Aussie ING customers slam bank for treating them ‘like criminals’ by closing accounts

A string of furious customers have come forward to claim they’ve been treated like criminals by their own bank with no explanation given.

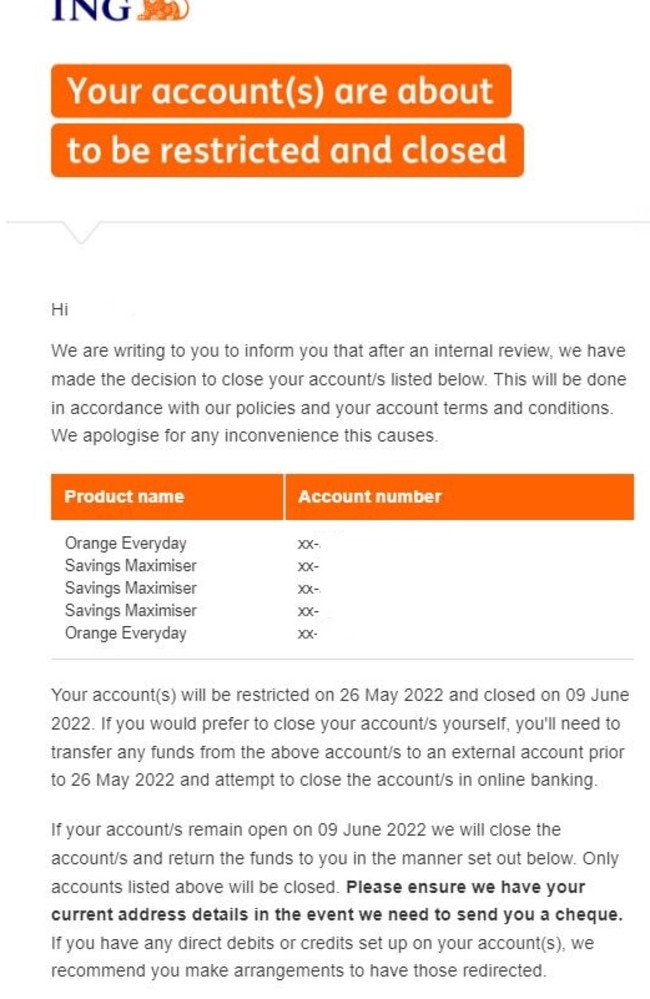

When Katie* opened an email from her bank several weeks ago, she was expecting it to be the usual dull information about home loans, new policies or credit card limits.

Instead, she was stunned to learn her bank was ditching her after more than a decade of loyal business – with no excuse given.

Katie rang ING immediately after receiving the email, initially believing it had simply been sent accidentally, but was told there had been no mistake and that all five of her accounts would be shut due to a violation of their banking policies.

She said the bank also failed to provide an explanation for the abrupt decision, and as a result she was forced to spend four hours opening new accounts and updating all her direct debit payments.

“It was a massive inconvenience – huge,” she told news.com.au, adding ING had made her “feel like a criminal”.

“I had five accounts with them, and it came out of nowhere. We’ve been with ING for more than 10 years so it was very hard to swallow, and I’m really annoyed.”

Katie said she had racked her brains trying to think of possible reasons why her bank dumped her, but was still stumped – until a friend who worked in finance shared a potential theory.

“My friend has seen this before – it’s called debanking, when a bank closes accounts for no particular reason at all, and it’s very hush-hush – they won’t tell you why, not even frontline staff or managers, and it’s all cloak-and-dagger,” she said.

“It could be due to one of two things – either you’ve committed a criminal act that’s under investigation by the Australian Transaction Reports and Analysis Centre (AUSTRAC), and that’s not me, or secondly, they’ve done something wrong themselves with paperwork, and it’s easier for them to get rid of customers than potentially to get huge fines in the future after not having followed the right processes.”

Katie now believes ING failed to gather the correct identification paperwork from her when she originally opened her accounts, and was now scrambling to avoid a possible fine.

“How dare they make me feel like I’ve done something wrong? It’s not right we should be made to feel like criminals,” she said.

“I’m not money laundering or doing any criminal activity whatsoever, yet they made me feel like I’ve been doing something untoward, and therefore they’re sorry, they don’t want me as a customer anymore.

“After I left a one-star review I had a look and saw that many other people have also had this happen, so surely this needs to be investigated further if they are doing this willy nilly? It sounds like they’ve massively stuffed up and have been caught out.”

