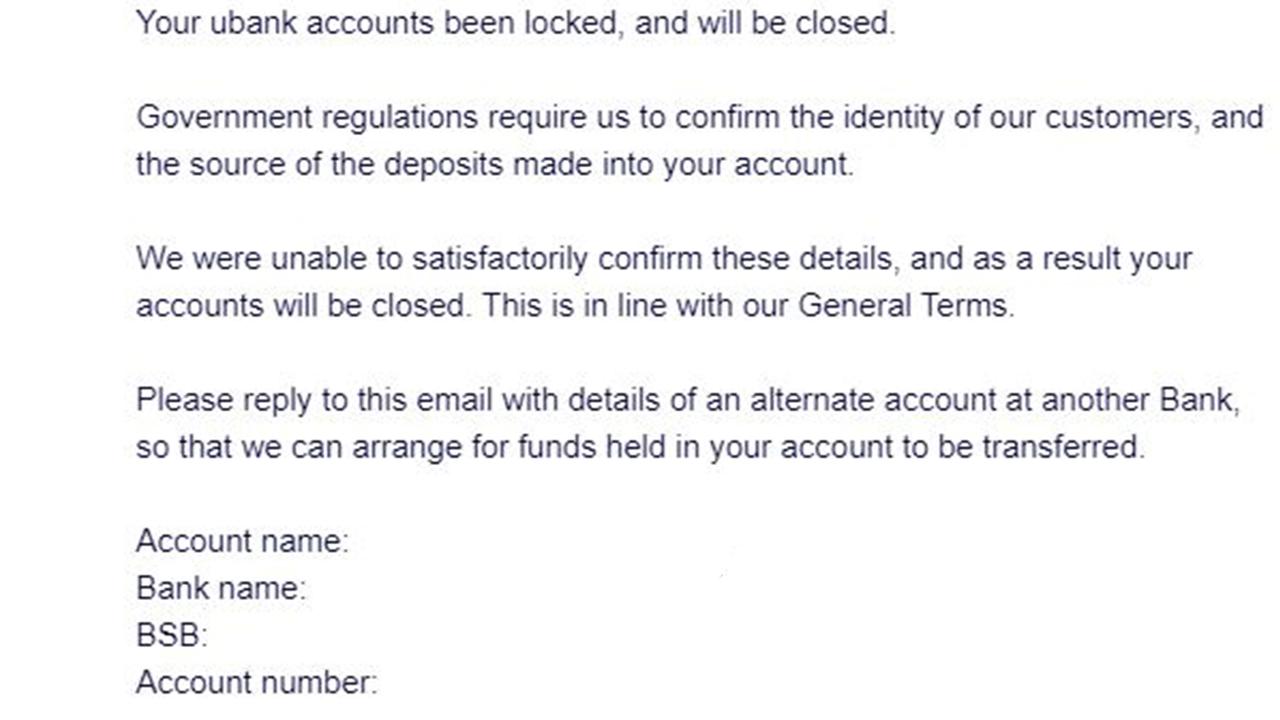

“Ubank locked my bank account, essentially audited my account and forced me to send them a lengthy email substantiating every dollar that had gone in to my account including where/who it came from and what it was sent for,” she told news.com.au.

“Once I did this I received an automated email saying that they couldn’t substantiate my funds and would be immediately closing my account.”

Talking to customer service, she was simply told the closure was “protocol” but she felt like she was being treated like a criminal.

“I called customer service and was on hold for three hours and was met with hostility, rudeness and a complete disregard for my situation from a customer service rep who spoke to me like I was a criminal,” she added.

“It was absolutely awful.”

Have a similar story? Continue the conversation | sarah.sharples@news.com.au

‘Like I’m living like a fugitive’

The copywriter said she was left in tears on the phone call but prior to her account being abruptly closed she had no idea how severe the consequences could when the transaction was flagged.

She added her identity was verified and that wasn’t an issue.

Instead, she has been left with the reality her account is now closed and it will take five business days for the funds to be transferred to a new bank of her choosing.

Matilda now faces at least 12 days without a bank account or access to her money, which includes $20,000 of her own and the $20,000 her partner transferred in, while her direct debits have also failed.

“I’m being chased by everyone. I have Optus chasing me for payment, the gas and electricity people chasing me, my gym has cancelled my membership and I had to sneak into my gym. I feel like I’m living like a fugitive having to request payment extensions for everything,” she explained.

“My Netflix will be cut off, it’s just crazy. I’ve already been through the annoyance of having to update all of my direct debits as like everyone else I had to a get new card, BSB and account number and I just updated all payments and now they have all bounced.

“I the lead up to Christmas it’s just annoying. I can’t do any of Christmas shopping, it’s been just a pain.”

‘Lack of empathy’

Matilda added she also didn't have a credit card and has been lucky her partner has been able to lend her money.

“So I can put petrol in my car and live but some other people might not have friends or family that might lend them money in a situation this,” she added.

“I guess the learning is to have another account with some back up money.”

Matilda is still fearful her new bank won’t accept the funds and is worried she might not be able to access her money past two weeks.

The experience had left her “overwhelmed with stress”.

“I was incredibly stressed. I am a lot more calm now as I know there is nothing else I can do now I have stopped fighting it,” she said.

But she added had been left “with absolutely no access to any money” for days and it was just not good enough.

“I’m appalled at their lack of empathy and disorganisation,” she added.

A spokesperson for Ubank said: “We can’t talk about specific customers due to confidentiality requirements. Ubank is however working with customers who have been impacted.”

News.com.au has also revealed how a customer from ING had her five bank accounts closed abruptly, while high-profile Sydney sex worker Samantha X too had her accounts shut down with no explanation other than it had been a “business decision” earlier this year.

What is debanking?

Debanking, also known as unbanking, refers to the denial of banking services by banks or other financial institutions to customers.

In a submission to the parliament of Australia, Bitaroo, an Australian Bitcoin-only exchange, said that “banks have the ability to freeze accounts instantly, shut them down with little notice and even ban customers from using their services ever again”.

It noted “no reason needs to be given and currently no regulator has the power to force banks to reveal the reasoning behind such decisions”.

Yannick Ieko, CEO of SMSF Loan Experts, told news.com.au that “thankfully this is not a common practice”, but said there were a range of reasons when debanking could occur.

“Financial institutions work hard to ensure their financial products are not used to support money laundering, terrorism, and other illegal activities,” he explained.

“They do this for a range of reasons, ie, to comply with the law, be good corporate citizens and to protect their own brand.

“They have sophisticated systems to assess risk and identify potential issues. Where the risk needle rises, so too does the need for institutions to act. When this happens, you see debanking happening more often.”

*Name has been changed for privacy reasons

– with Alexis Carey

Originally published as ‘I’ve been left with not even a dollar to my name because of my bank’