‘Appalling’: Furious customers hit out

Katie’s story comes days after high-profile Sydney sex worker Samantha X also shared a similar story with news.com.au, revealing she too had her accounts shut down with no explanation other than it had been a “business decision”.

She said the bank’s lack of transparency, and the fact that she’d always been a good customer, led her to fear she was being discriminated against based on her sex work.

“If it is discrimination, ING needs to wake up to the fact it’s 2022,” she said.

Unfortunately, Katie and Samantha X’s experiences with the bank are all too familiar for Chris, an Australian long-term ING customer who is currently living and working overseas who was also unceremoniously dumped by the company “out of the blue” last month.

After receiving an email asking him to contact the lender urgently about his account, Chris, who requested his surname be withheld, was told that as he had an overseas address registered with them, he could no longer bank with them.

“I had an Australian address registered for mail but for tax purposes and regulatory reporting I had registered my address overseas as the residential address,” he said.

“When I asked why I couldn’t bank with them anymore as an Australian citizen who just happened to be living and working overseas they gave me a lame excuse about them just wanting to provide banking services to Australians living in Australia.

“When I pressed them for a reasonable explanation, the person just read from clear script that management had decided to only provide banking services to Australian residents in Australia.”

Chris, who has worked in the banking industry for 35 years, told news.com.au the situation was “bizarre”.

“Their lack of transparency and honesty is in my opinion appalling and unprofessional,” he said.

And Ian Morrison, who is currently based in Indonesia, is yet another Australian ING customer left feeling “insulted” by the spate of debanking.

Mr Morrison, who had been an ING customer for at least a decade, originally opened an account based on recommendations by the Barefoot Investor, and because ING refunded charges or transactions from any ATM anywhere in the world, which allowed him to travel while continuing to run his finances from Australia.

But he too received an email from ING shortly before Easter 2021 informing him his account would be closed.

Mr Morrison, who has spent years travelling throughout Asia and sponsoring disadvantaged children to help them learn English, told news.com.au he believed ING might have “misconstrued” his charity work, after he read that Australian banks were “looking seriously at single white middle aged males who were sending money outside Australia, specifically Asia” in the wake of the banking royal commission.

However, Mr Morrison also contacted ANZ, which he had dormant accounts with, and was assured he did not have a “black mark” against his name.

“Maybe the problem was that I was costing ING too much in refunded ATM fees but why didn’t they contact me? I would have been happy to negotiate a solution that worked for both of us,” he said.

“Or am I automatically considered a paedophile just because my profile doesn’t look normal, whatever that is? If yes, then again, why didn’t someone ask?

“Given nothing further has happened and this was their reasoning, then I don’t believe their decision was based on any real evidence.”

Mr Morrison said the “real issue” was the way ING treated some of its long-term customers.

“ING were granted a licence to trade in Australia and as part of that licence they would be expected to operate within the law,” he said.

“Given that they are a foreign entity I would have thought that they would also be expected to treat us Australians with respect.

“What’s happened to many of us is far from respectful and that really p*sses me off.”

Debanking

Debanking, also known as unbanking, refers to the denial of banking services by banks or other financial institutions to customers.

In a submission to the Parliament of Australia, Bitaroo, an Australian Bitcoin-only exchange, said that “banks have the ability to freeze accounts instantly, shut them down with little notice and even ban customers from using their services ever again”, noting “no reason needs to be given and currently no regulator has the power to force banks to reveal the reasoning behind such decisions”.

Yannick Ieko, CEO of SMSF Loan Experts, told news.com.au that “thankfully this is not a common practice”, but said there were a range of reasons when debanking could occur.

“Financial institutions work hard to ensure their financial products are not used to support money laundering, terrorism, and other illegal activities,” he explained.

“They do this for a range of reasons, ie, to comply with the law, be good corporate citizens and to protect their own brand.

“They have sophisticated systems to assess risk and identify potential issues. Where the risk needle rises, so too does the need for institutions to act. When this happens, you see debanking happening more often.”

But aside from these obvious reasons, Mr Ieko said there were “probably only a handful” of other explanations, such as customers being “overly aggressive or acting inappropriately towards staff, fees on a customer’s account have not been paid or possibly a system error or failure”.

Speaking about Samantha X’s experience specifically, Mr Ieko said the case “seemed to be about the profession of the client”.

“We are assisting a number of sex workers with their lending requirements and I can absolutely confirm that there is covert discrimination against them in the mortgage space,” he said.

Despite being asked about the general reasons ING may choose to shut down a customer’s account, an ING spokeswoman simply told news.com.au the bank was “unable to discuss this matter due to customer confidentiality”.

*Name has been changed